While borrowers with pristine credit are still getting a majority of purchase loans, lenders are showing signs that they are willing to let borrowers with “moderate” credit in on the action, according to Black Knight Financial Services’ Mortgage Monitor for July 2016 released Tuesday.

While borrowers with pristine credit are still getting a majority of purchase loans, lenders are showing signs that they are willing to let borrowers with “moderate” credit in on the action, according to Black Knight Financial Services’ Mortgage Monitor for July 2016 released Tuesday.

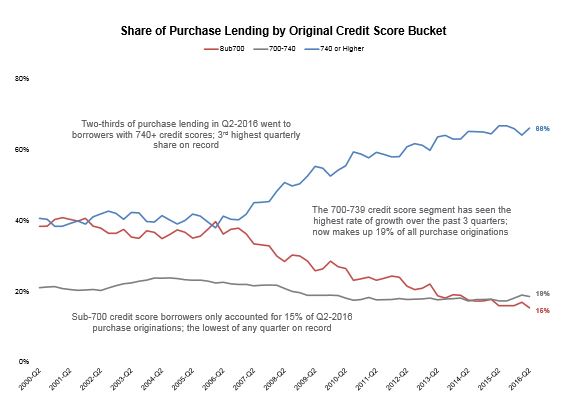

Two-thirds of purchase lending in the second quarter of 2016 went to borrowers with credit scores of 740 or higher, which is little-changed over-the-year, the number of “moderate” credit borrowers (those with credit scores between 700 and 739) increased by 13 percent.

“This segment has seen the highest rate of growth over the last three quarters, and now makes up 19 percent of all purchase originations,” Black Knight Data & Analytics EVP Ben Graboske said. “On the other end of the spectrum, sub-700 score borrowers now account for only 15 percent of originations, with less than five percent going to borrowers with scores of 660 or below. Both of these mark the lowest share of low credit purchase lending seen dating back to at least 2000.”

Purchase originations made up 57 percent of all first-lien lending during Q2, totaling $297 billion—a leap of 52 percent from Q1 (largely due to seasonality) and the highest level, both in terms of volume and dollar amount, in nine years.

Overall, Q2 was the strongest quarter for mortgage originations in three years, according to Black Knight. A combination of continued purchase origination growth and refinance activity spurred by low interest rates resulted in $518 billion in first-lien originations during the quarter. Curiously, refinances did not increase at near the same rate as purchase originations over-the-quarter despite a decline of 15 basis points.

“While purchase originations jumped more than 50 percent from Q1, refinances saw only an eight percent increase over that period, and were actually down from the same time last year, despite the number of potential refinance candidates outpacing 2015 by over one million in every month since March,” Graboske said. “That said, refinance lending has risen for three consecutive quarters and accounted for $221 billion in originations in Q2.”

Click here to view the entire Black Knight Mortgage Monitor for July 2016.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news