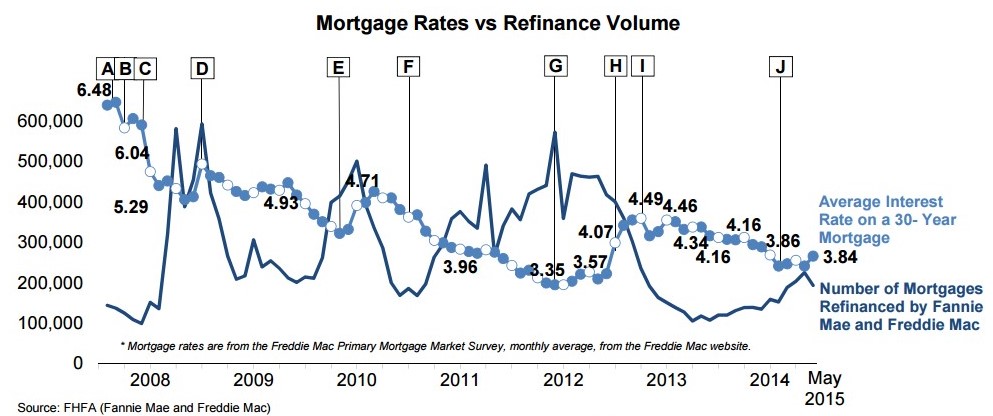

Refinance volume dropped lower in May 2015, but remained above levels recorded in 2014, according to the Federal Housing Finance Agency's (FHFA) May 2015 Refinance Report.

Refinance volume dropped lower in May 2015, but remained above levels recorded in 2014, according to the Federal Housing Finance Agency's (FHFA) May 2015 Refinance Report.

The report also found that mortgage rates increased in May, with the average interest rate on a 30 year fixed-rate mortgage reaching 3.84 percent.

According to the FHFA, 10,419 refinances were completed through the Home Affordable Refinance Program (HARP) in May 2015, bringing the total number of HARP refinances to 3,324,228 since the program began.

HARP volume accounted for 5 percent of total refinance volume in May 2015, the report says. Borrowers with loan‐to‐value ratios greater than 105 percent accounted for 24 percent of the volume of HARP loans from the January 2015 to May 2015.

On the other hand, 8 percent of the loans refinanced through HARP had a loan‐to‐value ratio greater than 125 percent in May. From January 2015 to May 2015, 28 percent of HARP refinances for underwater borrowers were for shorter‐term 15‐and 20‐year mortgages. These type of refinances build equity faster than traditional 30‐year mortgages.

The report found that in Florida and Georgia, HARP refinances represented 13 or more percent of total refinances from January 2015 to May 2015. This was more than double the 6 percent of total refinances nationwide over the same period.

Borrowers who refinanced through HARP had a lower delinquency rate compared to borrowers eligible for HARP who did not refinance through the program.

HARP was established April 1, 2009 to assist homeowners unable to access a refinance due to a decline in their home value. The program is designed to provide these borrowers with an opportunity to refinance by permitting the transfer of existing mortgage insurance to their newly refinanced loan, or by allowing those without mortgage insurance on their previous loan to refinance without obtaining new coverage.

HARP enhancements took effect in 2012 to increase access to the program for responsible borrowers. The program was scheduled to expire on December 31, 2013, and was extended to expire on December 31, 2015. On May 8, 2015, HARP was extended again to expire December 31, 2016.

HARP Eligibility Criteria:

- Loan must be owned or guaranteed by Fannie Mae or Freddie Mac.

- Loan must have been originated on or before May 31, 2009.

- Current loan‐to‐value ratio ‐‐ LTV ‐‐ (outstanding mortgage

balance/home value) must be greater than 80 percent. There is no LTV

ceiling. - Borrower must be current on their mortgage payments at the time of

the refinance. - Payment history – borrower is allowed one late payment in the past

12 months, as long as it did not occur in the 6 months prior to the

refinance.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news