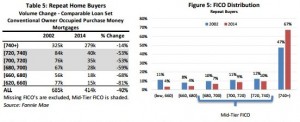

[1]Mortgage lending to borrowers with mid-tier credit scores has severely declined since the mid-2000s, even after Fannie Mae made eligibility changes.

[1]Mortgage lending to borrowers with mid-tier credit scores has severely declined since the mid-2000s, even after Fannie Mae made eligibility changes.

Fannie Mae [2] defines a mid-tier credit score as a FICO between 680 and 740 in its newest study from its Pricing and Underwriting Mortgage Analytics group.

The study determined that Fannie Mae's eligibility changes had little impact on mortgage lending volume [3], especially to mid-tier borrowers. In addition, repeat borrowers are suffering the most from the drop in mid-tier lending than first-time homebuyers.

"This decline in repeat borrowers is strongest along the U.S. coasts, where the housing crisis diminished borrowers’ abilities to retain or gain equity in their current homes, reducing their likelihood of selling their existing homes and purchasing new ones," the report stated.

[4]The study showed that first-time homebuyers are up by 45 percent in 2014 compared to 2002, while repeat homebuyers are down by 40 percent over the same time period.

[4]The study showed that first-time homebuyers are up by 45 percent in 2014 compared to 2002, while repeat homebuyers are down by 40 percent over the same time period.

Fannie Mae's Consequences of Declining Mid-Tier FICO Credit Score Lending:

- Lower FICO can lead to existing households being potentially “locked” in to their mortgage and property.

- These borrowers might not even be able to benefit from low mortgage rates by turning over their existing property and purchasing a new one if their equity levels are low or if they are under water.

- Some homeowners who locked in lower-than-current market rates on their mortgage may have less incentive to move, since any home purchased today would become more expensive than their current residence based purely on prevailing interest rates.

- And some homeowners who could benefit from current low mortgage rates may even choose not to get back in the housing market if they have seasoned their loan and are amortizing mostly principal.

- Stagnant wages and the slow recovery of housing prices have also played a role by impacting the income and wealth of home buyers and reducing the likelihood of changing their residence.

"Policy changes that expand “access to credit” programs to include repeat borrowers may encourage home purchase activity within the mid-tier FICO segment," Fannie Mae concluded. "For borrowers who lost significant value on their property, carefully designed renovation products may provide some level of support. This would not only help borrowers to achieve their home of choice, but also would increase house values and could open up avenues for possible future home sales and turnover buyers."

Click here [3]to view the complete report.