High performance of first-lien mortgages and declining foreclosure activity spelled a healthy servicing market for the first quarter of 2016 and a decreasing need for new loss-mitigation actions, according to the Office of the Comptroller of the Currency’s (OCC [1]) newest quarterly report on mortgages [2].

High performance of first-lien mortgages and declining foreclosure activity spelled a healthy servicing market for the first quarter of 2016 and a decreasing need for new loss-mitigation actions, according to the Office of the Comptroller of the Currency’s (OCC [1]) newest quarterly report on mortgages [2].

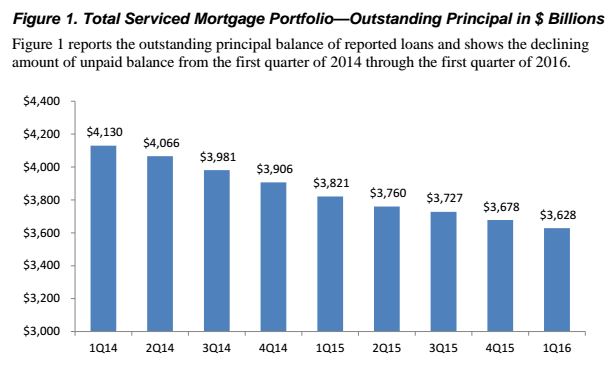

The report showed that 95 percent of mortgages at the seven largest banks were current and performing at the end of Q1, up from just over 94 percent a year earlier. Also, banks serviced approximately 21 million first-lien mortgage loans with $3.6 trillion in unpaid principal balances, which was 38 percent of all first-lien residential mortgage debt outstanding.

The report also showed that foreclosure activity declined 7 percent from Q4 of 2015 and 29 percent from a year ago; there were 58,921 new foreclosures during the Q1 of 2016 than Q1 of 2015. Home forfeiture actions—completed foreclosure sales, short sales, and deed-in-lieu-of-foreclosure actions— also decreased 19 percent from a year earlier, to 38,429. Servicers implemented 34,481 mortgage modifications in the first quarter of 2016. Of these modifications, 91 percent were “combination modifications,” meaning modifications that included multiple actions affecting affordability and sustainability of the loan, such as an interest rate reduction and a term extension. An additional 2,681 loan modifications received only a single action. Eighty-seven percent of these mods reduced the loan’s pre-modification monthly payment, the report stated.

Among modifications that were completed during the third quarter of 2015‒‒the first quarter for which all loans modified during the quarter could have aged at least six months by March 31‒‒servicers reported that 6,058 were 60 or more days past due or in the process of foreclosure at the end of the month that they became six months old.

California had the highest number of modifications of any state, with 2,933. North Dakota had the fewest, with five.

Click here [2] to view the complete report, which covers single-family mortgage loans in the portfolios of seven banks: Bank of America, Citibank, HSBC, JPMorgan Chase, PNC, U.S. Bank, and Wells Fargo.