Is balance returning to the housing marketplace?

Is balance returning to the housing marketplace?

After a week that saw the fixed-rate mortgage plummet 47 basis points week-over-week [1], a second consecutive week of rate drops is bringing signs of life back to the market.

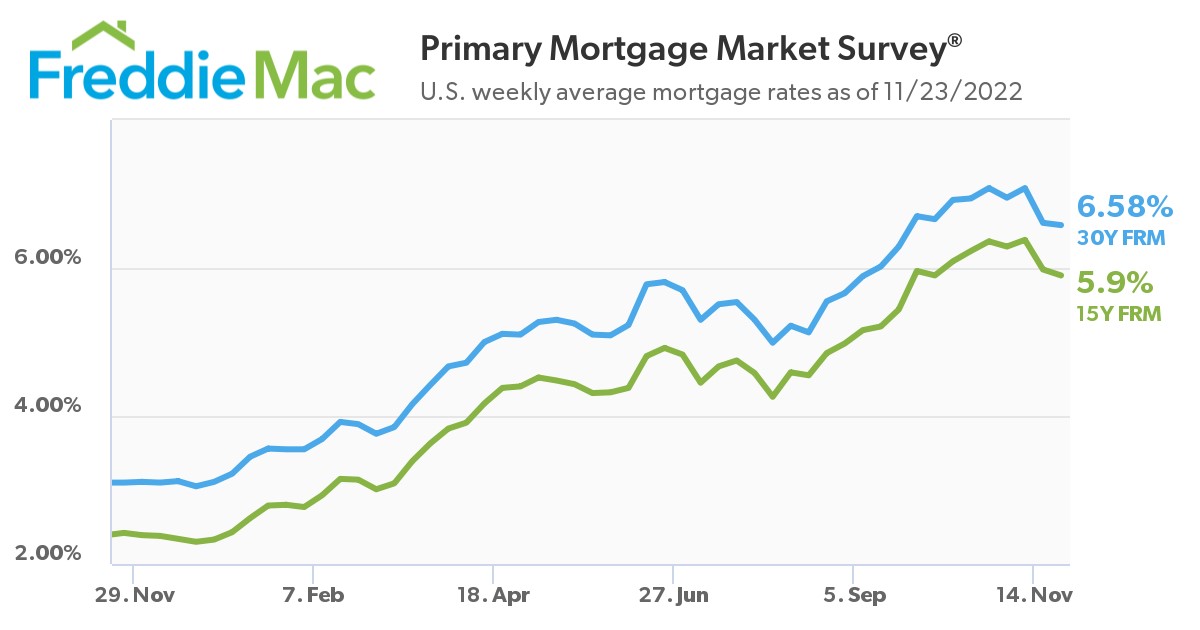

After last week’s historic one week dip in mortgage rates, Freddie Mac reported the 30-year fixed-rate mortgage (FRM) [2] averaged 6.58% for the week ending November 23, 2022, down from last week when it averaged 6.61%. A year ago at this time, the 30-year FRM averaged more than half that total, averaging just 3.10%. The 15-year FRM averaged 5.90% for the week, down from last week when it averaged 5.98%, while year-over-year, the 15-year FRM averaged 2.42%.

“Mortgage rates continued to tick down heading into the Thanksgiving holiday,” said Sam Khater, Freddie Mac’s Chief Economist [3]. “In recent weeks, rates have hit above seven percent only to drop by almost half a percentage point. This volatility is making it difficult for potential homebuyers to know when to get into the market, and that is reflected in the latest data which shows existing home sales slowing across all price points.”

The downtick in rates brought forth a rise in overall mortgage application volume, as the Mortgage Bankers Association (MBA) reported volume increasing 2.2% from one week earlier [4], according to the MBA’s Weekly Mortgage Applications Survey for the week ending November 18, 2022.

Those seeking a dip in rates found some solace in this latest rate drop, as the MBA reported its Refinance Index increased 2% from the previous week, yet was still 86% lower than the same week one year ago. The seasonally adjusted Purchase Index increased 3% from one week earlier. The unadjusted Purchase Index increased 9% compared with the previous week, and was 41% lower than the same week one year ago.

“The 30-year fixed-rate mortgage fell for the second week in a row to 6.58%, and is now down almost 50 basis points from the recent peak of 7.16% one month ago,” said Joel Kan, MBA’s VP and Deputy Chief Economist [5]. “The decrease in mortgage rates should improve the purchasing power of prospective homebuyers, who have been largely sidelined as mortgage rates have more than doubled in the past year. As a result of the drop in mortgage rates, both purchase and refinance applications picked up slightly last week. However, refinance activity is still more than 80% below last year’s pace.”

The refinance share of overall mortgage activity increased to 28.4% of total applications from 27.6% the previous week. The adjustable-rate mortgage (ARM) share of activity decreased to just 8.8% of total applications.

“With the decline in rates, the ARM share of applications also decreased to 8.8% of loans last week, down from the range of 10% and 12% during the past two months,” added Kan.

By loan type, the FHA share of total applications decreased slightly to 13.4% from 13.5% the week prior, while the VA share of total applications decreased slightly as well to 10.5% from 10.6% the week prior. The USDA share of total applications remained unchanged at 0.6% from the week prior.