Mortgage credit availability increased in March, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

Mortgage credit availability increased in March, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from ICE Mortgage Technology.

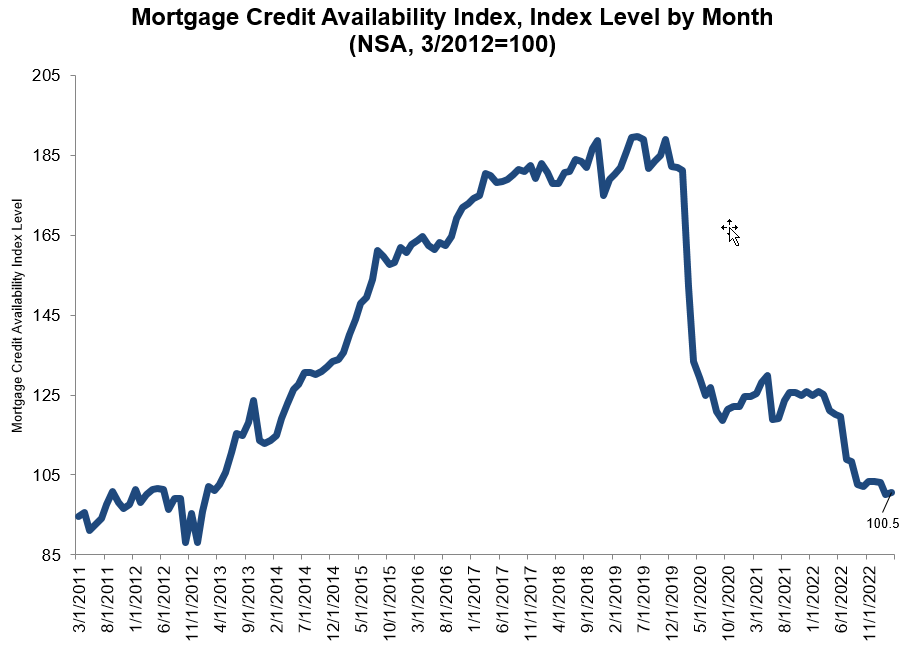

The MCAI rose by 0.4% to 100.5 in March. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The MCAI was benchmarked to 100 in March 2012. The Conventional MCAI increased 1.1%, while the Government MCAI decreased by 0.2%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 1.4%, and the Conforming MCAI rose by 0.4%.

“Mortgage credit supply increased modestly in March, but remained close to its tightest levels since 2013. With the spring buying season underway, lenders are grappling with the threat of a recession and tighter overall financial conditions following the recent bank failures,” said Joel Kan, MBA’s VP and Deputy Chief Economist. “The supply of government mortgage credit–which includes FHA and VA loans that many first-time homebuyers rely on–declined for the third time in four months, which could potentially hinder first-time buyer activity. There was a small increase in credit availability for jumbo loans, with more programs offered for cash-out refinances. However, we expect banks, which account for most of the jumbo market, will tighten jumbo credit criteria in response to recent challenges in the banking sector.”

The MBA’s MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for more than 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology, and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

Black Knight’s latest Originations Market Monitor report, looking at mortgage origination data through March 2023 month-end, found that rate lock dollar volumes were up 43% month-over-month in March, as lock volumes increased across the board. According to Black Knight, when measured over the previous month, purchase locks rose 44%, cash-out refinances were up 31%, and even rate/term refis, which had been hovering near historic lows, up 36%. Despite the rebound, refinance locks fell to just 13% of the month's activity, a new low for this cycle, due to the disproportionate rise in purchase locks.

"It is not unusual for rate locks to surge in March ahead of the spring homebuying season, although this year's rise outpaced what we typically see on a seasonal basis," said Andy Walden, VP of Enterprise Research at Black Knight. "A cooling market lacking the multiple bids and all-cash offers of the recent past has made sellers more receptive to FHA offers. That, combined with a recent reduction in FHA mortgage insurance premiums and a mid-month increase in the FHA-to-conforming spread, made FHA loans comparatively more attractive. FHA share increased to more than 20% of the pipeline in March, up from 18% at the beginning of the year and 12% a year ago."

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news