As the housing market continues to improve, more buyers enter the market, and inventory levels decline, favor now rests in sellers' hands.

As the housing market continues to improve, more buyers enter the market, and inventory levels decline, favor now rests in sellers' hands.

Pro Teck Valuation Services' October Home Value Forecast (HVF) reviewed inventory levels and the impact they have in the real estate market.

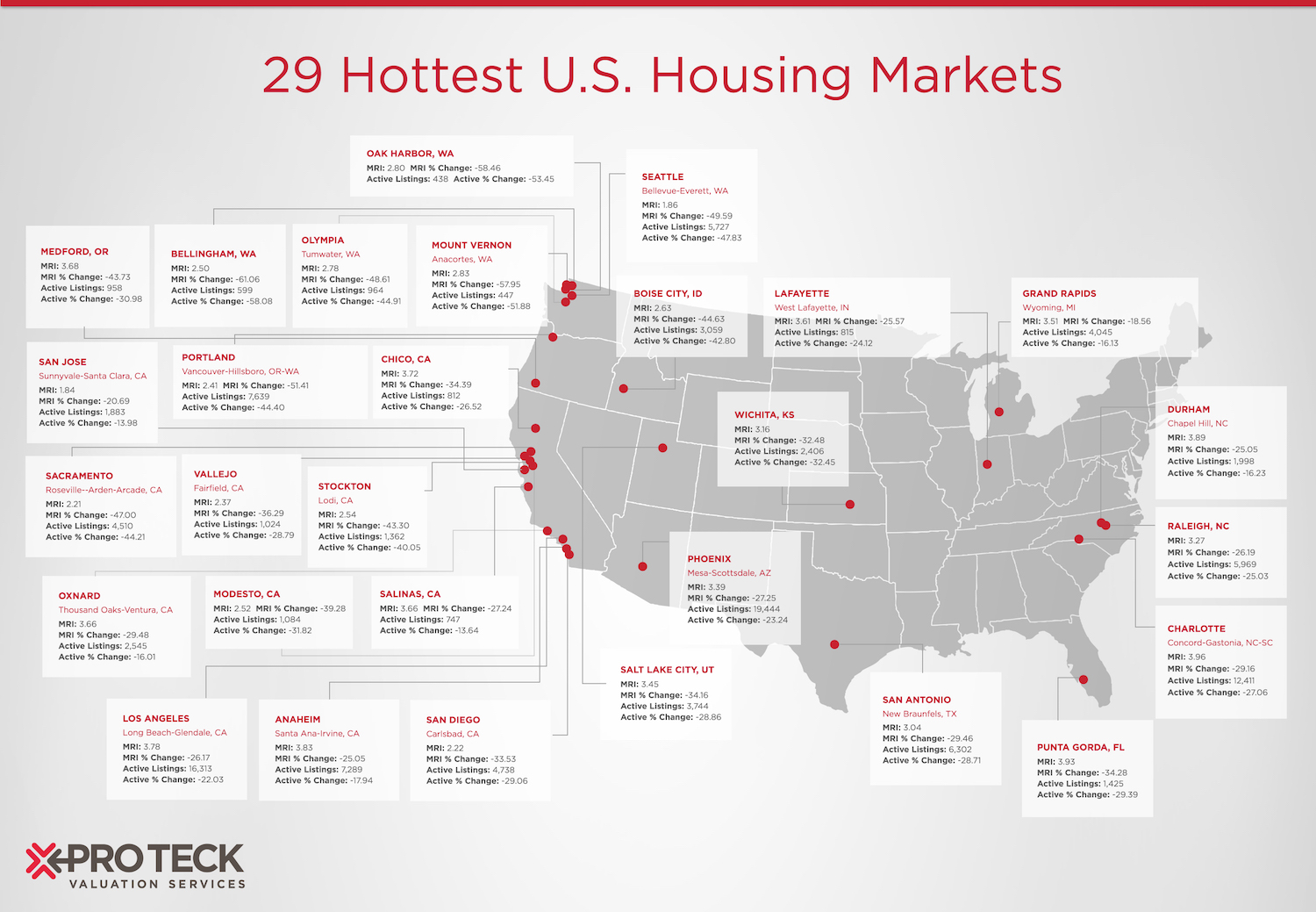

The forecast found that 29 of the core-based statistical areas (CBSAs) the company tracked got their highest inventory score possible, compared to zero last year.

Indicating a transition to a sellers’ market, all 29 CBSAs have less than four months of inventory left, Pro Teck noted. In addition to these findings, all areas have seen double-digit increases in active listings, which the company believes won’t change anytime soon.

"While new housing units are on the upswing, the numbers are still at historical lows," said Tom O'Grady, CEO of Pro Teck Valuation Services. "That, combined with approximately 2.5 million single family homes becoming rental units since the crash has left the U.S. with a limited housing supply."

Top 10 Hottest Markets with Their Months of Remaining Inventory:

Top 10 Hottest Markets with Their Months of Remaining Inventory:

1. Charlotte-Concord-Gastonia, North Carolina-South Carolina - 3.96

2. Punta Gorda, Florida - 3.93

3. Durham-Chapel Hill, North Carolina - 3.89

4. Anaheim-Santa Ana-Irvine, California - 3.83

5. Los Angeles-Long Beach-Glendale, California - 3.78

6. Chico, California - 3.72

7. Medford, Oregon - 3.68

8. Oxnard-Thousand Oaks-Ventura, California - 3.66

9. Salinas, California - 3.66

10. Lafayette-West Lafayette, Indiana - 3.61

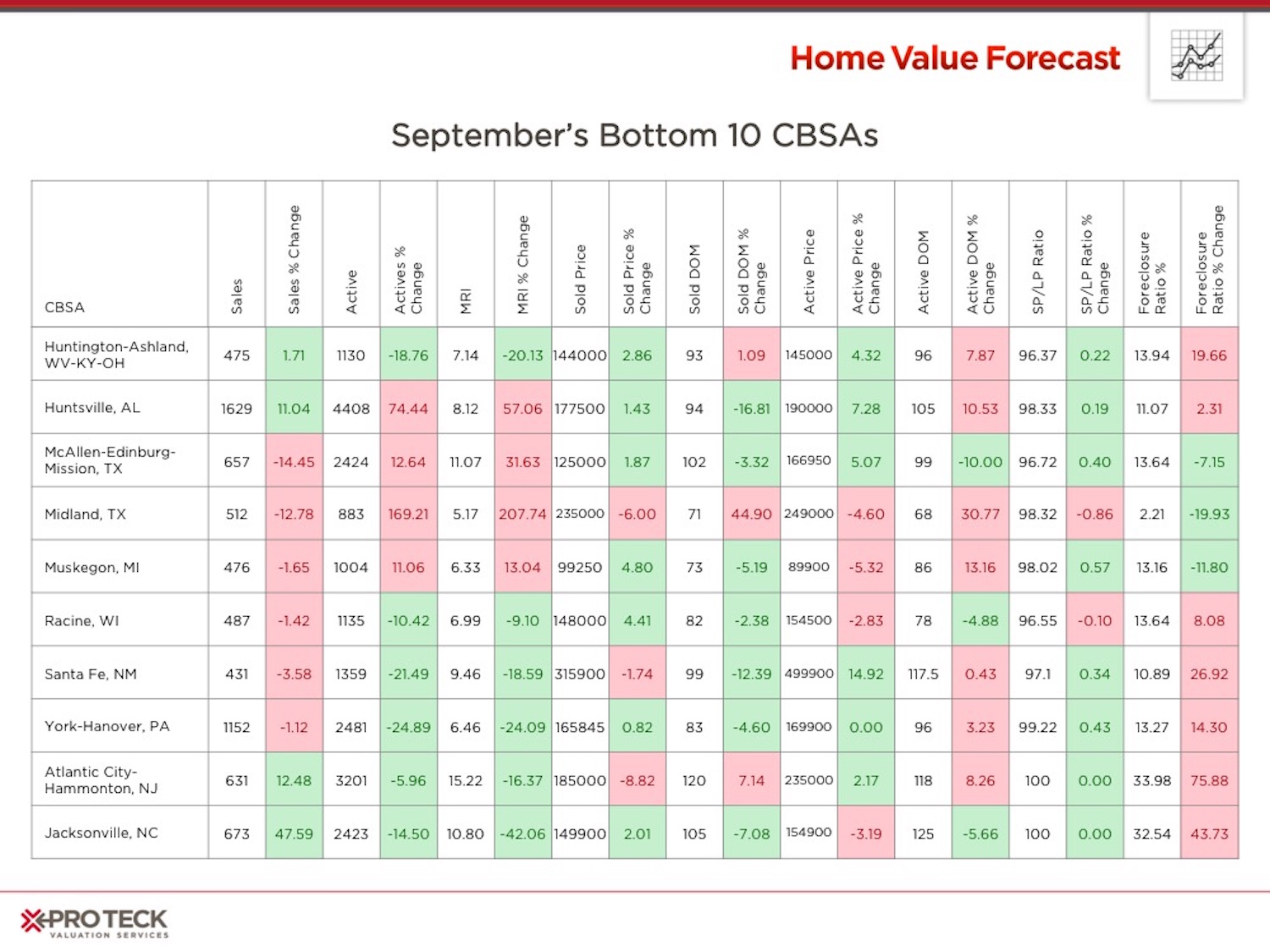

Pro Teck also ranked the best and worst performing metros based on their market condition ranking model. These lists are determined using a variety of indicators such as: sales/listing activity and prices, months of remaining inventory (MRI), days on market (DOM), sold-to-list price ratio, foreclosure percentage, and REO activity.

"There are no communities ranked 'distressed' this month, with only Atlantic City and Jacksonville, North Carolina hitting our 'weak' level because of the percentage of foreclosure sales. In Midland, TX you can see the swift impact changes in the oil industry can have. With many oil rigs idle, families are moving out. A 169 percent increase in active home listings and 207 percent increase in MRI are just two example of how quickly change can come," O'Grady said.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news