The 30-year fixed-rate mortgage hovered at 3.63 percent this week, up from record lows last week, with debt crises in Europe continuing to scare investors and drag down prospects for a steady economic recovery. Real estate Web site Zillow found the 30-year fixed-rate mortgage down to 3.63 percent, up from 3.59 percent last week. The 15-year home loan averaged 2.93 percent, while rates for 5-year and 1-year adjustable-rate mortgages reached 2.54 percent. Europe remains a sore spot for the economic recovery.

Read More »Prices for Existing Homes See Strongest Gains in Six Years

Existing-home sales rose to 4.62 million at a seasonally adjusted annual rate in April from a downwardly revised March rate of 4.47 million, the National Association of Realtors said Tuesday. Economists had forecast the April sales pace would be 4.66 million. The median price of an existing home climbed 10 percent to $177,400 in April 2011, the strongest year-to-year gain since January 2006. The median price in April reached its highest level since July 2010 when it was $182,100. For-sale homes rose to 2.54 million in April.

Read More »Affordability, Inventory Improve, Still Shy of Full Recovery

The U.S. housing market continues to trudge down the slow, bumpy road to recovery with a few positive indicators lighting the way. However, a full recovery continues to linger listlessly on the horizon. Obama's Housing Scorecard for April, released jointly by HUD and the Treasury Department, reveals some positive movement in home sales, though prices continue to languish in many markets. Another piece of good news for the market: Housing inventory is now at a sustainable level. The market currently holds a 5.3-month supply of new homes.

Read More »Pending-Home Sales Leap Ahead in March: NAR

The Pending Home Sales Index rose sharply in March to 101.4 from February's revised 97.4, the National Association of Realtors said Thursday. Economists had expected the Index to increase 1.0 percent from February. The index is now at the highest level since April 2010 when it reached 111.3. The index improved for the third straight month and fifth time in the last six month. The March reading is up 12.8 percent from March 2011, the strongest year-over-year gain since last July. The PHSI has been drifting upward, albeit modestly for most of the past two years.

Read More »Mortgage Rates Dip, Staying Aboard Rollercoaster

Higher gasoline prices and concerns about Chinese growth fed bond investments, driving down mortgage rates once again amid worrying signs about the economy. Mortgage giant Freddie Mac found rates for the 30-year fixed-rate mortgage falling from 4.08 percent last week to 3.99 percent this week. The company said the 15-year loan fell from 3.30 percent last week to 3.23 percent this week, a change of pace from 4.09 percent seen year-over-year. Five-year and 1-year adjustable-rate mortgages meanwhile slid from 2.96 percent and 2.84 percent to 2.90 percent and 2.78 percent, respectively.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

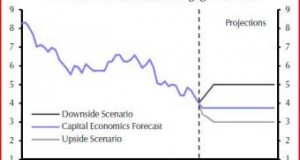

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Last Year’s Housing Doldrums Dampen Obama Scorecard

A troubled year for housing surfaced in a February housing scorecard from the Obama administration Friday, underscoring a still-unsteady pace for home prices, mortgage origination volume, and housing supply. Jointly released by HUD and the Treasury Department, the scorecard reflects an industry still in transition from crisis to recovery. The scorecard cited a National Association of Realtors Home Affordability Index, showing that it moved from 179.1 February last year to 194.9 this year, not far from the level seen in January.

Read More »Still Falling, Mortgage Rates Read From the Same Script

This week mortgage rates played by the same script seen for the last few months, furthering a season for all-time high affordability while fears for Europe drove investors across the Atlantic. Finance Web site Bankrate.com, mortgage giant Freddie Mac, and real estate Web site Zillow.com delivered a dearth for rates across the board. Bankrate.com likewise offered declines for loans across the board. For its part, Greece remains in the clutch of a debt crisis that drew $172 billion in bailout funds from eurozone finance ministers last week.

Read More »Discounts Drive Cash Buyers to Market: Survey

More homebuyers are scooping up properties with cash only, even in an environment for record-low mortgage rates, according to a recent survey. Campbell Surveys and Inside Mortgage Finance jointly released the HousingPulse Tracking Survey, collecting responses from about 2,500 real estate agents around the industry. The survey said that cash buyers will account for roughly half of all homebuyers in 2012 if current trends continue. The survey also attributed the rise in all-cash transactions to hefty discounts and late appraisals.

Read More »New Home Sales Fell Slightly in January

New home sales fell 0.9 percent in January, declining from 324,000 in December to a seasonally adjusted annual rate of 321,000. The Commerce Department found that the new home sales from January reflected a 3.5-percent increase year-over-year, up from a seasonally adjusted annual rate of 310,000. Sales in the Northeast accordingly leapt forward by 11.1 percent from December but fell 39.4 percent from January last year. The South boasted still-strong numbers on either basis, up 9.3 percent month-over-month and 15.3 percent year-over-year.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news