An analysis of millions of credit reports comparing financial behavior patterns of those who currently rent and those who have a current mortgage revealed that tens of millions of renters might not qualify for a mortgage due to a low credit score—and that a large share of renters have other outstanding debt that is currently in collections, according to the Urban Institute.

An analysis of millions of credit reports comparing financial behavior patterns of those who currently rent and those who have a current mortgage revealed that tens of millions of renters might not qualify for a mortgage due to a low credit score—and that a large share of renters have other outstanding debt that is currently in collections, according to the Urban Institute.

In a report released Thursday titled Comparing Credit Profiles of American Renters and Owners by Wei Li, Senior Research Associate, and Laurie Goodman, Director, Housing Finance Policy Center from the Urban Institute, the authors discovered several patterns on how mortgage debt relates to other types of debt when examining the financial habits of 118 million homeowners and 127 million renters nationwide.

Homeowners tend to have higher credit scores than renters, the authors reported. About 68 percent of homeowners had a Vantage credit score above 700, compared to just 33 percent of renters; meanwhile, renters accounted for 84 percent of all consumers with scores below 550. About 45 percent of renters who have not had a mortgage in the past 16 years have credit scores below 600; that share becomes 30 percent for renters who have had a mortgage in the past 16 years but do not currently have one; and 9 percent for renters who currently have a mortgage.

"Generally, consumers need a minimum credit score of 650 to qualify for a mortgage," the authors stated. "Using this number, 60.2 million current renters—48 percent of all adult renters—could qualify for a mortgage based on their credit score alone. . . The other 63.8 million—52 percent of renters—do not have a high enough credit score to qualify for a mortgage. This number would be lower once debt-to-income and ability to fund a down payment are considered."

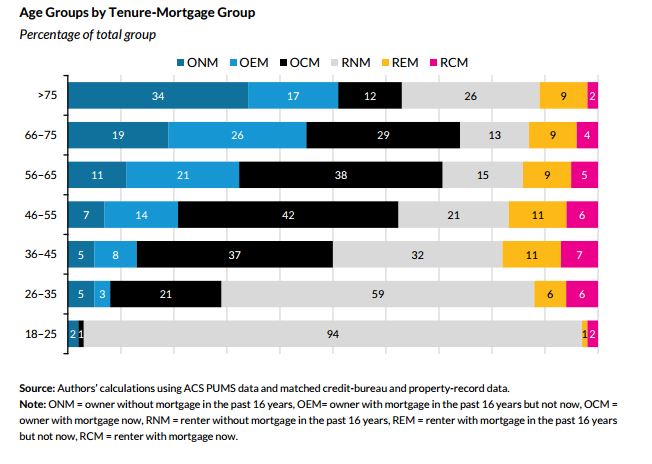

The authors found that 96 million American renters have never had a mortgage—and 42 percent of them have some other type of consumer debt in collections. This group tends to be younger than other groups covered in the report and the members of this group are “less likely to have credit card debt or spending but much more likely than the other five groups to have a debt in collection. This group also has the lowest credit scores, a concern given that this is the largest group and the group that might be interested in eventual homeownership,” according to Li on the Urban Institute’s blog.

The report also examined a group of current renters who have had a mortgage at some point in the last 16 years, which totals about 8 percent of American adults (19 million). The authors discovered that this group is typically about the same age as those who currently have mortgages but have more debt, which may have in fact led to their being forced out of homeownership. This group “has the highest percent of public debt records (28 percent) and the second highest percent of debt in collections (37 percent),” Li said. “This group uses auto loans and credit cards less than the two groups with current mortgages, possibly because of difficulties in obtaining credit.”

The report also examined a group of current renters who have had a mortgage at some point in the last 16 years, which totals about 8 percent of American adults (19 million). The authors discovered that this group is typically about the same age as those who currently have mortgages but have more debt, which may have in fact led to their being forced out of homeownership. This group “has the highest percent of public debt records (28 percent) and the second highest percent of debt in collections (37 percent),” Li said. “This group uses auto loans and credit cards less than the two groups with current mortgages, possibly because of difficulties in obtaining credit.”

Approximately 12 million renters are also paying on a current mortgage, according to the authors. Current homeowners and those renters who own a mortgage tend to have credit scores higher than 700, while about half the members of both groups have an auto loan and about 80 percent of both groups have some credit card debt.

“The percent of debt collections and public records of debts owed are similar and modest; and less than one in five people in each group have a student loan,” Li said. “Renters with current mortgages are, however, slightly younger than owners with current mortgages. The average age of the renters group is 45 compared with 51 for the owners.”

Click here to view the Urban Institute’s full report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news