New low down payment initiatives extend homeownership opportunities to qualified borrowers who might otherwise be locked out.

New low down payment initiatives extend homeownership opportunities to qualified borrowers who might otherwise be locked out.

According to Freddie Mac's July U.S. Housing Market Insight & Outlook, pre-crisis low payment underwriting allowed layered risk, while post-crisis low payment underwriting controls credit risk by requiring features that reduce risk. Pre-crisis payments were variable, while post-crisis payments are predictable.

"Affordability initiatives that allow low down payments—like Freddie Mac’s Home Possible Advantage (SM)—have raised concerns about the potential return of underwriting practices prevalent prior to the financial crisis, Freddie Mac noted. "However things are different this time."

The layered pre-crisis underwriting included a combination of multiple features that increased credit risk, according to the outlook. Meanwhile, post-crisis underwriting in the Home Possible Advantage program includes fixed payments, borrower-based underwriting, reliable appraisals, and more.

The Home Possible Advantage(SM) mortgage was introduced by Freddie Mac in March in order to make home ownership more affordable for first-time home buyers and low-and-moderate income borrowers. When using this program, borrowers can receive a reduced down payment for as little as 3 percent down. Borrowers can even obtain the down payment as a gift from a family member or employer or as a grant from a government agency.

Borrower irrationality has been replaced by realistic expectations, so even some consumers who could qualify for a mortgage are choosing to rent, at least for a while longer, the report said.

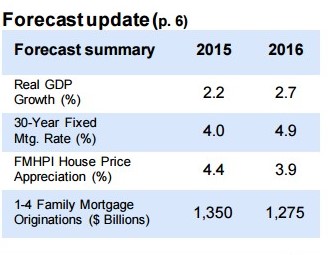

Freddie Mac predicts that housing starts will increase 14 percent and single-family mortgage originations will increase 8 percent for 2015. They also belive an upward revision of the first quarter GDP will occur, bringing real GDP projections for 2015 to 2.2 percent, up from 2.0 percent last month. The house price forecast was also revised down to 4.4 percent in 2015, but Freddie Mac expects solid house growth to continue so they increased the forecast for 2016 to 3.9 percent up from 3.5 percent in last month's forecast.

"By lowering down payments, programs like Home Possible Advantage extend the opportunity for home ownership to qualified borrowers who might otherwise be locked out," said Sean Becketti, chief economist of Freddie Mac. "Previous research has found that reduced down payments can increase the relative probability of homeownership among some groups by over 25 percent. As long as the underwriting process bars the return of the layered risks prevalent in the pre-crisis era, lower down payments are not a cause for concern. Home Possible Advantage strikes the right balance -- increasing affordability while incorporating the best practices of post-crisis underwriting."

Click here to view Freddie Mac's July U.S. Housing Market Insight & Outlook.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news