According to a new market analysis from Redfin, pending home sales fell the most on record in October [1] and deal cancellations and price cuts hit record highs as buyers were spooked by the biggest mortgage-rate jump in over four decades.

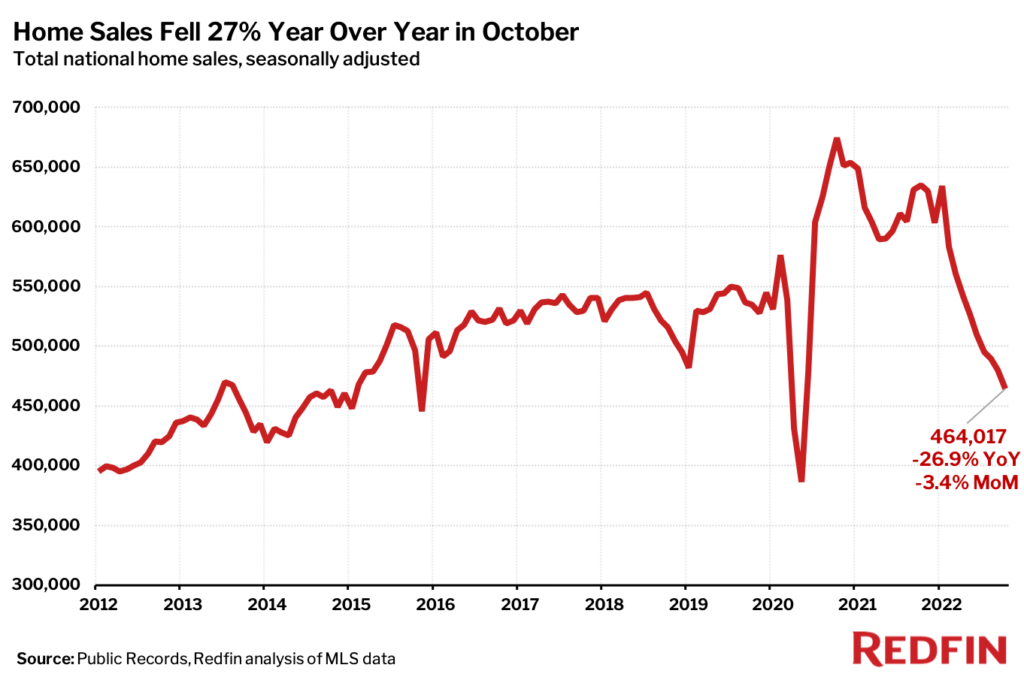

Pending sales dropped 32.1% year over year last month, the largest decline since at least 2013, when Redfin’s records begin. Nearly 60,000 home-purchase agreements fell through, equal to a record 17.9% of homes that went under contract. Meanwhile, almost one-quarter (23.9%) of homes for sale experienced a price drop, double the rate of a year earlier.

Roughly six of every seven (85%) U.S. homeowners with mortgages have a mortgage interest rate far below today’s level of 6%. With rates now at the highest since the 2008 financial crisis, some of those homeowners are discouraged from moving because selling their home and buying another could mean giving up their low mortgage rate and taking on a larger monthly housing bill. That’s according to a Redfin analysis of Federal Housing Finance Agency (FHFA) data.

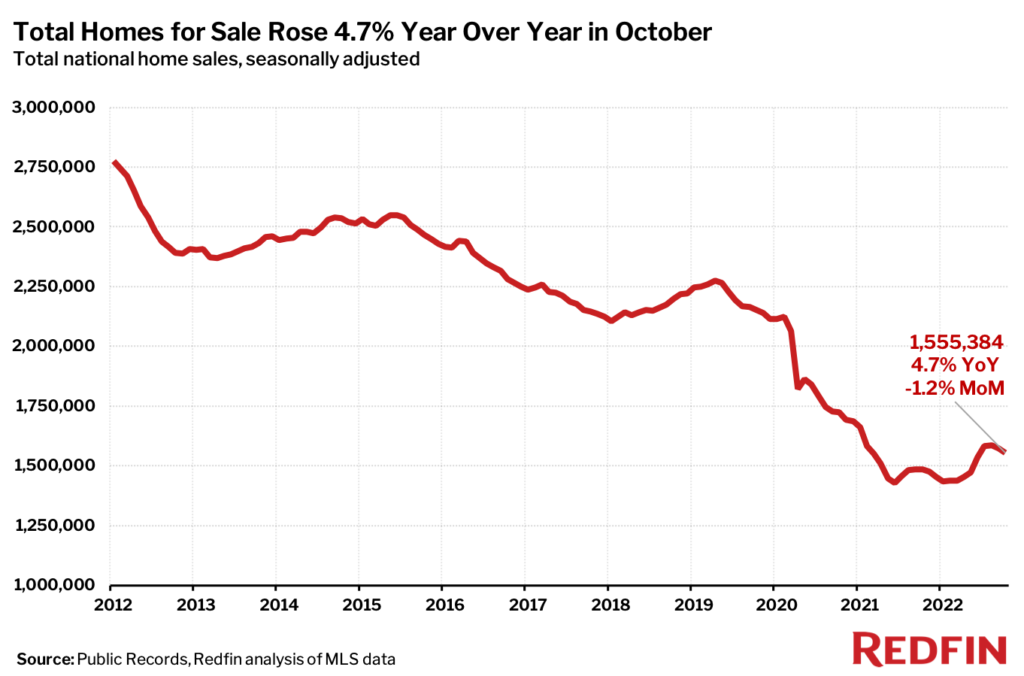

The high share of homeowners who feel locked into their low mortgage rate is contributing to a steep decline in the number of homes hitting the market. New listings slumped 19% year over year during the four weeks ending Sept. 11, the largest drop since May 2020.

This “lock-in” effect is manifesting in markets across the country. For example, Redfin found that in Atlanta, Chicago, Los Angeles and Washington, D.C., homeowners with a mortgage rate below 3.5% were 7.6% less likely to put their homes up for sale in August than homeowners with a rate above 3.5%.

Listings are also on the decline because many homeowners are hesitant to put their house up for sale at a time when the market is slowing and home prices are starting to fall in some areas. Some homeowners are opting to rent their properties out instead of selling to cash in on rising rents.

Metro-Level Highlights

Prices

- Prices fell on a year-over-year basis in five metros: San Francisco (-4.5%), Lake County, IL (-3.5%), San Jose, CA (-1.6%), Oakland, CA (-1.6%) and Stockton, CA (-0.2%).

- Prices increased most in North Port, FL (25.9%), El Paso, TX (18.2%), Miami (17.4%), Tampa, FL (17.2%) and Cape Coral, FL (16.1%).

- More than two-thirds (68.7%) of homes for sale in Boise, ID had a price drop—a larger share than any other metro Redfin analyzed. Next came Denver (56.8%), Indianapolis (54.7%), Salt Lake City (54.7%) and Tacoma, WA (52.5%).

- Newark, NJ had the smallest share of price drops (17%), followed by El Paso (17.2%), Miami (20.1%), Honolulu (20.6%) and New Brunswick, NJ (20.7%).

- Raleigh, NC, Phoenix, Austin, San Antonio and Jacksonville, FL saw the biggest year-over-year increases in the share of homes for sale with price drops. Three metros–Lake County, Chicago and Fresno, CA–saw decreases.

Sales

- Pending home sales fell the most in Allentown, PA, declining 54.9% year over year. Next came Greensboro, NC (-50.4%), Honolulu (-47.3%), Salt Lake City (-46%) and Jacksonville (-45.9%).

- Pending sales fell the least in McAllen, TX (-6.6%), Rochester, NY (-14.2%), Detroit (-14.4%), Buffalo, NY (-15.1%) and El Paso (-15.8%).

- The number of homes sold fell the most in Salt Lake City (-47.6%), Stockton (-45.4%), Cape Coral (-45.3%), Las Vegas (-43.7%) and San Diego (-41.5%).

- The number of homes sold fell the least in Greenville, SC (-14.6%), McAllen (-15.9%), Worcester, MA (-16.4%), Oklahoma City (-16.6%) and New Orleans (-17.6%).

- In Jacksonville, 706 home-purchase agreements fell through, equal to 30.6% of homes that went under contract that month—the highest percentage among the metros Redfin analyzed. It was followed by Tampa (26.7%), San Antonio (26.6%), Atlanta (25.2%) and Las Vegas (25.1%).

- San Francisco had the lowest percentage of cancellations (6%), followed by San Jose (8%), Nassau County, NY (8.2%), Montgomery County, PA (9.3%) New York (10.5%).

Inventory

- New listings fell the most in Cape Coral (-50.8%), followed by Boise (-49.8%), Greensboro (-46.3%), Allentown (-42.1%) and Baton Rouge (-39.3%).

- New listings only rose in one market—El Paso—increasing 3.3%. They fell the least in McAllen (-0.4%), New Orleans (-3.2%), Detroit (-6.3%) and Rochester (-7.8%).

- Active listings (the total number of homes for sale) fell the most in Hartford, CT (-32.6%), followed by Milwaukee (-29.3%), Greensboro (-27.8%), Bridgeport, CT (-27.6%) and Allentown (-25.8%).

- Active listings rose the most in North Port (46.9%), followed by Austin (42.3%), Nashville (40%), Tampa (33.2%) and Phoenix (32.9%).

Competition

- The fastest market was Rochester, where half of all homes were pending sale in just 10 days. It was followed by Omaha, NE and Grand Rapids, MI with 11 median days on market. Next came Columbia, SC and Buffalo, with 12 median days on market.

- The slowest market was Chicago, with 61 median days on market. It was followed by Honolulu (59), West Palm Beach, FL (58), New York (57) and Lake County (56).

- In Rochester, 65.4% of homes sold above their final list price—a higher share than any other metro Redfin analyzed. It was followed by Buffalo (60.1%) Hartford (58.5%), Worcester (52.1%) and Camden, NJ (50.9%).

- In North Port, 12.9% of homes sold above their final list price—a lower share than any other metro Redfin analyzed. Next came Cape Coral (13.5%), Phoenix (13.6%), West Palm Beach (13.9%) and Boise (14%).

- Worcester had the highest bidding-war rate, with 68.4% of home offers written by Redfin agents facing competition. Next came Providence, RI (61.9%), Boston (57.5%), San Jose (54.9%) and San Francisco (51.7%).

- The lowest bidding-war rates were in Nashville (11.1%), Colorado Springs, CO (11.1%), Phoenix (22.1%), Orlando, FL (23.2%) and Riverside, CA (24%).

“The plunge in new listings is hindering growth in housing supply, which is keeping home prices relatively high even though the market is slowing down,” said Redfin Deputy Chief Economist Taylor Marr. “Housing supply fell 1% in August from the month before; normally, it would rise during a downturn.”

To read the full report, including more data, charts and methodology, click here [1].