Millennials have been cited by many economists and analysts as they key demographic for raising the homeownership rate in the U.S., which is near a five-decade low.

Millennials have been cited by many economists and analysts as they key demographic for raising the homeownership rate in the U.S., which is near a five-decade low.

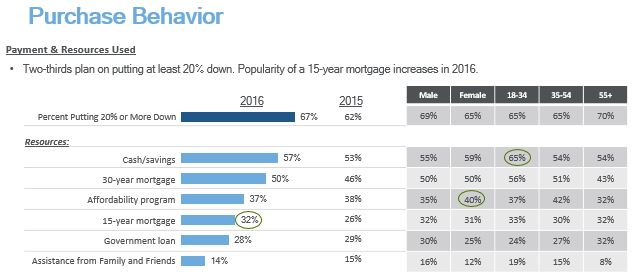

While saving for a down payment remains a significant obstacle for millennials who hope to achieve homeownership, a recent survey indicates they are saving. TD Bank’s second annual First-Time Home Buyer Pulse [1] found that out of more than 1,000 Americans who want to purchase a home in the next five years, nearly two-thirds are saving cash to buy their first home.

“It's encouraging to see millennials thoughtfully prepare to enter the housing market,” said Scott Haymore, Head of Pricing and Secondary Markets at TD Bank. “With today's affordability programs, owning a home doesn't have to be a dream, it can be a reality.”

Sixty-five percent of those surveyed said that the down payment is the biggest barrier to buying a home, but at the same time, would-be first-time buyers have that covered. Nearly one-fifth of them plan to supplement their down payment savings with financial assistance from friends and/or family, and 65 percent of them plan to use a spouse or a partner as a co-signer. More than one-third of those surveyed plan to put less than 20 percent down on a home (for millennials, that percentage rises to 35 percent) and 37 percent of first-time buyers indicated that they plan to take advantage of mortgage affordability programs.

“It's encouraging to see millennials thoughtfully prepare to enter the housing market.”

Scott Haymore, TD Bank

“For many consumers, a 20 percent down payment is a major barrier to homeownership,” Haymore said. “It's often difficult to save this much cash, especially for young adults saddled with substantial student loan debt. First-time buyers are shopping for low-down payment mortgage programs, which allow buyers to put as little as 3 percent down.”

Millennials surveyed reported that their top three priorities before purchasing a home are saving for a down payment, paying off debt, and having a steady job. Those millennials that do have mortgages indicated that they want to pay them off quickly, with one-third of them stating the play to pay off their loan over a 15-year period.

Click here [1] to view the complete survey results.