[1]During the height of the coronavirus pandemic home values alongside incomes rose — however, they didn’t do so at the same pace. To find out how much home values increased relative to incomes, LendingTree analyzed U.S. Census Bureau American Community Survey data [2], comparing both variables from 2019 through 2021.

[1]During the height of the coronavirus pandemic home values alongside incomes rose — however, they didn’t do so at the same pace. To find out how much home values increased relative to incomes, LendingTree analyzed U.S. Census Bureau American Community Survey data [2], comparing both variables from 2019 through 2021.

While many states saw significant growth in median household incomes, home values grew by more than 10 percentage points, on average, than incomes across the nation’s 50 states.

Key Findings:

- Home value growth outpaced income growth in the nation’s 50 states. On average, median home values increased by 17.36% from 2019 through 2021, while median household incomes grew by an average of 6.00%. That’s a difference of 11.36 percentage points.

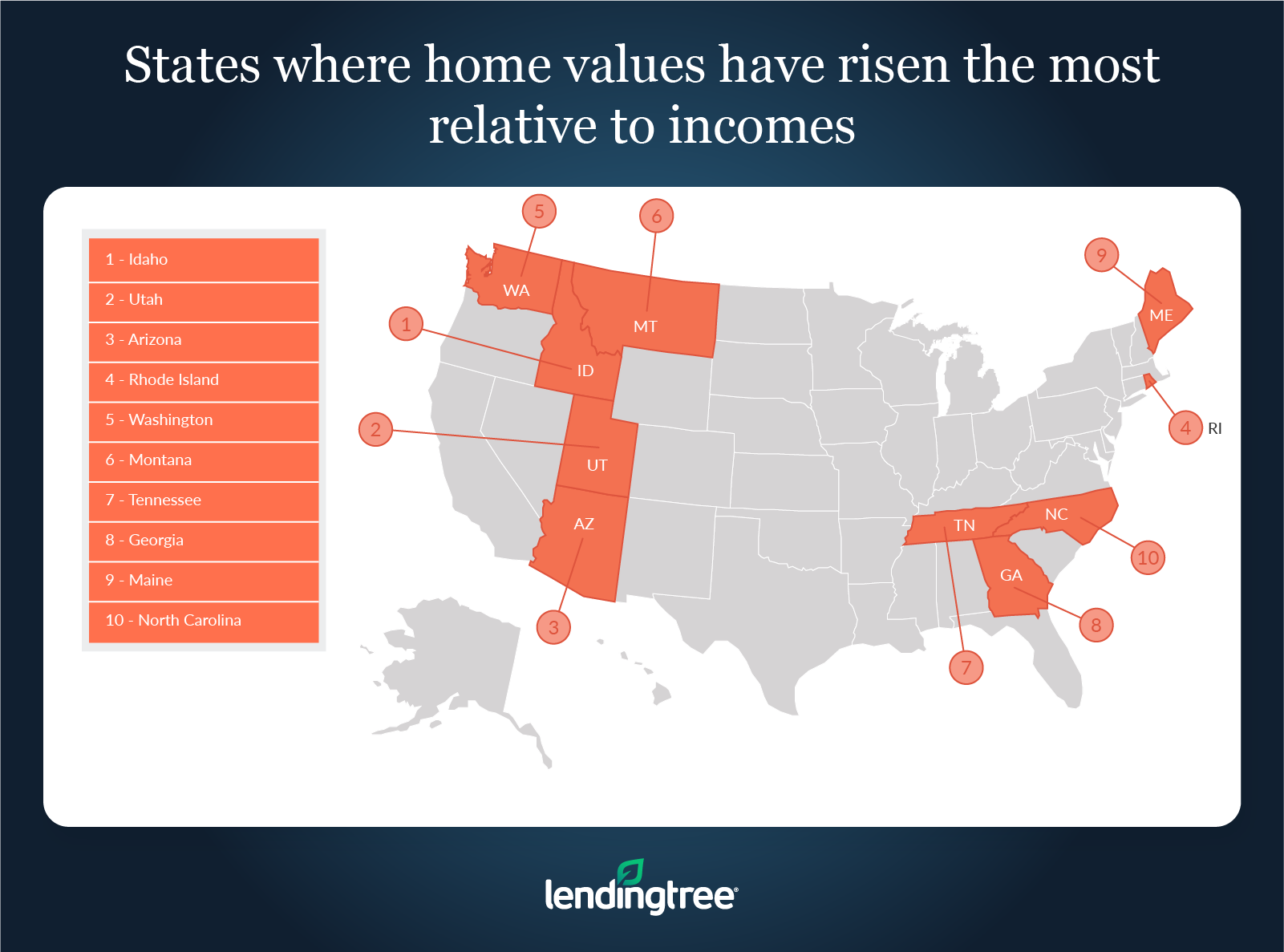

- Idaho, Utah and Arizona are the states where home values increased the most relative to incomes. While incomes increased by more than the national average in Idaho and Arizona, home values increased by 35.73 and 20.14 percentage points more in each state. In Utah, where income growth was less robust than the national average, home values increased by 22.83 percentage points more than the state’s median household income.

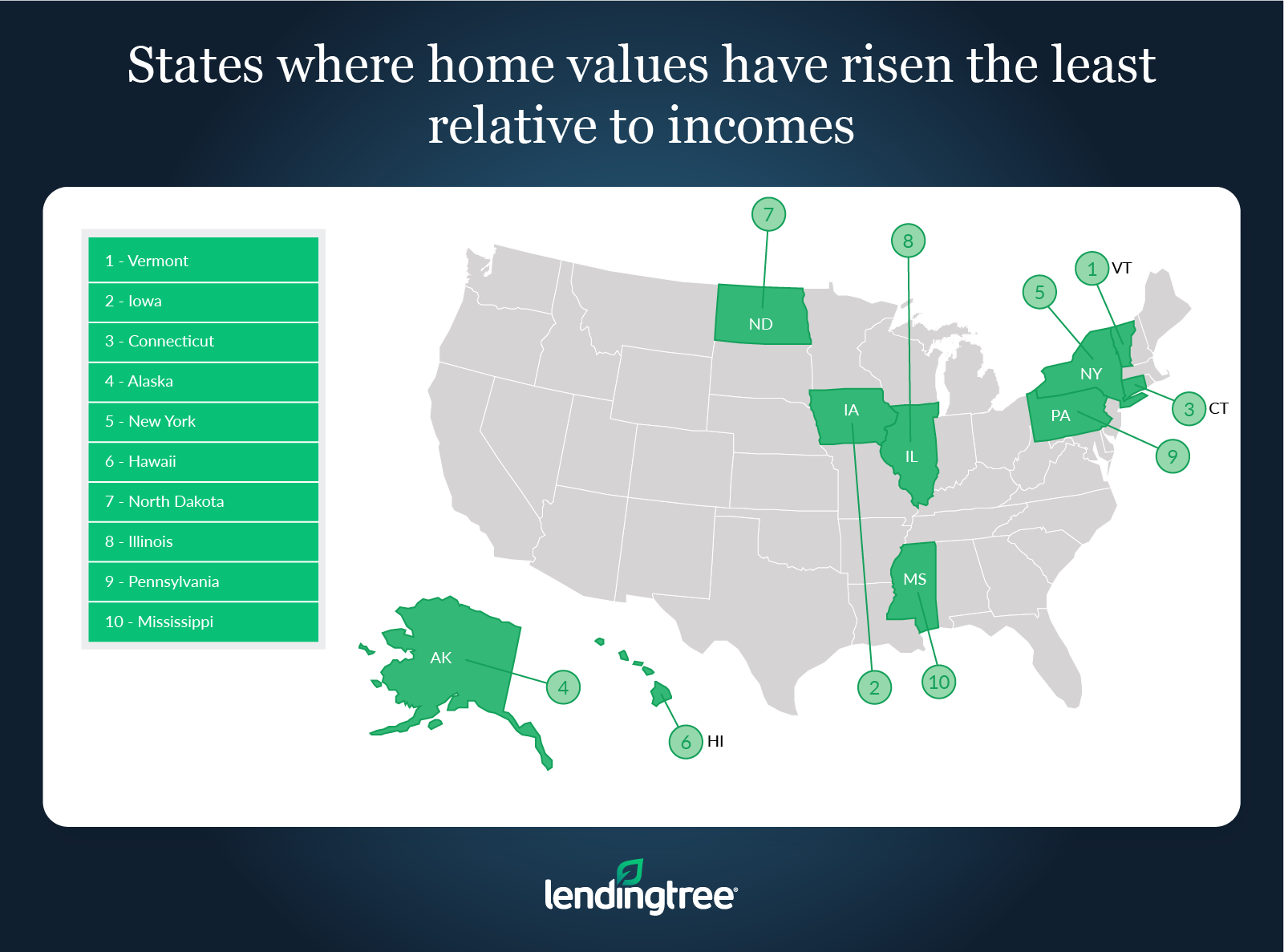

- Home prices increased the least relative to incomes in Vermont, Iowa and Connecticut. In Iowa and Connecticut, median household incomes increased by 6.34% and 6.26%from 2019 through 2021, while home values increased by 9.75% and 10.97% — differences of 3.42 and 4.71 percentage points. In Vermont, where both incomes and median home values increased by double digits (14.97% and 16.42%, respectively), the median home value increased by 1.46 percentage points more than the median household income.

States where home values have risen the most relative to incomes

No. 1: Idaho

- Percentage growth in median household income from 2019 through 2021: 8.98%

- Percentage growth in median home value from 2019 through 2021: 44.71%

- Percentage point difference between home value and income growth: 35.73

No. 2: Utah

- Percentage growth in median household income from 2019 through 2021: 4.84%

- Percentage growth in median home value from 2019 through 2021: 27.67%

- Percentage point difference between home value and income growth: 22.83

No. 3: Arizona

- Percentage growth in median household income from 2019 through 2021: 11.28%

- Percentage growth in median home value from 2019 through 2021: 31.42%

- Percentage point difference between home value and income growth: 20.14

States where home values have risen the least relative to income

No. 1: Vermont

- Percentage growth in median household income from 2019 through 2021: 14.97%

- Percentage growth in median home value from 2019 through 2021: 16.42%

- Percentage point difference between home value and income growth: 1.46

No. 2: Iowa

- Percentage growth in median household income from 2019 through 2021: 6.34%

- Percentage growth in median home value from 2019 through 2021: 9.75%

- Percentage point difference between home value and income growth: 3.42

No. 3: Connecticut

- Percentage growth in median household income from 2019 through 2021: 6.26%

- Percentage growth in median home value from 2019 through 2021: 10.97%

- Percentage point difference between home value and income growth: 4.71

Home unaffordability will likely persist, even as prices fall

Though home prices are starting to come down in many parts of the country, that doesn’t mean housing will become more affordable for the majority of buyers who use a mortgage to purchase a house.

This is because mortgage rates have increased significantly since the start of 2022. As a result, homes purchased at today’s rates can have higher monthly payments than homes purchased at the start of the year, even if borrowers take out smaller loans on those newly purchased homes.

To read the full report, including more charts, data and methodology, click here [2].