According to Fannie Mae’s National Housing Survey (NHS), one-third of borrowers do not rate shop during the mortgage process, and took the first offer extended to them.

According to Fannie Mae’s National Housing Survey (NHS), one-third of borrowers do not rate shop during the mortgage process, and took the first offer extended to them.

This number has been relatively consistent over the last eight years meaning a large segment of mortgage owners probably spent more time looking for a home and negotiating the price than the amount of time they thought about financing.

“According to our latest survey from Q1 2022, 36% of 2021 homebuyers received only one mortgage quote, consistent with survey findings from prior years, Q1 2014 and Q1 2019,” Fannie Mae’s Economic and Strategic Research Group wrote in a new insights blog post. “Interestingly, first-time and repeat homebuyers do not show much difference in their mortgage shopping behavior; approximately one-third of both groups received only one quote across all years.”

In the first quarter of 2022, the top two reasons cited by recent homebuyers who only received one quote were the same top reasons cited in previous surveys in 2014 and 2019. First, homebuyers responded that they felt comfortable with the lender they chose and second because they found the first quote they got was satisfactory or within their budget.

This trend also held true for repeat buyers, as the survey found that about one-third of these buyers only shopped for a single rate quote.

“It's likely that innovation to simplify the process by which consumers can compare mortgage quotes would help a substantial portion of homebuyers make better, more informed decisions—and help many save money on their monthly mortgage payment,” Fannie Mae said. “Several simplified mortgage comparison solutions have been proposed over the years, examples include ‘no-cost’ or ‘zero cost’ mortgages, a product option in which closing costs are incorporated into the mortgage rate, and consumers need only compare one number—their mortgage rate—across mortgage quotes.”

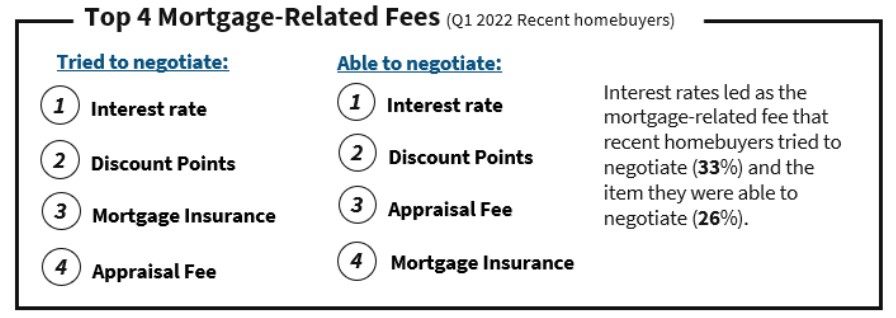

Only 33% of recent homebuyers surveyed in the first quarter of 2022 tried to negotiate the mortgage rate, compared to 40% in 2019. Discount points, mortgage insurance, and appraisal fees were the next top areas that homebuyers tried to negotiate, although to a lesser degree than mortgage rate—less than 15% of homebuyers tried to negotiate each of these items in 2022, and a slightly higher percentage of homebuyers tried to negotiate those costs in 2019.

Click here to view what else Fannie Mae found in their survey.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news