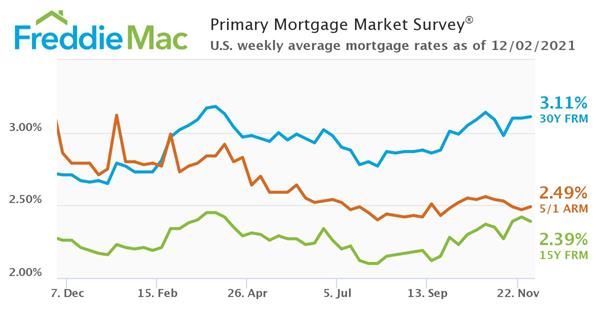

The latest Primary Mortgage Market Survey (PMMS) from Freddie Mac has found the 30-year fixed-rate mortgage (FRM) averaged 3.11% for the week ending December 2, 2021, up slightly from last week when it averaged 3.10%. A year ago at this time, the 30-year FRM averaged 2.71%.

The latest Primary Mortgage Market Survey (PMMS) from Freddie Mac has found the 30-year fixed-rate mortgage (FRM) averaged 3.11% for the week ending December 2, 2021, up slightly from last week when it averaged 3.10%. A year ago at this time, the 30-year FRM averaged 2.71%.

“Mortgage rates continue to remain stable notwithstanding volatility in the financial markets,” said Sam Khater, Freddie Mac Chief Economist. “The consistency of rates in the face of changes in the economy is primarily due to the evolution of the pandemic, which lingers and continues to pose uncertainty. This low mortgage rate environment offers favorable conditions for refinancing.”

Freddie Mac also reported the 15-year FRM averaged 2.39% with an average 0.6 point, down from last week when it averaged 2.42%. A year ago at this time, the 15-year FRM averaged 2.26%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.49% with an average 0.3 point, up from last week when it averaged 2.47%. A year ago at this time, the five-year ARM averaged 2.86%.

In a week shortened by the U.S. Thanksgiving holiday, the Mortgage Bankers Association (MBA) found that overall mortgage application volume declined 7.2% week-over-week, as the nation comes off a holiday-shortened week due to Thanksgiving.

And while Khater notes that opportunities remain for refis, the MBA found that the refinance share of weekly overall mortgage activity decreased to 59.4% of total applications, down from 63.1% the previous week.

One reason for the tail off of refis could be found in the continued imbalance between housing supply and prices. As the number of listings dwindles, bidding wars are heating back up and prices have followed, as the latest report from S&P CoreLogic Case-Shiller Indices found an annual gain of 19.5% in home prices in September, down slightly from 19.8% the previous month.

Craig J. Lazzara, Managing Director at S&P DJI, said, “Housing prices continued to show remarkable strength in September, though the pace of price increases declined slightly. The National Composite Index rose 19.5% from year-ago levels, with the 10- and 20-City Composites up 17.8% and 19.1%, respectively.”

Positive swings were found in the latest unemployment report from the U.S. Department of Labor, as for the week ending November 27, the advance figure for seasonally adjusted initial unemployment claims was 222,000, the lowest level for this average since March 14, 2020 when it was 225,500.

“The Freddie Mac fixed rate for a 30-year loan slid this week, as investors found fresh worries and questions surrounding the new omicron COVID variant and consumer confidence fell,” said Realtor.com Manager of Economic Research George Ratiu. “In addition, Federal Reserve Chairman Powell’s testimony in Congress pointed to a potentially faster pullback in asset purchases, including mortgage-backed securities, which drove further uncertainty about the monetary impact on capital markets and pushed the 10-year Treasury to 1.4%, the lowest level since September. A silver lining this week was that private sector employment outpaced market expectations, but markets will be focused on tomorrow’s payroll employment data.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news