For a program that was only supposed to be temporary, The Home Affordable Refinance Program [1] (HARP) is still going rather strong.

For a program that was only supposed to be temporary, The Home Affordable Refinance Program [1] (HARP) is still going rather strong.

The Federal Housing Finance Agency [2]'s (FHFA's) first quarter Refinance Report [3] showed that over 19,989 HARP refinances have been completed through March. According to the FHFA, the total number of HARP refinances since the program began in 2009 is now at 3,400,543 homeowners.

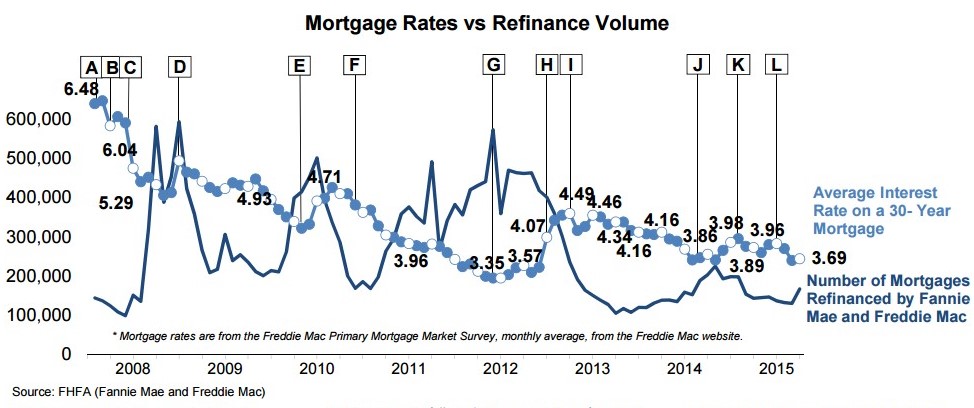

The FHFA attributes the increase in refinance volume to low mortgage rate observed throughout January and February. However, mortgage rates rose in March, with the average interest rate on a 30‐year fixed rate mortgage increasing to 3.69 percent from 3.66 percent in February. HARP volume accounts for 5 percent of total refinance volume, the FHFA reported.

HARP is expected to expire at the end of the year, the FHFA found that there are still more than 325,000 U.S. borrowers [4] eligible for the program who have a financial incentive to refinance.

HARP is expected to expire at the end of the year, the FHFA found that there are still more than 325,000 U.S. borrowers [4] eligible for the program who have a financial incentive to refinance.

"These so-called "in-the-money" borrowers meet the basic HARP eligibility requirements, have a remaining balance of $50,000 or more on their mortgage, have a remaining term on their loan of greater than 10 years, and their mortgage interest rate is at least 1.5 percent higher than current market rates. These borrowers could save, on average, $2,400 per year by refinancing their mortgage through HARP," the FHFA said in the report.

The FHFA also announced that it will hold one final HARP outreach webinar [5]on May 24, 2016 to provide community leaders with tools to help encourage eligible borrowers to take advantage of HARP before it expires. Representatives from Freddie Mac, Fannie Mae, the U.S. Department of the Treasury, Quicken Loans, and Neighborworks America will all be present.

Another step the FHFA has taken to expand HARP outreach to the large pool of homeowners who could still take advantage of HARP is the February announcement of its social media campaign called #HARPNow [6]. The initiative will be focusing its outreach efforts mainly on the 10 states with the highest number of borrowers thought to be “in-the-money,” meaning they meet the basic HARP eligibility requirements, have a remaining mortgage balance of $50,000 or more, have a remaining term of greater than 10 years, and have an interest rate at least 1.5 percent higher than current market rates.

The states with the most eligible borrowers, in order, are Florida, Illinois, Michigan, Ohio, Georgia, California, Pennsylvania, New Jersey, New York, and Maryland. Florida, in fact, has nearly as many eligible borrowers as Illinois and Michigan combined, with 51,100 HARP-eligible borrowers.

FHFA has teamed up with the Treasury Department, Fannie Mae, Freddie Mac and local housing experts for town hall-style events in Chicago, Miami, Detroit, Phoenix, Atlanta, Newark, and Columbus throughout 2016. FHFA estimates these borrowers could save as much as $2,400 a year on their mortgage payments.