Measures of early-stage homebuying demand are up by double digits since hitting a low point at the end of October, according to Redfin’s latest Homebuyer Demand Index [1]. The Homebuyer Demand Index is up 10%, and mortgage-purchase applications are up 14% from the end of October, when both hit their 2022 troughs.

That’s largely because mortgage rates continue to steadily decline. The weekly average came in at 6.31% this week, down from a peak of 7.08% during the last week of October, saving the typical homebuyer more than $200 on their monthly payment.

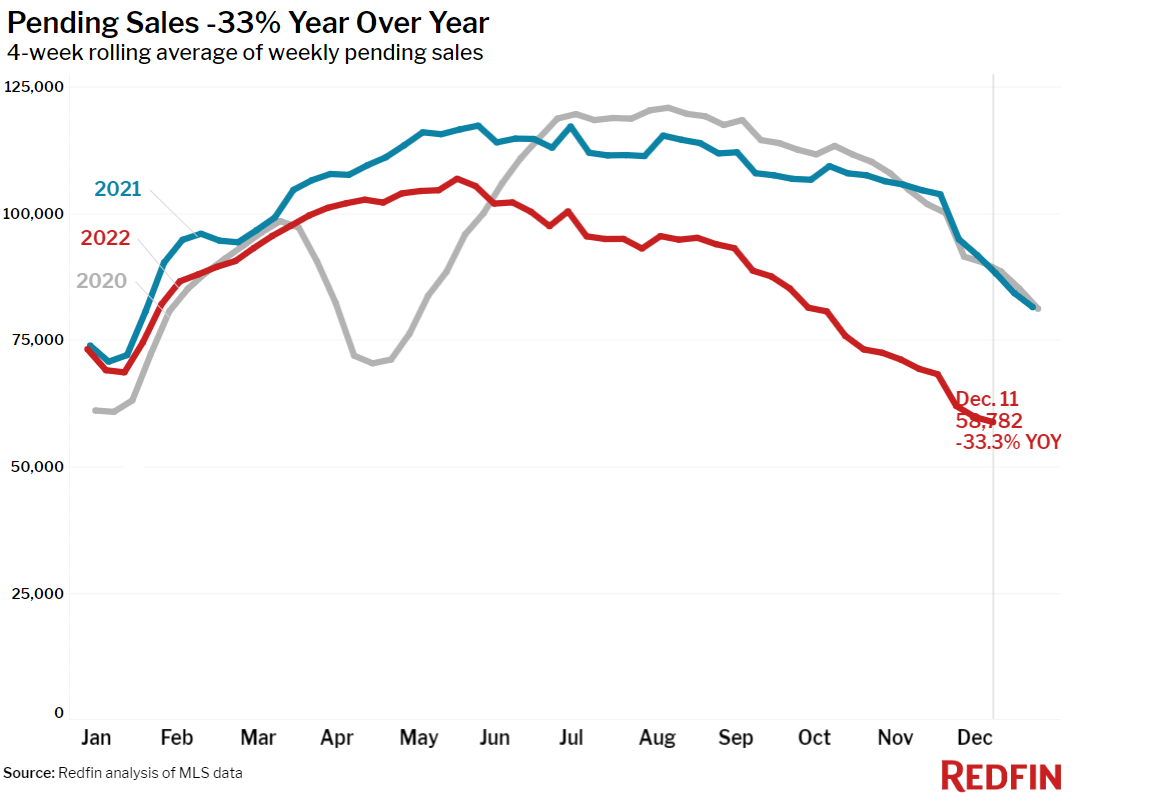

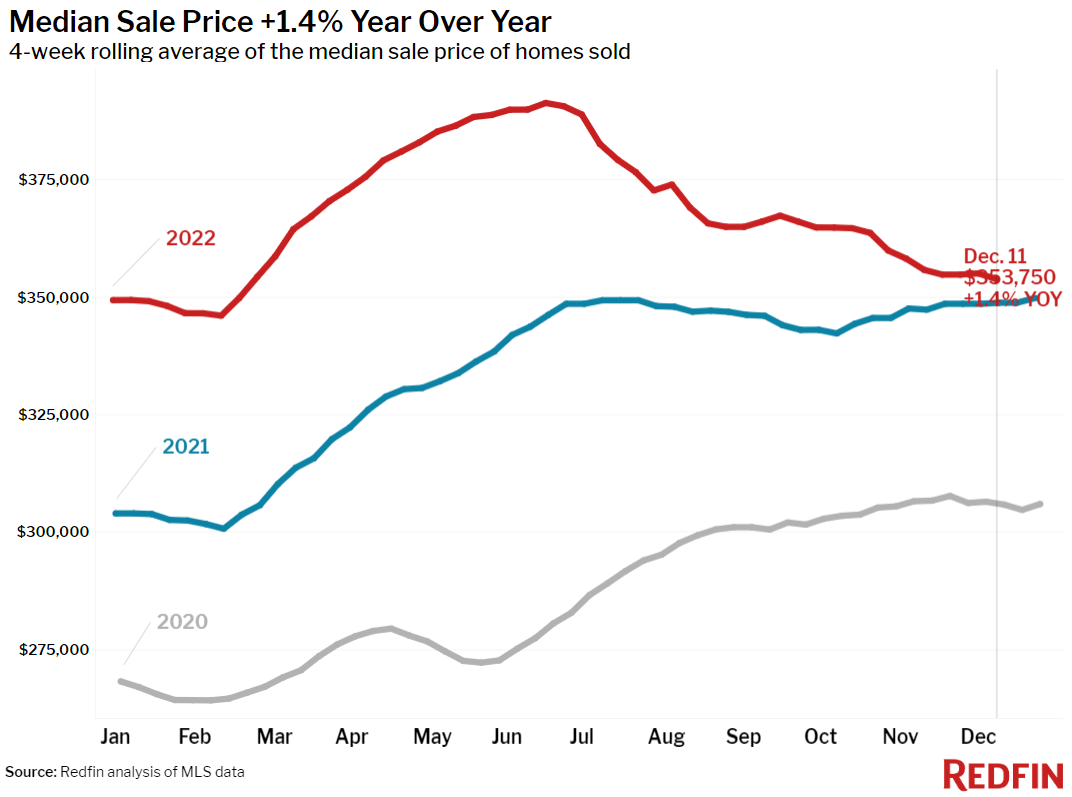

Demand and purchase applications are still down sharply from a year ago, while, pending home sales are down more than 30% year-over-year and homes are selling at their slowest pace in nearly two years –though it takes time for early indicators of demand to translate into pending sales. The nation’s median home-sale price rose just 1.4% year-over-year, the slowest growth rate since the start of the pandemic, reflecting still-cool homebuyer demand.

“Slowing inflation and the hope of the Fed easing rate hikes in the new year are likely to bring mortgage rates down further and thereby improve homebuying demand,” said Redfin Deputy Chief Economist Taylor Marr. “But don’t call it a comeback or even a recovery yet; demand is still way down from its peak. We’re keeping a close eye on the labor market for confirmation that inflation will continue slowing. A strong job market like the one we have now contributes to inflation because it pushes up wages and leads to higher prices. Though it seems counterintuitive, a slight uptick in unemployment and/or slower economic growth would likely help bring mortgage rates down further. If that happens, the increase we’re seeing in early-stage demand could translate to an uptick in pending sales in early 2023.”

Home prices fell from a year earlier in 15 of the 50 most populous U.S. metros

The number of metros with declining sale prices is piling up. Home-sale prices fell year over year in 15 of the 50 most populous U.S. metros, many of them in California, compared with declines in 11 of the 50 a week earlier.

Prices fell 7.3% year-over-year in San Francisco, 5.8% in San Jose, California, 3.3% in Los Angeles, 3% in Austin, 2.6% in Pittsburgh, 2% in Oakland, 1.9% in Detroit and 1.8% in Sacramento. They declined 1% or less in Anaheim, California, Chicago, Philadelphia, Seattle, Riverside, California, Phoenix, and Las Vegas.

The Los Angeles and Austin price declines are the biggest since at least 2015, as far back as this data goes. Although the declines were small, this marks the first time Las Vegas and Riverside home prices have fallen on a year-over-year basis since at least 2015.

Leading indicators of homebuying activity:

- For the week ending December 15, 30-year mortgage rates ticked down slightly to 6.31%, the fifth straight weekly decrease. The daily average was 6.13% on December 15.

- Mortgage purchase applications during the week ending December 14 increased 4% from a week earlier and 7.6% from a month earlier, seasonally adjusted. They’re up 13.8% from late October, when purchase applications fell to their trough. Still, purchase applications were down 38% from a year earlier.

- The seasonally adjusted Redfin Homebuyer Demand Index–a measure of requests for home tours and other homebuying services from Redfin agents–was essentially flat from a week earlier, but up 5% from a month earlier during the four weeks ending December 11. It was down 27% from a year earlier.

- Fewer people searched for “homes for sale” on Google than this time in 2021. Searches during the week ending December 10 were down about 34% from a year earlier, and flat from the week before.

- Touring activity as of December 11 was down 40% from the start of the year, compared to a 16% decrease at the same time last year, according to home tour technology company ShowingTime [2].

Key housing market takeaways for 400+ U.S. metro areas

Data based on homes listed and/or sold during the period:

- The median home sale price was $353,750, up 1.4% year over year, the slowest growth rate since the start of the pandemic.

- The median asking price of newly listed homes was $354,779, up 3.9% year over year, the slowest growth rate since the start of the pandemic.

- The monthly mortgage payment on the median-asking-price home was $2,276 at the current 6.31% mortgage rate. That’s down slightly from a week earlier and down more than $200 from a month earlier, when mortgage rates were around 7%. Still, monthly mortgage payments are up 36.5% from a year ago.

- Pending home sales were down 33.3% year over year, one of the largest declines since at least January 2015, as far back as this data goes.

- Among the 50 most populous U.S. metros, pending sales fell the most from a year earlier in Las Vegas (-64%), Austin (-58.3%), Phoenix (-57.1%), Portland, OR (-53.6%) and Jacksonville, FL (-52%).

- New listings of homes for sale were down 21.5% from a year earlier, the largest decline since the start of the pandemic.

- Active listings (the number of homes listed for sale at any point during the period) were up 15.9% from a year earlier, the biggest annual increase since at least 2015.

- Months of supply—a measure of the balance between supply and demand, calculated by dividing the number of active listings by closed sales—was 3.7 months, down from a week earlier and up from 2 months a year earlier.

- 29% of homes that went under contract had an accepted offer within the first two weeks on the market, down from 37% a year earlier and the lowest share since January 2020.

- Homes that sold were on the market for a median of 38 days, up more than a week from 29 days a year earlier and up from the record low of 17 days set in May and early June.

- 25% of homes sold above their final list price, down from 41% a year earlier and the lowest level since June 2020.

- On average, 5.6% of homes for sale each week had a price drop, down sharply from 7.2% a month earlier. It’s up from 2.6% a year earlier.

- The average sale-to-list price ratio, which measures how close homes are selling to their final asking prices, fell to 98.3% from 100.3% a year earlier. That’s the lowest level since March 2020.

To read the full report, including more data charts and methodology, click here [1].