Low delinquencies, a significant credit enhancement build-up, and high credit quality of loans remaining in pools are all factors resulting in improved credit performance of post-crisis jumbo residential mortgage-backed securities (RMBS) transactions rated by Moody’s, according to Moody’s Investors Service.

Low delinquencies, a significant credit enhancement build-up, and high credit quality of loans remaining in pools are all factors resulting in improved credit performance of post-crisis jumbo residential mortgage-backed securities (RMBS) transactions rated by Moody’s, according to Moody’s Investors Service.

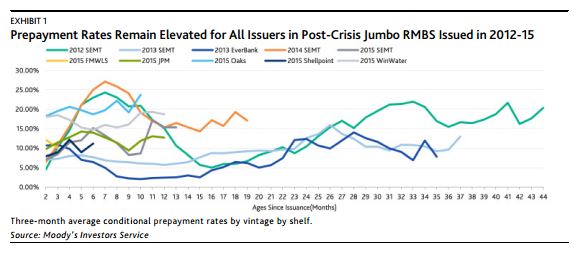

According to Moody’s analysts Zimin Li and Michael B. Gallagher, “Elevated voluntary prepayments and transaction structures provide sufficient and continually increasing credit enhancement for senior bonds and, as of March 2016, credit enhancement levels for all transactions were adequate.”

A jumbo mortgage is defined as a home loan for an amount that exceeds conforming loan limits established by regulation. For most of the United States, the jumbo loan limit is $417,000; for the highest-cost areas, it is $625,000.

All jumbo RMBS transactions have had low delinquencies since issuance, and the performance of jumbo RMBS transactions is expected to remain strong given the high credit quality of the remaining collateral. Voluntary prepayments are remaining elevated, which continues to enhance the credit quality of post-crisis jumbo RMBS.

As long-term interest rates rise, prepayment rates will likely decline in the future on jumbo RMBS; but according to Li and Gallagher, the credit enhancement to senior bonds built will provide sufficient coverage against serious delinquencies to these transactions. The Moody’s data shows that credit enhancement for senior bonds has risen for post-crisis jumbo RMBS while serious delinquencies have stayed low.

As long-term interest rates rise, prepayment rates will likely decline in the future on jumbo RMBS; but according to Li and Gallagher, the credit enhancement to senior bonds built will provide sufficient coverage against serious delinquencies to these transactions. The Moody’s data shows that credit enhancement for senior bonds has risen for post-crisis jumbo RMBS while serious delinquencies have stayed low.

As for the outlook for jumbo RMBS, according to Li and Gallagher, “Delinquencies in post-crisis jumbo RMBS will remain low owing to a lack of negative selection, the continuously strong performance of the remaining loans, and the improving US housing market. As the transactions season and mortgage loans prepay, the remaining bonds will continue to be backed by the high-credit-quality loans with higher borrower equities in the properties, helping to keep future default rates on the loans low.”

Click here to view the complete report from Moody’s.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news