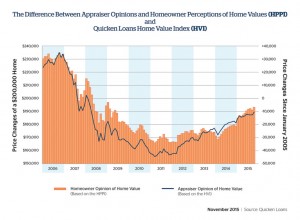

The gap between homeowner and appraisal values of homes narrowed slightly again in October, as appraisers' values were 1.98 percent under homeowner opinions.

The gap between homeowner and appraisal values of homes narrowed slightly again in October, as appraisers' values were 1.98 percent under homeowner opinions.

October marks the second consecutive month that the perception gap has shrunk, and the ninth consecutive month where homeowner estimates exceeded appraisal estimates, according to Quicken Loans' Home Price Perception Index (HPPI).

September's report showed that appraiser values were 2 percent higher than homeowner opinions, the report found.

“It’s too early to call it a trend, but it is encouraging to see the gap between the estimates homeowners provide and the appraised values starting to narrow,” said Bob Walters, Quicken Loans Chief Economist. “The more homeowners are in line with appraisers, the easier it will be to refinance their mortgage and easier for those looking to buy a home. If the two are aligned, it eliminates one of the top stumbling blocks in the mortgage process.”

Quicken Loans also reported that home values rose 1.07 percent in October, after two months of mostly flat home value changes, according to the company's Home Value Index. Year-over-year, home values have risen 4.01 percent.

Quicken Loans also reported that home values rose 1.07 percent in October, after two months of mostly flat home value changes, according to the company's Home Value Index. Year-over-year, home values have risen 4.01 percent.

Quicken Loans observed home value increases among all four regions. The Northeast had the highest home appreciation, with a 1.94 percent increase. Meanwhile, the Midwest, South, and West regions all had value growth of less than 1 percent.

San Jose, California’s appraiser opinions were 5.10 percent higher than homeowner values in October, the report showed. Denver, Colorado and San Francisco, California followed this same trend with appraiser values 4.35 percent and 4.22 percent higher than homeowners, respectively.

“Home values continue to make steady, healthy, growth,” said Walters. “Equity gains increase homeowner faith and enthusiasm in the housing market. There are still many Americans underwater, but with every bump in equity more homeowners who have been waiting to list their home are able to sell or more easily refinance–which takes pressure off of those homeowners and provides housing inventory for first time homebuyers.”

Click here to view the full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news