The Consumer Financial Protection Bureau (CFPB)’s Consumer Complaint Database has generated much controversy since June when it began publishing narratives of complaints from consumers. So much so that CFPB Director Richard Cordray issued a rare public response to the criticisms in late November.

The Consumer Financial Protection Bureau (CFPB)’s Consumer Complaint Database has generated much controversy since June when it began publishing narratives of complaints from consumers. So much so that CFPB Director Richard Cordray issued a rare public response to the criticisms in late November.

This week, the CFPB’s Ombudsman Office issued its annual report for FY 2015 to Cordray outlining potential changes to the database. One of the items mentioned was a need for the normalization of data presented.

“In our FY2014 Annual Report, we highlighted the concern from industry groups about the need for normalization of data in the public Consumer Complaint Database to provide context to the data and continued to hear this and related concerns in FY2015,” the Ombudsman stated. “This year, we provided feedback and suggestions to the CFPB regarding normalization of the data.

On July 1, a week after the complaint narratives were published for the first time, the CFPB issued a request for information regarding the database. The Bureau published the request for information to determine whether there are ways to help the public more easily understand the information presented in the database and how consumers can compare the information the database contains. Comments were due on August 31, 2015; the Ombudsman’s Office noted in the report that it “looks forward to the Bureau’s review of the public submissions.”

Issues regarding duplicate complaints and third-party consumer complaint submissions were also addressed in the Ombudsman’s report. The Ombudsman’s office stated in the report that it found out through individual inquiries that resulting complaints submitted by third parties on behalf of multiple consumers may contain inconsistent information when they are published.

“As a result, the company that is the subject of the complaint may not recognize the consumer and/or the consumer may not be able to access the complaint. We highlighted this concern to the CFPB,” the report said. “As of this writing, we understand that the agency is beginning to address this issue and plans to update the form and instructions to address it further.”

Also according to the Ombudsman’s report, the CFPB and companies are working together to prevent duplicate complaints from being published in the database and that in recent months the companies are taking more of a role in identifying duplicate complaints. The Ombudsman recommended that Consumer Response share an expanded definition of “duplicate complaint” on the Consumer Complaint Database website to include complaints that are from “the same person, same transaction, and same issue” and not just complaints that are simply verbatim copies of previous complaints. The purpose of expanding the definition of “duplicate complaint” is so database users can adjust their calculations and analyses accordingly, according to the report.

The CFPB launched its Consumer Complaint Database in 2012, a year after the Bureau opened its doors, as a way to help consumers make informed and responsible decisions about financial transactions, and to ensure the transparent and efficient operations of markets for consumer financial products. In June 2015, the Bureau began publishing consumers' narratives of complaints; some analysts and stakeholders in financial markets say that since the CFPB does not verify the allegations made in the complaints, in some cases the Bureau may just be offering up the biased opinions of disgruntled individuals for everyone to see.

In late August, the National Association of Federal Credit Unions (NAFCU) aired its grievances with the database via a letter to the Bureau. In that letter, Kavitha Subramanian, Regulatory Affairs Counsel for NAFCU, wrote that his organization was “deeply concerned about the existing reputational and consumer privacy issues” presented by the current database. Subramanian said that the industry noted “a number” out of the 8,000 complaint narratives published in June for which personal information was not properly scrubbed. He also asserted in the letter that harmful reputational risks to financial institutions exist because there is no mechanism to validate a consumer's comments in the database.

In late August, the National Association of Federal Credit Unions (NAFCU) aired its grievances with the database via a letter to the Bureau. In that letter, Kavitha Subramanian, Regulatory Affairs Counsel for NAFCU, wrote that his organization was “deeply concerned about the existing reputational and consumer privacy issues” presented by the current database. Subramanian said that the industry noted “a number” out of the 8,000 complaint narratives published in June for which personal information was not properly scrubbed. He also asserted in the letter that harmful reputational risks to financial institutions exist because there is no mechanism to validate a consumer's comments in the database.

Cordray, who seldom responds publicly to criticism of the Bureau, fired back at a report published in American Banker in late November titled “Errors About in CFPB’s Complaint Portal.” He responded via a letter to that publication’s editor on November 30.

The CFPB's Office of the Inspector General (OIG) in September released the results of an audit in which it analyzed more than a quarter of a million complaints in the Bureau's database and found "several noticeable inaccuracies." While the OIG said the number of complaints with inaccuracies it found was relatively small, "enhancing existing controls would help ensure that as the number and types of complaints published increase, overall reliability of the data is maintained."

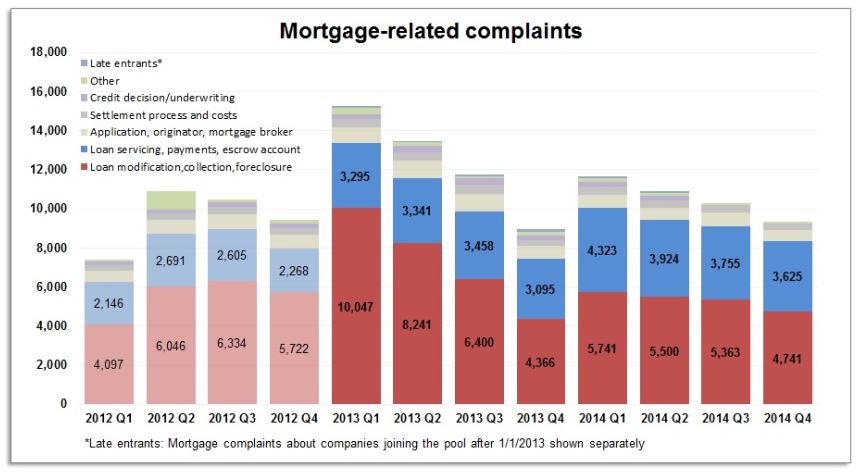

In order to provide more context and insight to the complaints received, The Five Star Institute and Black Knight Financial Services released a report titled Analysis and Study of CFPB Consumer Complaint Data Related to Mortgage Servicing Activities in April. In the report, Black Knight and Five Star compared the Bureau's two predominant mortgage complaint categories—servicing and default—with loan trends, and also included publicly available data from both the CFPB and mortgage servicers as reported from the CFPB database.

Click here to view the CFPB Ombudsman’s complete report.

Editor's note: The Five Star Institute is the parent company of DS News and DSNews.com.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news