The Mortgage Bankers Association (MBA) Builder Application Survey [1] (BAS) data for November 2023 shows mortgage applications for new home purchases increased by 21.8% compared to a year ago.

Compared to October 2023, applications decreased by 12%. This change does not include any adjustments for typical seasonal patterns.

“Lending on new construction has been the one bright spot in an otherwise slow year for purchase originations,” said Mike Fratantoni, MBA’s SVP and Chief Economist. “That trend continued in November, with applications to purchase a new home up 22% compared to last year, while the purchase market as a whole remains about 20% behind last year’s pace. It is also interesting to see that a growing portion of this demand for new homes is being financed by FHA loans. This is a sign that first-time homebuyers remain a strong force in this market. We are forecasting that lower rates should help to keep this demand strong as we enter the spring homebuying season.”

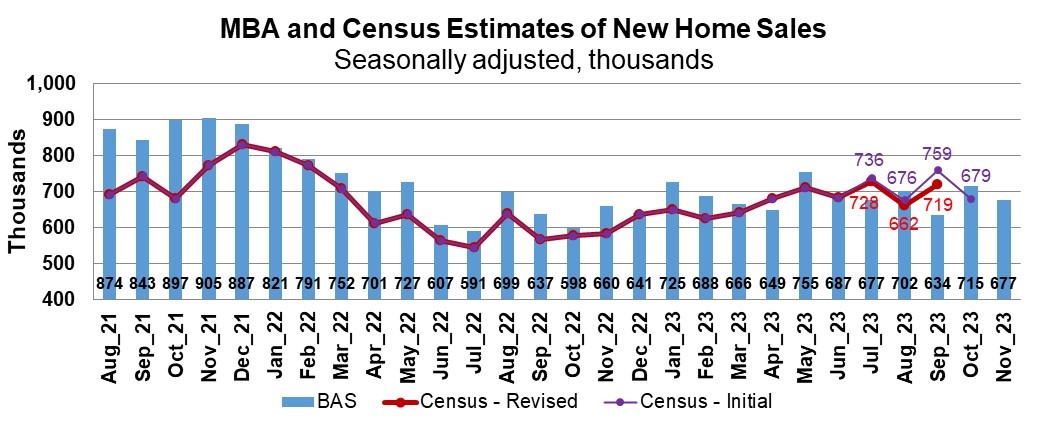

MBA estimates new single-family home sales, which have consistently been a leading indicator of the U.S. Census Bureau’s New Residential Sales report, is that new single-family home sales were running at a seasonally adjusted annual rate of 677,000 units in November 2023.

The new home sales estimate is derived using mortgage application information from the BAS, as well as assumptions regarding market coverage and other factors.

The seasonally adjusted estimate for November is a decrease of 5.3% from the October pace of 715,000 units. On an unadjusted basis, MBA estimates that there were 49,000 new home sales in November 2023, a decrease of 10.9% from 55,000 new home sales in October.

To read the full report. including more data, charts, and methodology, click here [1].