Fannie Mae reported that business in their single-family sector experienced a massive loss for the fourth quarter 2015 and full year 2015, just one day after FHFA Director Mel Watt stated during an address in Washington, D.C., that risks facing the agency (namely the GSEs’ declining capital buffer) are “certain to escalate” the longer the conservatorships of the GSEs continue.

Fannie Mae reported that business in their single-family sector experienced a massive loss for the fourth quarter 2015 and full year 2015, just one day after FHFA Director Mel Watt stated during an address in Washington, D.C., that risks facing the agency (namely the GSEs’ declining capital buffer) are “certain to escalate” the longer the conservatorships of the GSEs continue.

The GSE reported an annual net income of $11.0 billion for 2015—a decline of 23 percent from the previous year’s net income of $14.2 billion, according to its earnings report for Q4 and the full year 2015, released Friday.

The decline in year-over-year net income for Fannie Mae was primarily driven by a substantial decrease in the amount of income the GSEs received from settlements resolving lawsuits related to private-label mortgage-related securities sold to Fannie Mae, and increased expenses incurred due to single-family foreclosed properties on which the loan is owned or guaranteed by Fannie Mae.

Single-family net income was $936 million in the fourth quarter of 2015, down considerably from $2.0 billion in the third quarter of 2015. Fannie Mae attributes the decline in this sector to "a shift to credit-related expense in the fourth quarter from credit-related income in the third quarter."

The total year-end single-family business net income for 2015 reached $5.1 billion, compared with $8.5 billion in 2014. This is also due to "a shift to credit-related expense in 2015 from credit-related income in 2014," Fannie Mae said.

Despite the nearly one-quarter drop in net income from 2014 to 2015, Fannie Mae reported a positive net worth of $4.1 billion as of December 31, 2015, and the Enterprise’s financial results for the year drew praise from CEO Timothy J. Mayopoulos.

“Our strong 2015 results demonstrate our commitment to improving both our company and the broader housing finance system,” Mayopoulos said. “We are listening closely to our customers so we deliver industry-leading solutions that make doing business with us easier, more efficient, and more certain. We are evolving our business model so we better serve the industry and taxpayers, and fulfill our essential role in making affordable mortgage and rental options available for millions of people across the country.”

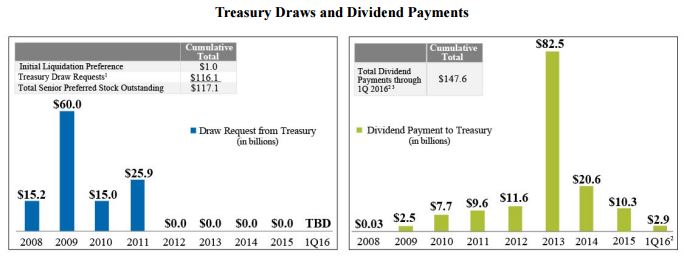

Fannie Mae announced these results just one day after fellow GSE Freddie Mac reported a 17 percent drop in annual net income in 2015, from $7.7 billion down to $6.4 billion. They year 2015 was the fourth consecutive year of profitability for both GSEs, though the profits have been steadily declining since 2012—their first year of profitability since the 2008 taxpayer-funded bailout.

Click here to see the full earnings report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news