According to the latest data analysis from the Mortgage Bankers Association (MBA), mortgage credit availability rose in November 2022, according to the MBA’s Mortgage Credit Availability Index (MCAI), a report that analyzes data from ICE Mortgage Technology.

According to the latest data analysis from the Mortgage Bankers Association (MBA), mortgage credit availability rose in November 2022, according to the MBA’s Mortgage Credit Availability Index (MCAI), a report that analyzes data from ICE Mortgage Technology.

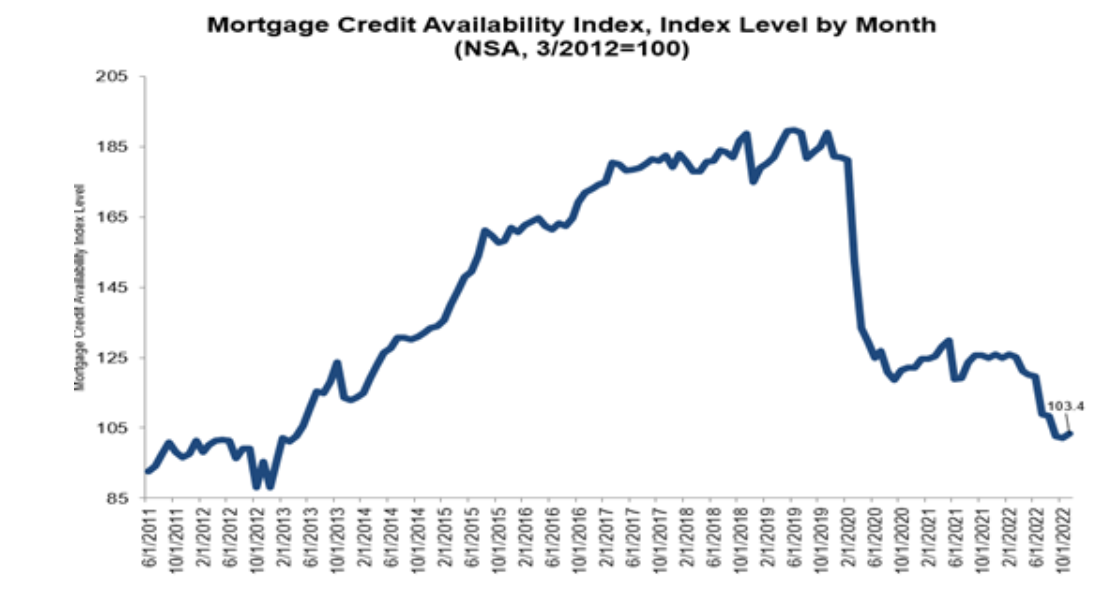

The MCAI rose by 1.4% to 103.4 in November. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The MCAI was benchmarked to 100 in March 2012. The Conventional MCAI increased 2.8%, while the Government MCAI remained unchanged. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 3.9%, and the Conforming MCAI rose by 1.0%.

“Credit availability increased slightly in November, the first increase in nine months, as lenders continued to navigate a challenging environment brought on by higher rates and a much slower housing market,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “Jumbo credit availability saw a 4% increase, as jumbo rates remained more competitive than rates on conforming loans. Lenders are seeking to capture more volume in this space. Most of last month’s increase came from more ARM loan programs being offered.”

The month of November began with the 30-year fixed-rate mortgage (FRM) over the 7% mark, averaging 7.08% for the week ending November 10, 2022. A historic drop of 47-basis points the following week (November 17) brought the 30-year FRM to 6.61%, and the month closed out with rates dipping even further, holding at 6.49% as of December 1, 2022.

The Conventional, Government, Conforming, and Jumbo MCAIs are constructed using the same methodology as the Total MCAI, and are designed to show relative credit risk/availability for their respective index.

The primary difference between the total MCAI and the Component Indices are the population of loan programs which they examine. The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news