[1]More than half of adults —or 53%— have delayed a major financial milestone due to the state of the economy, while another 58% have avoided activities or events, according to a new Bankrate poll [2]. That comes as another 57%say their quality of life has been negatively impacted by the economy.

[1]More than half of adults —or 53%— have delayed a major financial milestone due to the state of the economy, while another 58% have avoided activities or events, according to a new Bankrate poll [2]. That comes as another 57%say their quality of life has been negatively impacted by the economy.

Inflation on everyday essentials, including food and gas, is weighing on Americans’ purchasing power, and their earnings have struggled to keep pace.

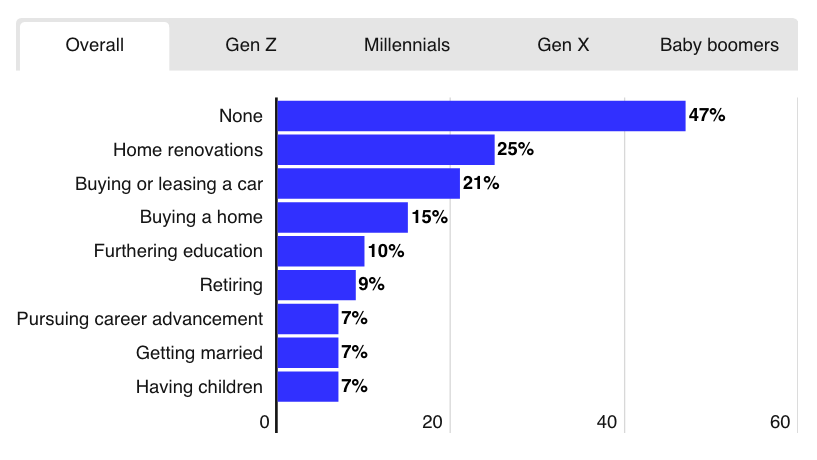

- More than half of adults (or 53%) have delayed a major financial milestone because of the economy, most commonly home improvements or renovations (25%), buying or leasing a car (21%) or buying a home (15%).

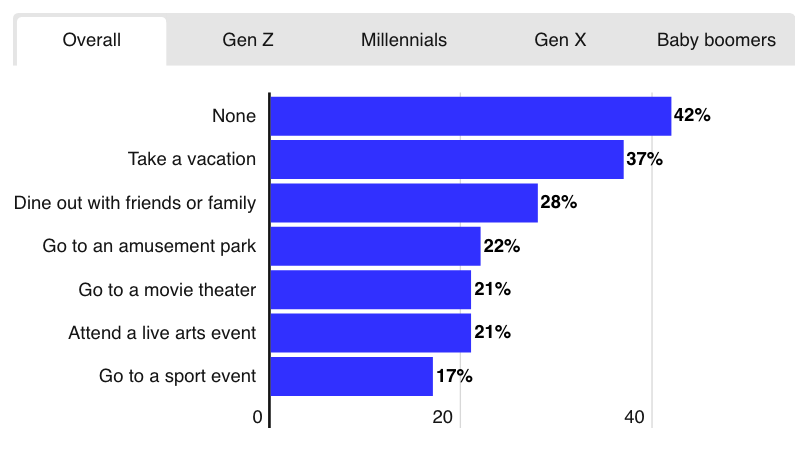

- Almost 3 in 5 (or 58%) have opted out of activities or events because of the economy, most likely taking a vacation (37%); dining out with friends or family (28%); going to an amusement park, zoo, aquarium or other attraction; or attending live arts events such as concerts and plays (21%).

- More than half (or 57%) say their quality of life has been negatively impacted by the state of the economy, including 22% who say they’ve been very negatively impacted.

- Americans whose quality of life has been negatively impacted are much more likely to have delayed major financial milestones (62%) or activities (67%) than those who were either positively or not impacted (43% and 46%, respectively).

More than half of adults have delayed a major financial milestone because of the economy

The major financial milestones Americans most commonly say they’re delaying because of the economy are no doubt related to that massive increase in interest rates. Those include:

- Home improvements or renovations (25%)

- Buying or leasing a car (21%)

- Buying a home (15%)

Yet, others say the economy is even affecting personal decisions, such as:

- Getting married (7%)

- Having children (7%)

Another 10 percent say they’ve decided to delay furthering their education, while 7 percent have pushed off pursuing a career advancement. And at a time when the S&P 500 is down almost 18% since the start of the year, another 9% say they’ve put off retiring.

Millennials (at 64%; ages 26-41) are especially likely to have delayed a major financial milestone because of the economy, with 26% saying they’ve put off buying a home. That compares with 55% of Generation Z (ages 18-25) who say they’ve delayed at least one milestone, along with 54% of Generation X (ages 42-57) and 46% of baby boomers (ages 58-76).

Meanwhile, younger generations (Gen Z and millennials, at 14 and 12%, respectively) are more than twice as likely as their older Gen X (5%) and baby boomer (1%) counterparts to say they’ve delayed trying to advance in their career.

Americans making $100,000 or more a year were slightly more likely (at 58%) to have delayed one or more financial milestones than households earning between $50,000 and $99,999 (at 55%) and others making less than $50,000 annually (54 percent).

Slightly less than half of Americans (or 47%) say the economy hasn’t led them to delay a major financial milestone because of the economy.

Nearly 3 in 5 have opted out of activities or events because of the economy

The U.S. economy isn’t just keeping Americans from making important financial decisions that could further their wealth-building opportunities. Consumers are also avoiding socially rewarding activities or events, many of which they lived without during the coronavirus pandemic.

Those include:

- Taking a vacation that involves one overnight stay for leisure (37%);

- Dining out with friends or family (28%);

- Going to an amusement park, zoo, aquarium or other attraction (22%);

- Attending live arts events, such as concerts or plays (21%);

- Going to see a movie in a theater (21%); and

- Going to a professional sports event (17%).

Even with the economy leading consumers to delay vacations, travel coming out of the pandemic has still boomed. TSA check-ins between Aug. 31 and Sept. 6, for example, eclipsed even pre-pandemic levels from 2019, according to the Transportation Security Administration [4]. That massive demand has helped push prices up on airlines by almost 43% from a year ago, according to the Department of Labor.

“Revenge spending in travel has been particularly robust, with full flights and sold-out hotels,” McBride says. “But just how much stronger could it have been? This tends to be the first discretionary expense to get cut when households are queasy about the economic path ahead.”

Gen Z and millennials (at 64% and 66%, respectively) were more likely than their older Gen X and baby boomer counterparts (at 59% and 50%, respectively) to have opted out of at least one activity or event within the past year.

And while higher-earning Americans were more likely to hold off on major financial milestones, the opposite was true with activities. Households earning less than $50,000 annually were the most likely to say no to an activity (at 61%), compared to 58% for households earning between $50,000 and $99,999 a year, and 55% of those earning $100,000 or more. [5]

[5]

More than half say their quality of life have been negatively impacted by the state of the economy

Looking at the majority of Americans who say the state of the economy has negatively impacted their quality of life, more than 1 in 3 (or 34%) say they’ve been somewhat negatively impacted, while more than 1 in 5 (or 22%) say they’ve been very negatively impacted, according to Bankrate’s poll.

Just 1 in 8 (or 12%) say the economy has positively impacted their life, including 5% who cite a very positive impact, and 7% who cite a somewhat positive impact.

Almost a third (or 31%) say the economy has neither positively nor negatively affected their well-being.

Americans who’ve been negatively impacted are more likely to delay activities (at 67%) or milestones (at 62%) than those who’ve been either positively or neutrally impacted (at 46% for activities and 43% for milestones).

Almost half of those negatively impacted Americans put off a vacation (49%), more than two times as many as those who were either positively or neutrally impacted (21%). Those who were negatively impacted were also two times as likely to delay buying or leasing a car (27%) and making home improvements (33%) than those who were positively or neutrally impacted (14% and 15% for both respective milestones).

The economy was more likely to have a negative impact on women’s quality of life than men’s (at 60% and 53%). Meanwhile, middle-income households earning between $50,000 and $99,999 a year (at 62%) were the most likely to say they’ve been negatively impacted. That compares with 55 percent for both those earning less than $50,000 annually and individuals making $100,000 and up a year.

Low-wage positions have seen some of the biggest pay bumps after the pandemic-induced recession as employers work through labor shortages in the key retail and food services sectors. Meanwhile, wealthier households with assets such as homes and stocks thrived during the pandemic amid the Fed’s massive efforts to prop up the financial system.

Wealth remains above pre-pandemic levels even despite the drop in equity prices this year, according to the Fed’s June 2022 monetary policy report [6].

Still, a substantial majority say they’ve taken a hit — no doubt related to the rapid increase in prices affecting the everyday essentials consumers need most, from food and gasoline to electricity and shelter.

“The pervasiveness of price increases remains problematic,” McBride says. “Any meaningful relief for household budgets is still somewhere over the horizon. Inflation has run far hotter for far longer than expected and we have yet to string together any kind of winning streak.”

To read the full report, including more data, charts and methodology, click here [2].