The potential for a lift in mortgage rates is unlikely to spell trouble for the housing recovery, according to a recent report. Paul Diggle, a property economist with Capital Economics, said in a note Monday that still-low home prices will help cushion the blow from interest rates. Mortgage rates continue to linger near record lows, with 30-year and 15-year fixed-rate mortgages hovering at or below 4 percent for the past several weeks. Waning confidence in Europe├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós ability to halt the debt crisis in Greece drives investors to U.S. Treasury debt.

Read More »March Builder Confidence Flat As String of Increases Ends

Builder confidence was flat in March, matching a downwardly revised February index of 28, the first time in six months the index has not increased, the National Association of Home Builders reported Monday. The builder assessment of present home sales conditions actually dipped in March, falling to 29, the first decline since last September. The outlook for home sales in the next six months rose to 36 ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô the highest level since June 2007 - from 34 in February. Buyer traffic was flat in March at 22. The drop in the index in the West census region was precipitous.

Read More »Mortgage Rates Rise With Higher Treasury Yields

The days of record-low mortgage rates may be in our rearview mirror. Rates for all loan products headed higher this week - and by more than just the incremental 1 or 2 basis points. Analysts attribute the rise to increasing bond yields, driven by investors' growing confidence in the economy and recent evidence from the Federal Reserve's stress tests that indicates banks have strengthened capital levels enough to maintain operations and continue lending through another hypothetical recession.

Read More »Zillow: Statistics Show Upticks Across Lending Sector

Economic releases in recent days have signaled positive movement, albeit gradual, toward a strengthening economy. The rosier outlook has led mortgage interest rates higher. The 30-year fixed-mortgage rate on Zillow Mortgage Marketplace came in at 3.74 percent, up five basis points from 3.69 percent at the same time last week. Rates for a 15-year fixed mortgage, as well as adjustable-rate mortgages, also rose. Experts say conditions are primed for mortgage rates to continue to rise in the coming weeks and months.

Read More »FHLB of Chicago Offers Downpayment Subsidies

The Federal Home Loan Bank of Chicago's Downpayment Plus programs went live recently, offering borrowers from its regional bank members in two states a subsidy of $8,000.

Read More »Fixed-Rate Mortgages Hold at or Near Record Lows

Homebuyer affordability is at a record high, and a big driver of that underlying market denominator is the fact that mortgage interest rates continue to hover close to 60-year lows. Data released Thursday by Freddie Mac puts the average rate for a 30-year fixed mortgage at 3.88 percent, and the 15-year fixed-rate mortgage hit a record low of 3.13 percent. Frank Nothaft, Freddie Mac's chief economist, says that due to these factors, the typical family had more than double the income needed to purchase a median-priced home in January.

Read More »More Americans Feel Confident About Housing: Survey

More Americans feel confident about their household finances, the housing recovery, and the prospect of an economic upturn, Fannie Mae said Wednesday. The mortgage giant drew on poll data from some 1,000 respondents to sketch a blend of guardedness and hopefulness in a National Housing Report. Thirty-five percent of Americans now believe the economy is on the right track, an increase from 19 percent in November, compared with 57 percent who still feel damp about the state of recovery. Fewer respondents fielded layoff concerns.

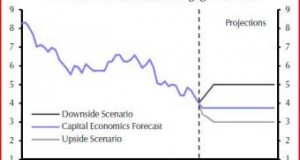

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Last Year’s Housing Doldrums Dampen Obama Scorecard

A troubled year for housing surfaced in a February housing scorecard from the Obama administration Friday, underscoring a still-unsteady pace for home prices, mortgage origination volume, and housing supply. Jointly released by HUD and the Treasury Department, the scorecard reflects an industry still in transition from crisis to recovery. The scorecard cited a National Association of Realtors Home Affordability Index, showing that it moved from 179.1 February last year to 194.9 this year, not far from the level seen in January.

Read More »Housing Looms Large, As Ever, For Bernanke, Lawmakers

A hearing held by House lawmakers Wednesday with Federal Reserve Chairman Ben Bernanke recast housing and the Dodd-Frank Act as issues critical to the economic recovery. The central banker said that 30 percent of home sales recently consisted of foreclosures and properties in distress, reflecting ongoing trouble for a market underpinned by high home vacancy rates and downward pressure for home prices. The underwriting process, down payments, and pending regulations also took center-stage during the discussion, with House members spotlighting recent servicer consent orders.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news