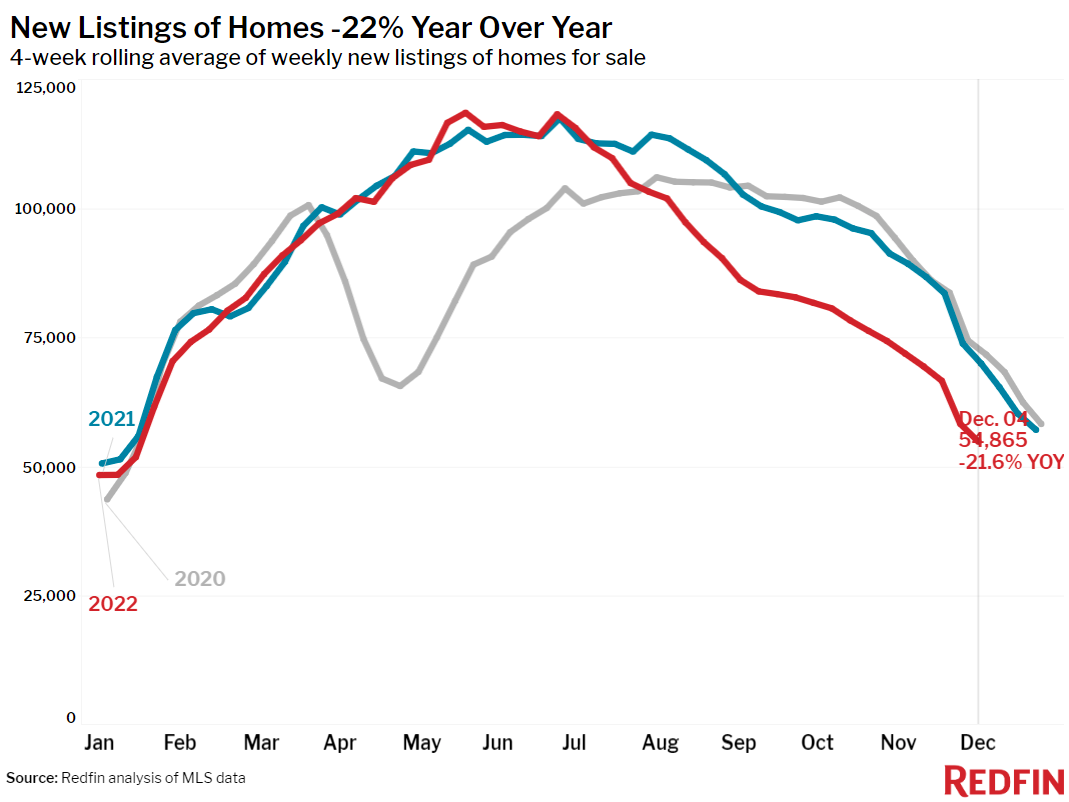

According to a new Report from Redfin [1], the total number of homes for sale increased 15% year-over-year during the four weeks ending December 4, the biggest uptick on record [2]. Meanwhile, new listings declined by more than 20%, which means homes are sitting on the market as prospective buyers stay on the sidelines and wait for mortgage rates and home prices to decline further from their peaks.

That’s also evidenced by a slowing market: The typical home that sold was on the market for 37 days, up from a record low of 17 days in June and up from 28 days a year earlier — the biggest year-over-year slowdown on record.

The Homebuyer Demand Index is rebounding from its low point — up 5% from a week earlier — as mortgage rates continue to decline from their early-November peak. Rates dropped to 6.33% from 6.5% a week earlier, cutting the typical U.S. homebuyer’s monthly housing bill by about $50.

“This week has been relatively calm and quiet as we approach the end of one of the most volatile years in housing history,” said Redfin Deputy Chief Economist Taylor Marr. “But it’s not over yet. Next Tuesday’s inflation report is the 500-pound gorilla in the room, and the Fed’s press conference the next day will bring us much more clarity on how soon and how quickly we can expect mortgage rates to come down in the new year. Since we expect only a small decline in prices next year, mortgage rates will dictate housing affordability, and as a result, demand and sales, in 2023. If rates continue declining, more buyers may wade back into the market, as they’ll have lower monthly payments.”

Home prices fell from a year earlier in 11 of the 50 most populous U.S. metros, mostly in California

Home-sale prices fell from a year earlier in 11 of the 50 most populous U.S. metros, six of which are in California. Prices fell 7.8% year over year in San Francisco, 3.6% in San Jose, 2.2% in Los Angeles, 1.4% in Detroit, 1.2% in Sacramento, and 1.1% in Pittsburgh. They declined less than 1% in Oakland, California, Anaheim, California, Austin, Philadelphia, and Phoenix.

Although the decline was small, this marks the first time Phoenix home prices have fallen on a year-over-year basis since at least 2015, as far back as this data goes. It’s the first time Anaheim prices have fallen since October 2019.

Leading indicators of homebuying activity:

- For the week ending December 8, 30-year mortgage rates ticked down to 6.33%, the fourth straight weekly decrease. The daily average was 6.29% on December 7.

- Mortgage purchase applications during the week ending December 2 declined 3% from a week earlier, seasonally adjusted. Purchase applications were down 40% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index – a measure of requests for home tours and other homebuying services from Redfin agents–was up 5% from a week earlier but down 29% from a year earlier during the four weeks ending December 4.

- Fewer people searched for “homes for sale” on Google than this time in 2021. Searches during the week ending December 3 were down about 34% from a year earlier, but up slightly from the week before.

- Touring activity as of December 4 was down 37% from the start of the year, compared to a 12% decrease at the same time last year, according to home tour technology company ShowingTime [3].

Key housing market takeaways for 400+ U.S. metro areas:

- The median home sale price was $355,500, up slightly from the week before and up 1.9% year-over-year, the slowest price growth since June 2020 (with the exception of the prior four-week period).

- The median asking price of newly listed homes was $357,470, up 4.4% year-over-year, the slowest growth rate since May 2020.

- The monthly mortgage payment on the median-asking-price home was $2,297 at the current 6.33% mortgage rate. That’s down slightly from a week earlier and down more than $200 from a month earlier, when mortgage rates were around 7%. Still, monthly mortgage payments are up 38% from a year ago.

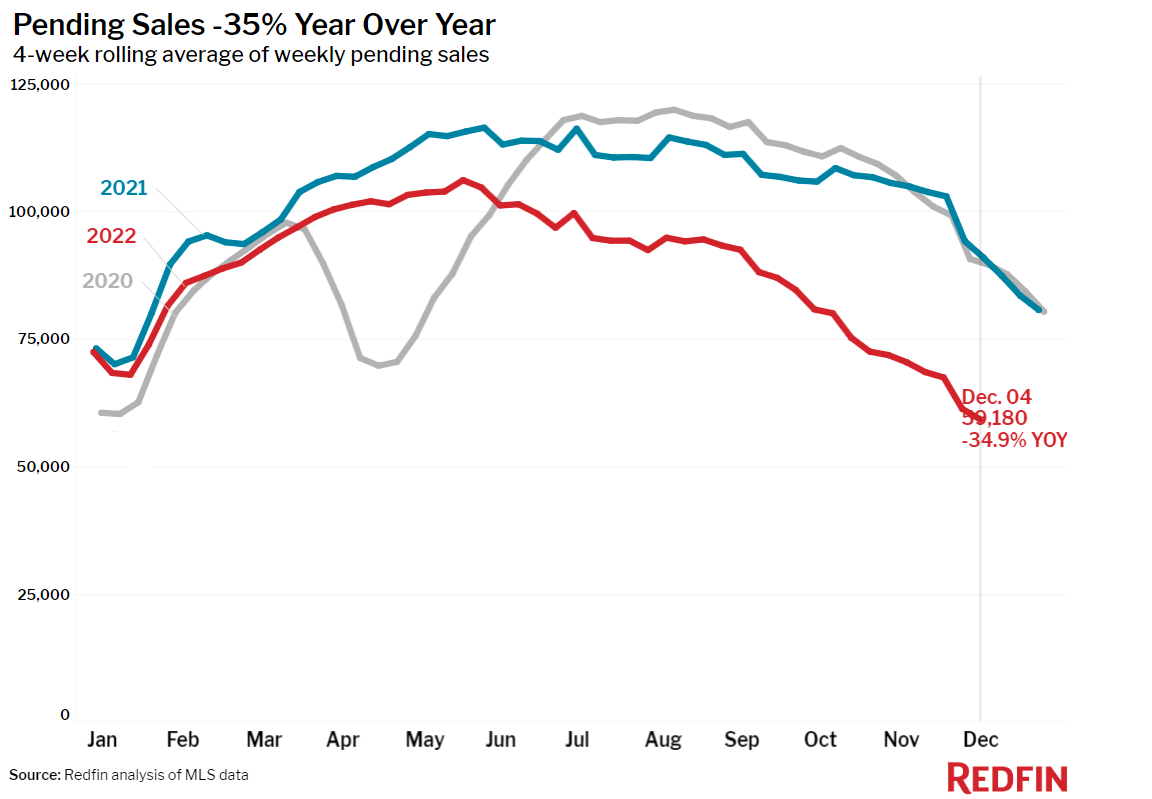

- Pending home sales were down 34.9% year-over-year, one of the largest declines since at least January 2015, as far back as this data goes.

- Among the 50 most populous U.S. metros, pending sales fell the most from a year earlier in Las Vegas (-65.4%), Austin (-60.7%), Phoenix (-56.8%), Jacksonville, Florida (-55.6%) and Portland, Oregon (-53.5%).

- New listings of homes for sale were down 21.6% from a year earlier, the largest decline since May 2020.

- Active listings (the number of homes listed for sale at any point during the period) were up 15% from a year earlier, the biggest annual increase since at least 2015.

- Months of supply — a measure of the balance between supply and demand, calculated by dividing the number of active listings by closed sales—was 3.9 months, flat from a week earlier but up sharply from 3.4 months two weeks earlier.

- 30% of homes that went under contract had an accepted offer within the first two weeks on the market, down two percentage points from the prior four-week period and down from 38% a year earlier.

- Homes that sold were on the market for a median of 37 days, up more than a week from 28 days a year earlier and up from the record low of 17 days set in May and early June.

- 25% of homes sold above their final list price, down from 42% a year earlier and the lowest level since June 2020.

- On average, 6% of homes for sale each week had a price drop, down slightly from a week earlier and down sharply from 7.5% a month earlier. It’s up from 2.8% a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, fell to 98.4% from 100.3% a year earlier. That’s the lowest level since June 2020.

To read the full report, including more data, charts and methodology, click here [2].