Ocwen Financial experienced its second straight financially difficult year, reporting a net loss of $224.3 million for the fourth quarter of 2015 and a net loss of $246.7 million for the full year of 2015 in the servicer’s earnings statement released on Monday.

Ocwen Financial experienced its second straight financially difficult year, reporting a net loss of $224.3 million for the fourth quarter of 2015 and a net loss of $246.7 million for the full year of 2015 in the servicer’s earnings statement released on Monday.

Although a net loss of $224 million is bad news for any for-profit company, it is still an improvement from Ocwen’s regulatory turbulent year of 2014 in which the company reported a record net loss of $546 million following a net profit of $310 million in 2013. Ocwen posted a net loss of $66.8 million in Q3 of 2015.

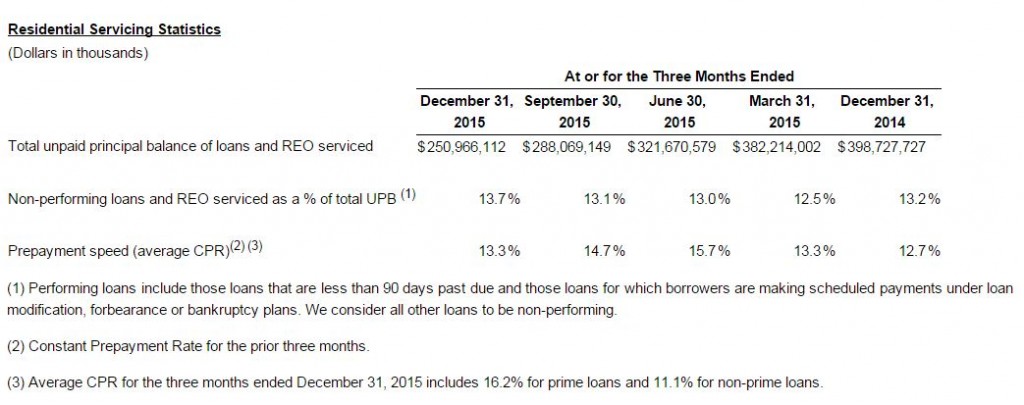

Revenues were also down for the Atlanta-based servicer. Ocwen’s fourth-quarter revenue of $362.5 million represented a 26.5 percent decline from the fourth quarter of 2014, primarily due to the impact of mortgage servicing rights (MSR) sales and portfolio run-off in 2015, according to Ocwen’s announcement. The company’s revenue for the full year of 2015 was $1.7 billion, a decline of 17.5 percent year-over-year. Amount of cash generated from Operating Activities for the full year was $582 million.

The positive note from Ocwen’s 2015 earnings statement was the $331 million in available liquidity as of the end of 2015, which was an increase of $202 million from the previous year.

“We continue to make progress in resolving legacy issues. We also continue to lower our corporate debt, ending the year with a corporate debt to equity ratio of under 0.9 to 1,” commented Ron Faris, President and CEO of Ocwen. “We are also focused on continuous improvement in operational and service excellence, employee engagement, diversity and inclusion. We have made good progress on our cost improvement initiative announced last year, and we are committed to making further progress in this area, while continuing to focus on the borrower experience.”

The pre-tax loss for Ocwen in Q4 2014 was $129.3 million, impacted by such factors as monitor costs ($22.1 million), net losses from sales of non-performing Agency MSRs ($14.0 million), and legal and other settlement costs ($13.9 million), according to Ocwen.

The pre-tax loss for Ocwen in Q4 2014 was $129.3 million, impacted by such factors as monitor costs ($22.1 million), net losses from sales of non-performing Agency MSRs ($14.0 million), and legal and other settlement costs ($13.9 million), according to Ocwen.

A highlight of the fourth quarter 2015 was the launch of a new commercial lending business line, Automotive Capital Services (ACS), which makes short-term inventory-secured loans to independent car dealers to finance their inventory. As of the end of February, the ACS line had entered eight sales markets in five states and executed credit lines for $19 million in new commitments with 22 dealers , according to Ocwen.

“Moving forward, our vision for Ocwen is to be a world-class asset origination and servicing company,” Faris said. “We are very excited about the formal launch of our Automotive Capital Services commercial lending business, and we continue to invest in our other lending businesses, all of which we believe will drive earnings growth in the future. We believe the successful implementation of our strategy and its initiatives can, over time, restore the Company to profitability and earnings growth.”

Other highlights of 2015 included 84,488 loan modifications, with 48.2 percent of those mods completed through the government’s Home Affordable Modification Program (HAMP) and 46.2 percent of the mods including some principal reduction; a partnership with New Residential in Q4 to execute Ocwen’s first call rights transaction on MSRs for loans with a UPB of $528 million, resulting in a gain of $3.2 million for Ocwen and retention of the transaction’s performing loans, which were about 90 percent of the loans; originating forward mortgage loans with a UPB of $813.8 million and reverse mortgage loans with a UPB totaling $173.3 million in Q4; and an estimated value of $97.7 million for the reverse mortgage portfolio at the end of the year.

Click here to see Ocwen’s complete Q4 2015 and full year 2015 earnings report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news