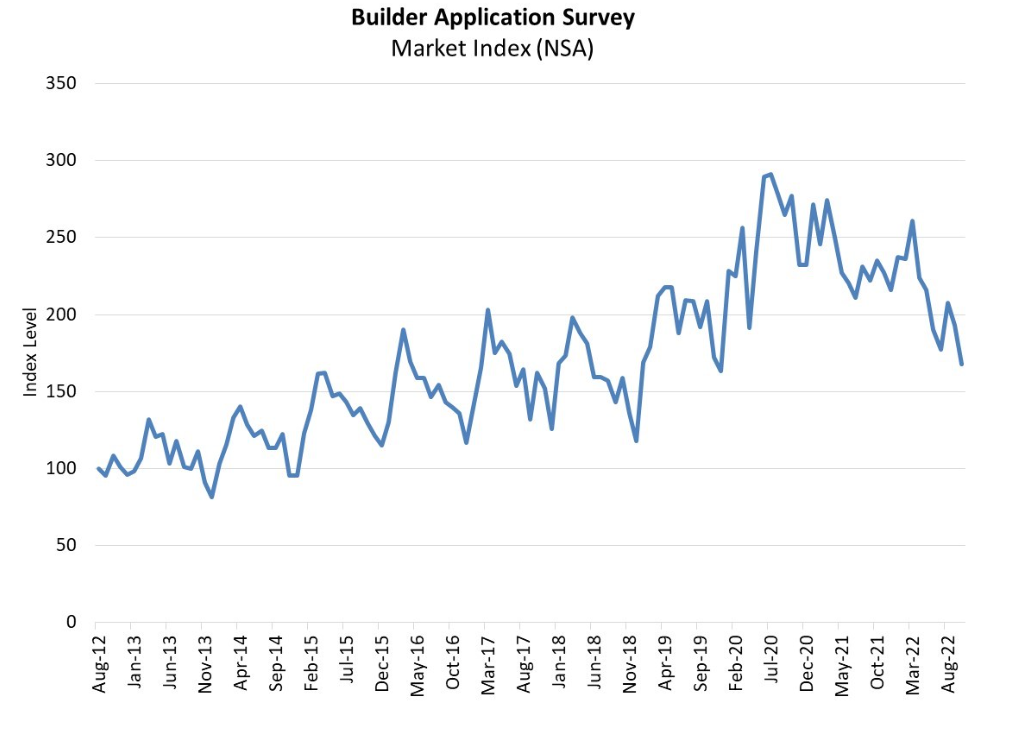

Mortgage applications for new homes fell 28.6% annually in October and declined 13% year-over-year in September, according to new data from the Mortgage Bankers Association (MBA).

Mortgage applications for new homes fell 28.6% annually in October and declined 13% year-over-year in September, according to new data from the Mortgage Bankers Association (MBA).

“New home purchase activity weakened on a monthly and annualized basis in October, as the sharp jump in mortgage rates to nearly 7% reduced both overall demand and the purchasing power for many prospective buyers,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The average loan size decreased to $400,616, down 8% from its peak in April 2022. The moderation in loan amounts is attributed to slower home-price growth and buyers stepping away from higher-priced homes.”

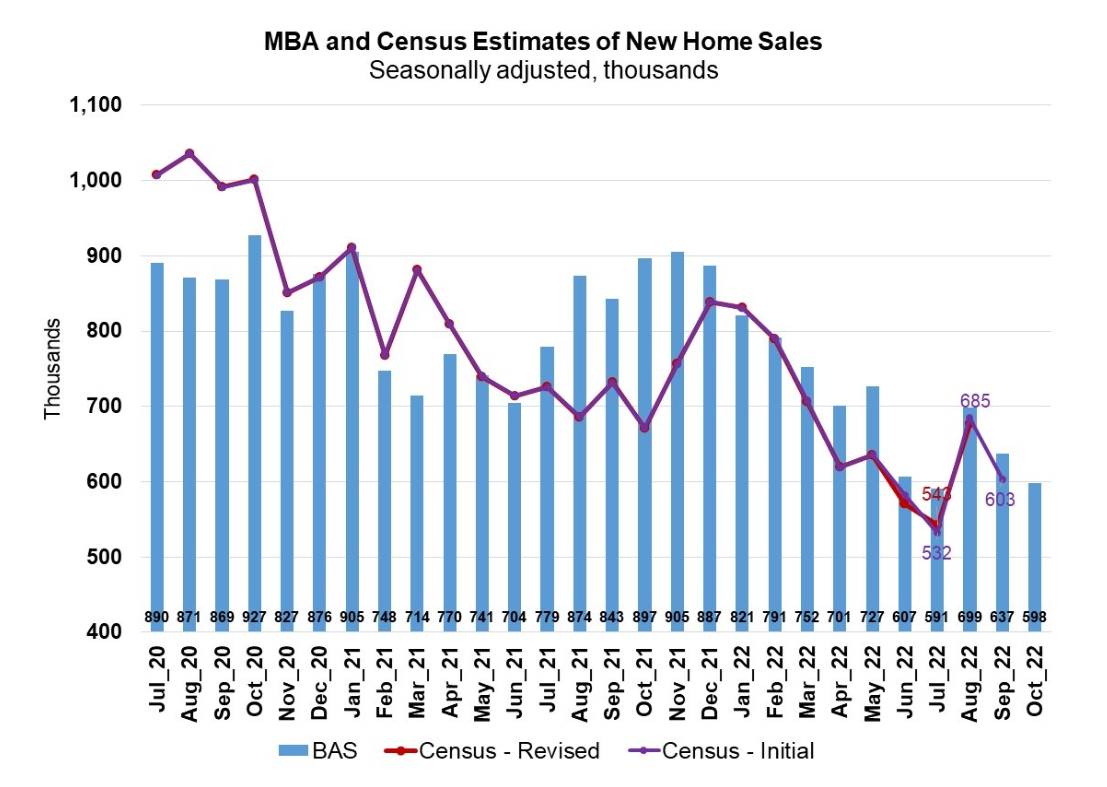

Kan added that MBA’s estimate of new home sales also declined in October, falling to 598,000 units--the slowest annualized pace since July 2022.

The MBA reports that the seasonally adjusted estimate for October is a decrease of 6.1% from the September pace of 637,000 units. Unadjusted, the MBA estimates that there were 47,000 new home sales in October 2022, a decrease of 9.6% from 52,000 new home sales in September.

Overall, a Redfin report found mortgage contract activity fell 30% across the U.S.

The report stated that the demand for homes eased in October, as one-third fewer homes went under contract than was reported in October 2021. This drop marks the largest decline in contracts since 2015.

While contracts may have dropped 30% across the nation, pandemic hotspots such as Las Vegas, Miami, and Phoenix reported contract declines of around 50%, causing a record-high share of home sellers to drop their asking price last month.

But as mortgage rates dipped below 7% in the final week of October, a handful of key measures of homebuying demand stabilized after several weeks of declines: Google searches of “Homes for Sale,” Redfin’s Homebuyer Demand Index, mortgage purchase applications, and pending sales.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news