Following the Federal Open Market Committee's (FOMC) decision to leave interest rates untouched, the Federal Housing Finance Agency (FHFA) reported Thursday that interest rates on conventional purchase-money mortgages fell in September.

Following the Federal Open Market Committee's (FOMC) decision to leave interest rates untouched, the Federal Housing Finance Agency (FHFA) reported Thursday that interest rates on conventional purchase-money mortgages fell in September.

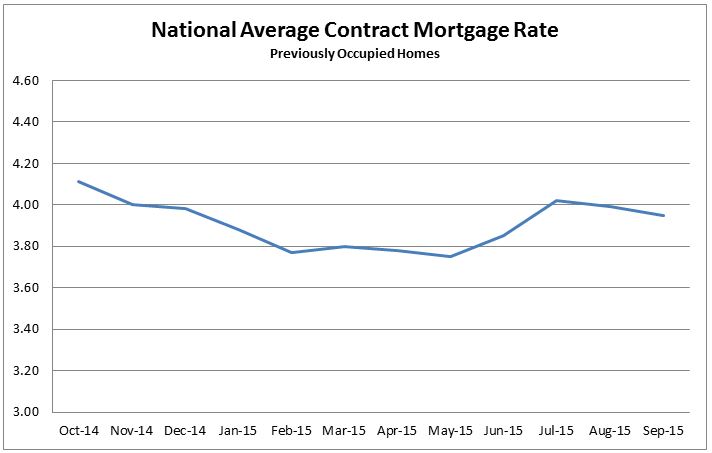

According to the FHFA, the average interest rate on all mortgage loans was 3.95 percent, down four basis points from 3.99 percent in August.

The National Average Contract Mortgage Rate for the Purchase of Previously Occupied Homes by Combined Lenders Index was 3.93 percent, down six basis points from 3.99 percent in August, the report showed.

For 30-year, fixed rate mortgages of $417,000 or less the interest rate was 4.17 in September, down three basis points from 4.20 in the prior month.

The effective interest rate, which accounts for the addition of initial fees and charges over the life of the mortgage, was 4.10 percent, down five basis points from August.

The report also showed that the average loan amount for all loans was $307,700 in September, up $4,400 from $303,300 in August.

Freddie Mac also released their Primary Mortgage Market Survey (PMMS) today, showing a decline in average fixed mortgage rates as well for the week ending October 29, 2015.

Freddie Mac also released their Primary Mortgage Market Survey (PMMS) today, showing a decline in average fixed mortgage rates as well for the week ending October 29, 2015.

According to the survey, the 30-year fixed-rate mortgage (FRM) averaged 3.76 percent with an average 0.6 point for the week, down from last week's average of 3.79 percent. The 30-year FRM averaged 3.98 percent on year ago at this time.

"Treasury yields oscillated without a clear direction heading into the October FOMC meeting, as investors were confident there would be no rate increase," said Sean Becketti, chief economist, Freddie Mac. "While the FOMC left rates unchanged at this meeting, they kept a December rate hike as an option causing Treasuries to sell off in the latter part of the day, after our survey closed."

He added, "Recent housing reports have done little to add or detract from the possibility of a December rate increase. Existing home sales were strong, contrasting with disappointing new home sales."

Freddie Mac also found that the 15-year FRM averaged 2.98 percent this week, with a 0.6 point, the same average as last week. One year ago, the 15-year FRM was 3.13 percent.

Click here to view the FHFA's full report.

Click here to view Freddie Mac's full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news