The share of cash sales in the housing market continues to decline, with the primary cause pointed at the decrease in REO properties.

The share of cash sales in the housing market continues to decline, with the primary cause pointed at the decrease in REO properties.

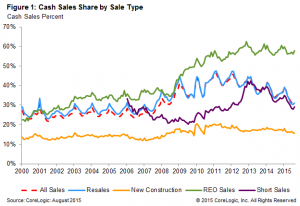

CoreLogic recently reported that cash sales occupied 31.7 percent of all home sales in August 2015, down more than 3 percentage points from 34.9 percent during the same period last year. Month-over-month, cash sales rose 0.8 percent.

At their peak in January 2011, cash sales accounted for nearly half of all residential home sales in the United States (46.5 percent), CoreLogic noted. Since then, that percentage has steadily declined.

However, before the crisis, cash sales averaged about one-fourth of all home sales, and at this rate, CoreLogic projects that this share should hit 25 percent once again by mid-2017.

As has been the historical trend, REO sales made up the largest share of cash transactions at 57.9 percent in August 2015, followed by resales (31.1 percent), short sales (29 percent), and new home sales (15.5 percent), the report showed.

Despite comprising more than half of all cash home sales, REO’s share of all residential home sales remained low in August at 6 percent—about one-quarter off of their peak in January 2011, when they accounted for about 23.9 percent of all home sales. Resales account for about 82 percent of all home sales and have the largest impact on the total cash sales share, according to CoreLogic.

Despite comprising more than half of all cash home sales, REO’s share of all residential home sales remained low in August at 6 percent—about one-quarter off of their peak in January 2011, when they accounted for about 23.9 percent of all home sales. Resales account for about 82 percent of all home sales and have the largest impact on the total cash sales share, according to CoreLogic.

"Distressed sales (REO and short sales) typically sell at a price discount, with REO selling at the steeper discount," CoreLogic Chief Economist Frank Nothaft said. "The discounts are attractive to investors, who can buy with less cash than if the house sold at full/market price, as would generally be the case with a resale or new construction. Thus, the drop in REO sales is a primary cause of the declining cash share."

Investors typically make up the largest share of all-cash buyers, but their share of all home sales is also declining.

“It’s also true that investors are buying a smaller share of all homes, but that may be related to the decline in REO inventory on the for-sale market,” Nothaft said.

Despite the consistently declining cash sales share nationwide, the share remains high in some states—in the case of Alabama, the cash sales share was higher than the nationwide January 2011 peak with 47.6 percent in August 2015. Florida (45.2 percent), New York (42.4 percent), West Virginia (39.5 percent), and Missouri (39.5 percent).

In some of the nation’s largest metro areas, the cash sales share was more than half: Miami (51.7 percent) had the highest, followed by Philadelphia (51 percent), West Palm Beach (50.8 percent), North Port-Sarasota-Bradenton, Florida (48.5 percent), and Fort Lauderdale (47.7 percent).

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news