This piece originally appeared in the April 2022 edition of MReport magazine, online now.

When borrowers seek mortgage loans from lenders, they tend to search for ones with the best terms, conditions, and interest rates, typically comparing these across different lenders. The savviest borrowers, however, will take an additional step in comparing origination fees charged by lenders, reviewing all itemized charges caused from a loan’s origination to find the most beneficial offer for them.

This practice coincides with advice from the Consumer Finance Protection Bureau (CFPB), which states, “The best way to tell if you have a competitive loan offer is to compare it to Loan Estimates from other lenders. Origination charges are upfront fees charged by your Lender and are an important part of the cost of your loan. When comparing Loan Estimates, make sure to compare the origination charges.”

A Closer Look at Origination Fees

In originating a loan, lenders will charge origination fees to cover the expenses associated with doing so. Typically, these fees include line items such as filing the documentation necessary to secure a loan through validating the borrower’s information, such as employment, credit score, and income.

Origination fees, as described by the CFPB, “… may include processing the application, underwriting and funding the loan, and other administrative services.” Because caps on origination fees vary from state to state, each lender can determine how much to charge for these, to some extent. Additionally, this is a major reason behind the willingness of some lenders to negotiate their charges for these fees, rather than risk a loss of a borrower’s business.

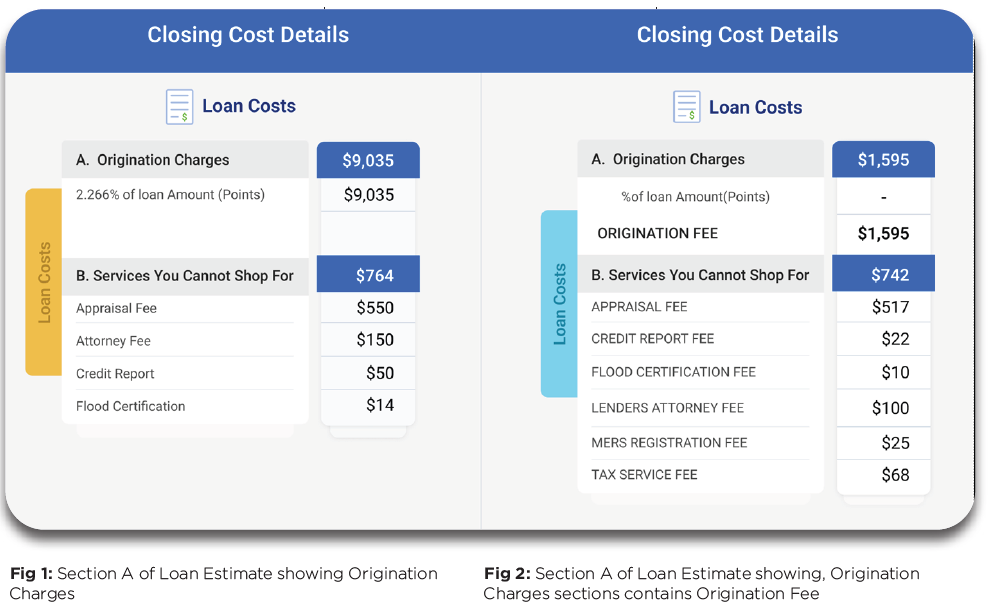

However, it should be noted that “origination charges” and “origination fees” are different line items. Origination charges tend to be charged by lenders upfront, and typically represent a conglomerate of fees like originating, underwriting, processing, and verifying a borrower’s application. They may also include rate-lock fees and other costs associated with a loan.

On the other hand, “origination fees” tend to refer to a specific, singular fee for a specific, singular service, although lenders may or may not itemize these fees as a single line item. For instance, Lender A may charge $1,195 as a total charge, whereas Lender Y might charge two separate fees for originating and underwriting a loan for a total of $1,195.

Meanwhile, Lender Z may opt to only charge for an underwriting fee of $1,195. If all three lenders have made the same assumptions about the borrower, then all three fees should be the same, even though borrowers may not understand what fees in all comprise the aggregate total charged to them.

Origination Fee, Application Fee, Processing Fee, Underwriting Fee

To summarize up to this point, we now know that lenders may decide to only charge borrowers for an origination fee, while others might split that aggregate total into separate line items for application fees, processing fees, underwriting fees, or any combination of associated fees.

What can make this lending process problematic, however, is that lenders can decide whether to itemize origination fees and charges, essentially, at will, at least so long as their “Origination Points” are disclosed as a separate line item. This becomes extremely challenging for borrowers to compare the total costs of loans side-by-side and line-by-line.

For example, if all line items in a borrower’s origination fees were contained in Section A of the official Loan Estimate (LE), gathering the total cost would be extremely simple for borrowers. Although, since other portions of the official LE could remain itemized, this makes it difficult for borrowers to understand the total charges they are responsible for. Rather, borrowers should be able to know how to find the aggregate total of fees charged by lenders originating their loan.

Six of One, Half a Dozen of the Other

Using the table below as an example, we can see how Lender A doesn’t charge the borrower Origination Fees, a MERS Registration fee, or a Tax Service fee. In this example, it’s possible that Lender A could have covered these fees. The side-by-side comparison shows that Lender A is better than Lender B by, at least, a difference of $1,688. Nevertheless, something as seemingly simple as comparing these totals can be far more difficult than just choosing the Lender that is less costly.

Guidance from Regulation Z; Comment 19(a)(1)(i)-2 tells us that the itemization of the amount financed—as required by §1026.18(c)—will contain items (i.e., origination fees or points) that must also be disclosed as part of the good faith estimates of settlement costs required under RESPA. The caveat is that creditors who furnish these good faith estimates under RESPA aren’t required to give borrowers an itemization of the total amount loaned to them.

If creditors furnishing Les aren’t required to itemize costs to borrowers, it becomes nearly impossible for borrowers to compare total charges between lenders.

Even in the event that all these fees are itemized, fees may not be consistent between lenders, which hinders borrowers from comparing total charges and finding the best offer for them. Despite the countless mentions of origination fees being labeled as reasonable and bona fide throughout Regulation Z, TILA, RESPA, and CFPB guidance, we still see the total amounts charged for these fees haphazardly appearing all over the board.

For instance, a lender might charge a fee between $10-100 per person on a credit report, yet many borrowers aren’t aware that this fee is covered by some lenders. In return, creditors might choose to collect a fee for obtaining a credit report, deeming it an ordinary course of their business.

Should the criteria in §1026.19(a) (1)(iii) be met, the creditor might then describe this fee as an “application fee” instead. However, the CFPB still states that, by law, “… a credit reporting company can charge no more than $13.50 for a credit report.” This means that for a typical household, where both spouses are on the same mortgage loan, lenders may expect borrowers to pay up to $400, even though the law restricts this total charge to be bona fide, fair, and reasonable.

The Letter of the Law and the Intent

Title X of the Dodd-Frank Wall Street Reform Bill was brought about with twofold intent; to provide greater clarity to borrowers regarding the mortgage loan terms they are agreeing to, and to grant borrowers the ability to compare different mortgage loan offers. Furthermore, Title X also created a new Bureau of Consumer Financial Protection within the Federal Reserve Board, meant to serve as a new supervisor for certain financial firms, as well as a maker and enforcer of rules against abusive, deceptive, unfair, and outright prohibited practices regarding the financial products or services offered to consumers.

The time to democratize home lending is now, and this process can be started by providing borrowers with clarity on charges from lenders. This will ensure consistency across origination fees, enabling borrowers to more easily compare costs between different lenders. Currently, this is not the case; no tools, services, or platforms exist to make these comparisons between lenders accessible or easy—if even possible.

To help borrowers in this regard, we must implement methods to make comparing LEs (along with available information about which lenders charge for specific services) from multiple lenders side-by-side as seamless as possible. This way, borrowers can more easily find the best lending offer based on their needs.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news