An independent monitor for the 2012 National Mortgage Settlement (NMS) [1] has issued a report that Atlanta-based servicer SunTrust has fulfilled nearly 70 percent of consumer relief obligation and was in compliance with all borrower treatment tests for the second half of 2015.

An independent monitor for the 2012 National Mortgage Settlement (NMS) [1] has issued a report that Atlanta-based servicer SunTrust has fulfilled nearly 70 percent of consumer relief obligation and was in compliance with all borrower treatment tests for the second half of 2015.

NMS Monitor Joseph A. Smith Jr. reported [2] to the US. District Court of the District of Columbia that through the first half of 2015, SunTrust has provided 16,921 borrowers with slightly more than $370 million under the terms of the settlement.

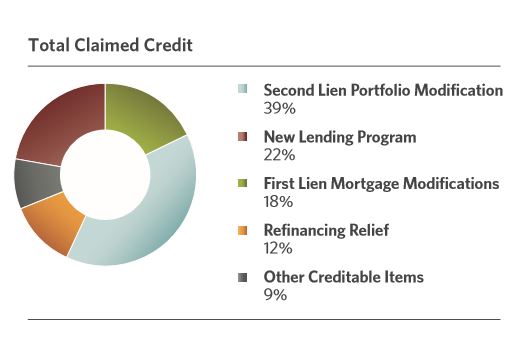

The NMS requires SunTrust to provide $475 million in consumer relief to distressed borrowers by September 30, 2017. SunTrust is also required as part of the NMS to establish a mortgage origination program and to provide $25 million in consumer relief credit by refinancing mortgages for borrowers who otherwise would not have qualified for refinancing.

“SunTrust has completed 69 percent of its consumer relief obligation and did not fail any of its tests on borrower treatment during the second half of 2015,” Smith said. “I will continue to monitor SunTrust’s compliance with the NMS and I will report my findings to the Court and the public later this year.”

Smith’s Secondary Professional Firm (SPF) assigned to SunTrust, Crowe Chizek, LLP, tested SunTrust’s Internal Review Group’s work on 31 borrower treatment metrics during the third and fourth quarters 2015 and determined that SunTrust passed all metrics. The metrics included complaint response timeliness, incorrect modification denial, foreclosure sale in error, and loan modification document collection timeline compliance.

Smith’s Secondary Professional Firm (SPF) assigned to SunTrust, Crowe Chizek, LLP, tested SunTrust’s Internal Review Group’s work on 31 borrower treatment metrics during the third and fourth quarters 2015 and determined that SunTrust passed all metrics. The metrics included complaint response timeliness, incorrect modification denial, foreclosure sale in error, and loan modification document collection timeline compliance.

The NMS was originally finalized in April 2012 between 49 states and the District of Columbia, the federal government, and five banks and/or mortgage servicers (Bank of America, Citi, JPMorgan Chase, Ally/GMAC, and Wells Fargo). As part of the agreement, the five servicers were required to provide $20 billion in consumer relief and $5 billion in other payments.

SunTrust became party to the NMS in June 2014 when it settled with the DOJ for $968 million to resolve claims that the bank engaged in improper mortgage origination practices as well as servicing and foreclosure abuses.

Click here [3] to view Smith’s report filed with the D.C. District Court, which includes a summary of consumer relief provided by SunTrust through the first half of 2015 and SunTrust’s compliance with the NMS through the second half of 2015.