Redfin reports that the supply of new homes saw its largest decline in almost six years, falling 1% in Q2 2019.

“When there’s a shift in the market, new construction is always one of the first categories to take a hit,” said San Jose, California, Redfin agent Kristen Nowack. “In the San Jose area, overall prices are falling and there are plenty of homes for sale right now, which means buyers may be less likely to pay a premium for new construction.

“And when one builder starts dropping prices in response to the market, competitors follow suit, which could lead to overall lower prices.”

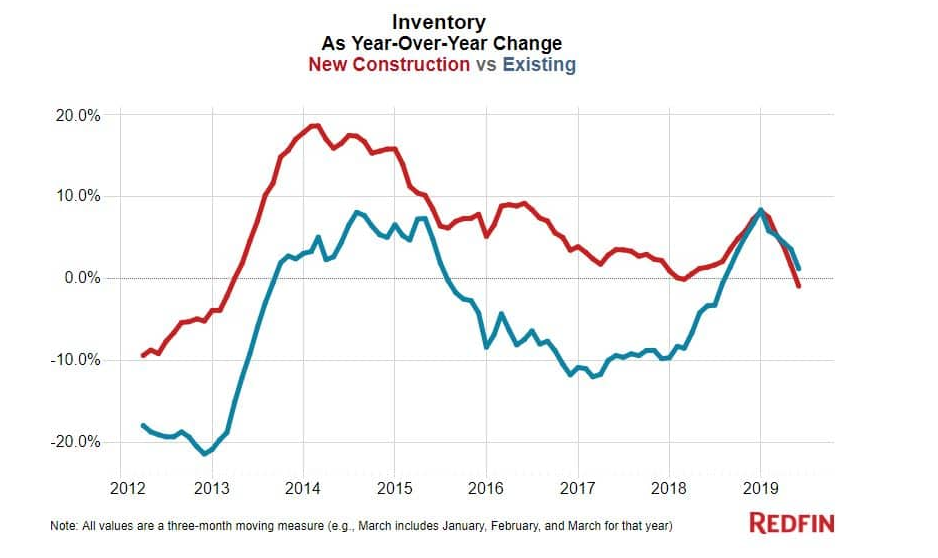

Although the supply of new homes took a hit, the inventory of existing homes rose 1.1% for the quarter—the fourth-consecutive quarter of increases.

Prices of new-build homes dropped 0.5% year-over-year to an average of $372, 900 for the quarter. The median-sale price for existing homes continued its seven-year trend of growth by rising 3.2% in Q2 2019 to $309,700.

New-home sales increased slightly by 0.8% since 2018, which is a reversal from decreases over the prior two quarters. Existing-homes sales also saw a decline—0.7% for the quarter.

Redfin stated that mixed results, along with a 0.7% annual decline in new listings, has caused the housing market to soften in Q2.

“The moderation we’re seeing in new-home prices was expected and follows right along with our observation late last year that builders were finally shifting their focus toward offering smaller, more affordable homes,” said Redfin chief economist Daryl Fairweather. “While this change was a clear and long-needed response to homebuyer demand and tastes amid an affordability crisis and a softening market, it also means that builders are now focused on homes that are less profitable for them.

“As builders continue to adjust to a less favorable market, along with rising tariffs for building materials and a labor shortage, I expect to see new-home inventory stay low overall. But low mortgage rates and more affordable prices for new homes mean sales could strengthen a bit in the coming months.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news