The Office of the Inspector General (OIG) of HUD found that loanDepot, LLC, originated loans using ineligible downpayment assistance gifts out of HUD Federal H0using Administration (FHA) requirements, according to a recent audit.

The Office of the Inspector General (OIG) of HUD found that loanDepot, LLC, originated loans using ineligible downpayment assistance gifts out of HUD Federal H0using Administration (FHA) requirements, according to a recent audit.

The audit was done based on a referral from HUD's Quality Assurance Division detailing a separate lender that originated FHA-insured loans containing ineligible downpayment assistance gifts.

The OIG found that loanDepot's FHA-insured loans using Golden State downpayment gifts were not always in HUD compliance.

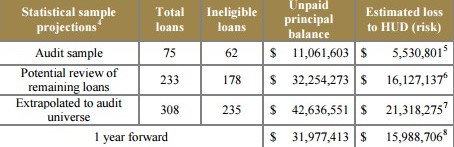

This placed unnecessary risk on the FHA insurance fund including potential losses of $5.5 million for 62 loans with ineligible gifts and $16.1 million for 178 loans that likely contained ineligible gifts. Looking one year ahead, this is equal to at least $16 million in potential losses for loans originated with ineligible gifts and have higher risk of loss in the first year.

The company also charged borrowers $13,726 in fees that were not "customary or reasonable," the audit said. This happened because of loanDepot's reliance on Golden State, acceptance of the Platinum Downpayment Assistance Program structure, and no due diligence conducted with regard to premium pricing, gifts, and fees.

The company also charged borrowers $13,726 in fees that were not "customary or reasonable," the audit said. This happened because of loanDepot's reliance on Golden State, acceptance of the Platinum Downpayment Assistance Program structure, and no due diligence conducted with regard to premium pricing, gifts, and fees.

Thus, borrowers were forced to make higher mortgage payment due to the ineligible loans, which included the burden of funding the downpayment assistance program through the premium interest rate. FHA borrowers were also given higher than market interest rates in exchange for Golden State downpayment assistance.

In addition, loanDepot allowed ineligible Golden State downpayment assistance gifts for at least 235 loans totaling $42.6 million.

The OIG recommended that HUD "determine legal sufficiency to pursue civil and administrative remedies against loanDepot for incorrectly certifying that mortgages were eligible for FHA mortgage insurance."

OIG also Recommends that HUD require loanDepot to:

- Stop originating FHA loans with the ineligible gifts

- Indemnify HUD for the 62 loans with ineligible gifts

- Indemnify HUD for loans that likely contain ineligible gifts from the remaining 233 loans

- Reimburse borrowers for $13,726 in fees that were not customary or reasonable

- Reduce the interest rate for borrowers who received ineligible gifts

- Reimburse borrowers for overpaid interest as a result of the premium interest rate

- Update all internal controls to include specific HUD requirements on gifts, premium rates, and allowable fees

Click here to view the complete audit report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news