Consumer confidence in the housing market declined slightly in October, while wages and salaries struggled and kept many from purchasing a home.

Consumer confidence in the housing market declined slightly in October, while wages and salaries struggled and kept many from purchasing a home.

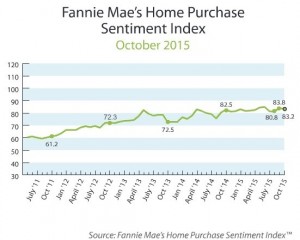

Fannie Mae's Home Purchase Sentiment Index (HPSI) fell 0.6 percentage points to 83.2 for the month of October from 83.8 in September as consumers’ volatile outlook on both household income improvement and mortgage interest rates kept housing sentiment relatively flat.

According to Fannie Mae, three component questions received net positive responses, while three components received negative responses.

The HPSI Household Income component fell in October, with the net share of respondents who say their household income is significantly higher than it was 12 months ago down 4 percentage points to 11 percent.

The Good Time to Buy and Good Time to Sell components both decreased in October, which suggests "hesitancy by some consumers to make long-term financial commitments such as buying or selling a home," Fannie Mae noted. The net share of respondents who say that it is a good time to buy a house fell 2 percentage points to 34 percent, while those who say it is a good time to sell a home fell 6 percentage points to 10 percent in October.

“The income growth necessary for renewed momentum in housing market sentiment remains elusive, even though consumers’ confidence in their job security continues to strengthen,” said Doug Duncan, SVP and chief economist at Fannie Mae.

“The income growth necessary for renewed momentum in housing market sentiment remains elusive, even though consumers’ confidence in their job security continues to strengthen,” said Doug Duncan, SVP and chief economist at Fannie Mae.

Duncan added, “Consumers’ net view on whether their household income has improved over the last year is down once again this month. Some consumers may be hesitant or unwilling to commit to buying or selling a home without seeing meaningful improvement in their wages and salaries. Still, the HPSI remains close to its near all-time high level of the past four years and, given the strong October jobs report, suggests that any cooling in near-term activity, if it occurs, should be moderate.”

On the other hand, consumers are not worried about losing their jobs, with the net share of respondents who say they are not concerned with losing their job rising 2 percentage points to 71 percent. This component has risen each month since July.

The report also showed that the share of consumers who think mortgage interest rates will go down increased by 4 points to negative 46 percent in October. The net share of respondents who say that home prices will go up rose 2 percentage points to 38 percent.

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news