With a much-anticipated speech by Federal Reserve Chair Janet Yellen looming on Friday morning and a possible Fed rate hike on the horizon in September, average fixed mortgage rates remained flat over the week but still hovered just above record lows, according to Freddie Mac’s Primary Mortgage Market Survey (PMMS) released Thursday.

With a much-anticipated speech by Federal Reserve Chair Janet Yellen looming on Friday morning and a possible Fed rate hike on the horizon in September, average fixed mortgage rates remained flat over the week but still hovered just above record lows, according to Freddie Mac’s Primary Mortgage Market Survey (PMMS) released Thursday.

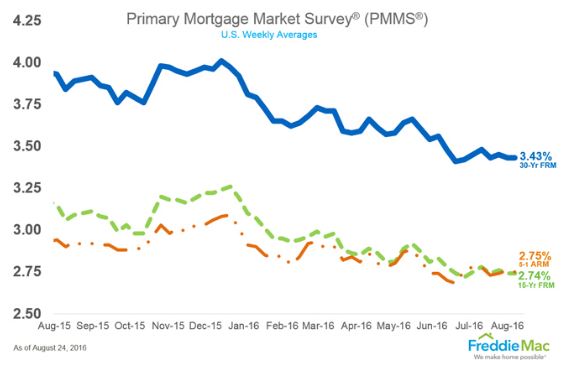

For the week ending August 24, the average 30-year fixed-rate mortgage (FRM) was 3.43 percent, unchanged from a week earlier but still only 12 basis points higher than the record low of 3.31 percent set in late 2012. At this time last year, the average 30-year FRM was 3.84 percent.

The average 15-year FRM for the week ending August 24 was 2.74 percent, also unchanged from the previous week but down from 3.06 percent from a year earlier.

“Treasury yields were little changed from the prior week and the 30-year fixed-rate mortgage held steady at 3.43 percent this week,” said Sean Becketti, Chief Economist with Freddie Mac. “This marks the ninth consecutive week that mortgage rates have been below 3.5 percent. Markets are erring on the side of caution ahead of the second estimate for second-quarter GDP and Fed Chair Janet Yellen's speech on Friday.”

The advance estimate for second quarter GDP growth, released in late July, came in at a disappointing 1.2 percent after an ever more disappointing 0.8 percent for the first quarter. The second estimate for Q2 GDP will be released on Friday morning by the Bureau of Economic Analysis.

The advance estimate for second quarter GDP growth, released in late July, came in at a disappointing 1.2 percent after an ever more disappointing 0.8 percent for the first quarter. The second estimate for Q2 GDP will be released on Friday morning by the Bureau of Economic Analysis.

Yellen’s speech on “Designing Resilient Monetary Policy Frameworks for the Future” is scheduled for 10 a.m. EST on Friday morning, August 26, as part of the Kansas City Fed’s monetary policy symposium in Jackson Hole, Wyoming.

There has been widespread speculation that a rate hike from the Fed will happen at the next policy meeting, which concludes on September 21. Until then. . .

“Mortgage rates remain in virtual stasis,” said Keith Gumbinger, vice president of HSH.com. “Quiet financial markets, no imminent threat of a move by the Federal Reserve as of yet and continuing moderate economic data have seemingly lulled markets to sleep for now, but that probably won't last forever.”

HSH.com reported a slight uptick in the 30-year FRM for the week, from 3.50 to 3.51.

“Despite some increased probability of a rate hike by the Fed, interest rates remain closer to bottoms than not,” Gumbinger said. “We may get some additional indication of the Fed’s intentions from Fed Chair Janet Yellen when she speaks at a global central banking conference in Wyoming on Wednesday, but probably not much in terms of a clean, clear signal that the Fed is poised to act. More likely is that mortgage and other rates keep drifting along in a soft pattern until we get a lot closer to the next Fed meeting.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news