[1]While the housing market begins to cool, home prices are still significantly higher in many parts of the U.S. than before the COVID-19 pandemic, according to a new study from LendingTree [2]. One of the side effects of these higher home prices is higher down payments.

[1]While the housing market begins to cool, home prices are still significantly higher in many parts of the U.S. than before the COVID-19 pandemic, according to a new study from LendingTree [2]. One of the side effects of these higher home prices is higher down payments.

On average, Lending Tree found that homebuyers across the nation’s 50 largest metros are putting tens of thousands of dollars, toward their down payments. Even in areas where household incomes and loan amounts are relatively low, five-figure down payments are common.

Key findings:

- A down payment on a home across the nation’s 50 largest metros averages $62,611. For comparison, that amount is 35.3% higher than when LendingTree last published this study in September 2021, when the average down payment across the nation’s 50 largest metros was $46,283. While average down payments can vary significantly by location, no metro featured in our study’s 2022 update has an average of less than $38,000.

- California is home to the three metros where down payments are highest — San Jose, San Francisco and Los Angeles. The average down payment in San Jose is $142,006. In San Francisco and Los Angeles, those figures are $131,631 and $104,749, respectively. These are the only metros in our study where average down payments top $100,000.

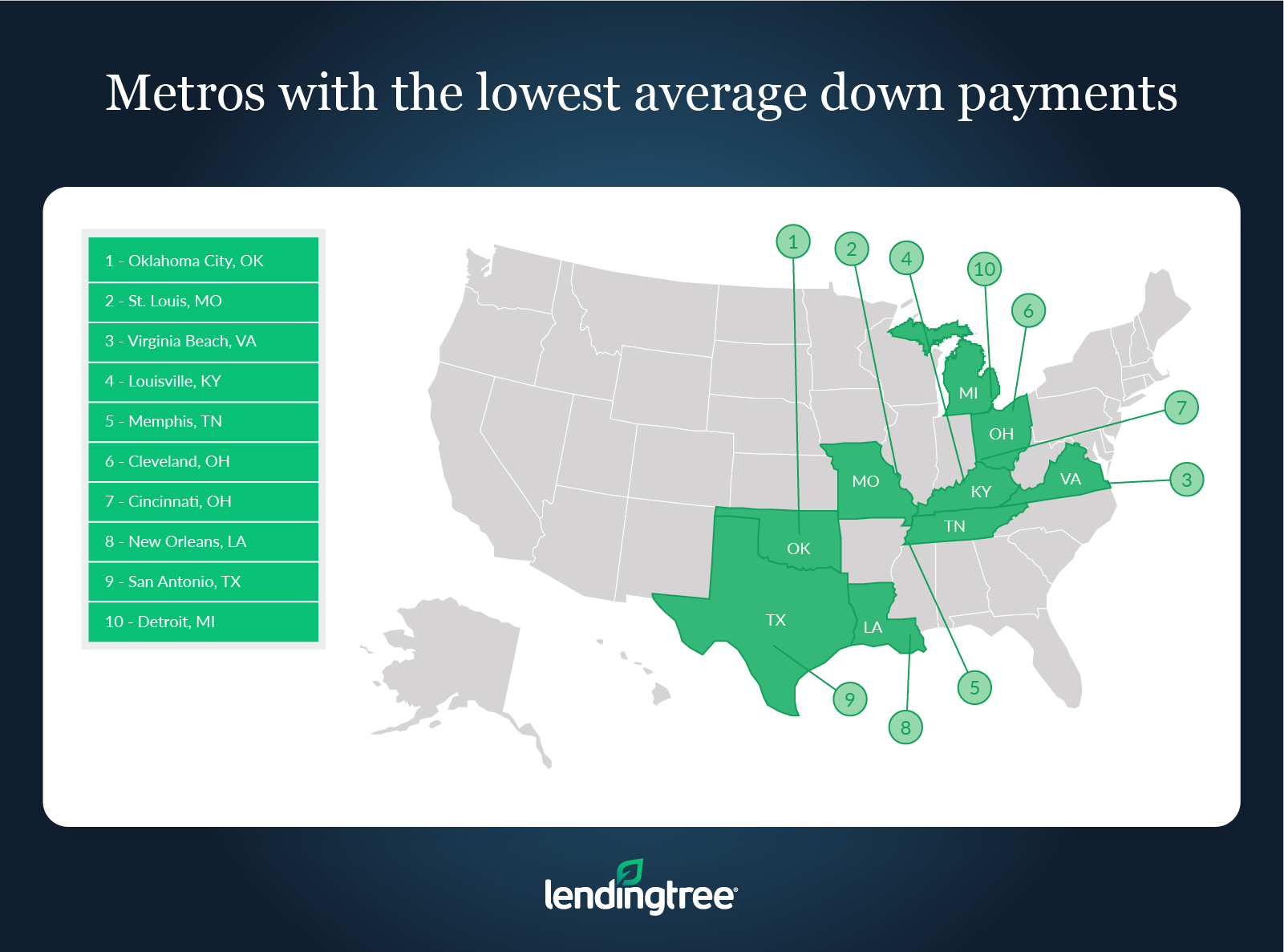

- Oklahoma City, St. Louis and Virginia Beach, Va., are the metros with the lowest down payments. Down payments in these metros average $38,169, $40,113 and $40,530, respectively.

- Across the nation’s 50 largest metros, the average down payment on a home equates to 58.3% of that area’s average yearly household income.

- Down payments are the most affordable relative to income in St. Louis, Virginia Beach and Hartford, Conn. Across the three metros, homebuyers put 43.5% of their area’s average annual household income toward a down payment.

- Los Angeles, San Diego and San Francisco are the metros where down payments are least affordable relative to income. Across the three metros, homebuyers put 83.4% of their area’s average annual household income toward a down payment.

Metros with the highest average down payments

No. 1: San Jose, California

- Average down payment: $142,006

- Average mortgage amount: $636,091

- Average annual household income: $195,284

- Average down payment as a percentage of average household income: 72.7%

No. 2: San Francisco

- Average down payment: $131,631

- Average mortgage amount: $593,860

- Average annual household income: $167,674

- Average down payment as a percentage of average household income: 78.5%

No. 3: Los Angeles

- Average down payment: $104,749

- Average mortgage amount: $535,268

- Average annual household income: $115,845

- Average down payment as a percentage of average household income: 90.4%

Metros with the lowest average down payments

No. 1: Oklahoma City

- Average down payment: $38,169

- Average mortgage amount: $252,495

- Average annual household income: $82,109

- Average down payment as a percentage of average household income: 46.5%

No. 2: St. Louis

- Average down payment: $40,113

- Average mortgage amount: $248,228

- Average annual household income: $96,061

- Average down payment as a percentage of average household income: 41.8%

No. 3: Virginia Beach, Virginia

- Average down payment: $40,530

- Average mortgage amount: $287,146

- Average annual household income: $94,877

- Average down payment as a percentage of average household income: 42.7%

What high down payments can mean for homebuyers

Higher down payments can severely impact would-be homebuyers depending on their situations.

For example, those who already own a home may need to plan to stay longer than they’d like while they save enough cash for a down payment. Or, if they sell their current house and make a profit, they might have to allocate more of that profit toward the down payment on a new home than in the past. Similarly, those who don’t own may need to rent for longer periods or resort to moving in with family to save more money.

High down payments aren’t necessarily bad news for those with ample cash on hand. The more money a person can put down on a home, the more likely they will get approved for a mortgage and be offered a lower interest rate. As a result, a high down payment can provide more benefits than drawbacks in many instances for those who can afford it.

To read the full report, including more data, charts and methodology, click here [2].