[1]Eased credit access is allowing more people to be eligible for mortgage loans, especially among middle-income blacks and Hispanics, but despite the uptick, they still lag behind in the housing market recovery.

[1]Eased credit access is allowing more people to be eligible for mortgage loans, especially among middle-income blacks and Hispanics, but despite the uptick, they still lag behind in the housing market recovery.

Mortgage denial rates are down and the percentage of U.S. mortgage applicants getting approved has increased for all borrowers, but most notably among the black and Hispanic races, according to Zillow’s analysis of mortgage access and homeownership by race [2].

Zillow noted that this indicates “that easing mortgage restrictions are making it easier for more Americans to become homeowners.”

However, this progression does not mean these races have fully recovered from crisis times. Zillow reported that despite notable differences in lending to black and Hispanic borrowers, they still lag behind whites and Asians in the housing recovery.

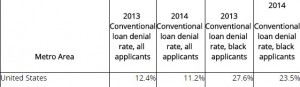

In 2013, 27.6 percent of blacks who applied for a conventional home loan did not get approved, while in 2014, 23.5 percent were denied, according to the most recent federal data released under the Home Mortgage Disclosure Act. Overall, in 2013, the denial rate was 12.4 percent and fell to 11.2 percent in 2013.

The Zillow analysis showed that “despite that improvement, there is still significant disparity in mortgage access among racial groups.”

Blacks comprised 12 percent of the U.S. population in 2014, but made up only 3 percent of conventional loan applicants, the data found. In addition, only 2.5 percent of those were actually approved for a conventional loan.

Meanwhile, Hispanics make up 17.3 percent of the U.S. population, Zillow says. They represent 6.1 percent of applicants and 5.5 percent of approved applicants for conventional loans.

On the other hand, whites make up 62 percent of the population, 69.5 percent of conventional loan applicants, and 71.9 percent of those approved for conventional loans.

Asian neighborhoods have “far outpaced” others in housing appreciation since the housing market crash, the report showed. In these neighborhoods, homes are worth 11.9 percent more than they were at the peak of the housing bubble.

White neighborhoods have almost recovered to their top home values at only 4.7 percent under the peak. Hispanic communities remain 20.3 percent below peak values, while black communities are 16.7 percent below their peak.

Click here [2] to view the full report.