In signs that a stable housing rebound may still be ways off, mortgage applications contracted by 1.2 percent last week, even while the Home Affordable Refinance Program offered a still-steady buttress for refinance activity. The Mortgage Bankers Association found in a weekly survey that mortgage application volume also declined by 10.2 percent on a seasonally adjusted basis. The Purchase Index went up by a seasonally adjusted 2.1 percent from last week, while it climbed by 14.7 percent on a seasonally unadjusted basis.

Read More »Group: Euro Crisis Could Choke ‘Healing’ Housing Market

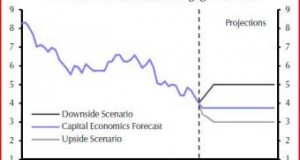

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Mortgage Rates Ride Rollercoaster Ahead of Greek Deadline

All-time highs for housing affordability persisted this week as interest rates for fixed-rate mortgages hovered near their record-breaking lows, a sign that Europe continues to ward off investors. Real estate Web site Zillow found only a minor shift for the 30-year fixed-rate mortgage, which lingered between 3.70 percent and 3.75 percent before nestling at 3.69 percent Tuesday. The 15-year loan stayed near 2.95 percent, along with rates for 5-year and 1-year adjustable-rate mortgages that averaged 2.65 percent, according to the Web site.

Read More »Obama Touts Lower FHA Premiums, Vet Homeowner Relief

The Obama administration revealed recently it will relieve veterans wrongly foreclosed upon by servicers, as well as slashing refinancing rates for FHA loans.

Read More »Home Prices Expected to Continue Stabilizing: Fitch

Lower unemployment figures and higher GDP growth continue to help stabilize home prices amid a still-steady recovery, Fitch Ratings said Monday. The ratings agency found in a report that home prices may plunge 9.1 percent nationally but that the figures remain below estimates of 13.1 percent from the fourth quarter. Fitch said that declines may contract by around 6 percent in lieu of inflation and benefit from improvements in macro-economic indicators, such as unemployment and GDP growth. The report said that still-anemic mortgage volume remains a problem.

Read More »NAHB Proposes Plan to Overhaul Secondary Market

A prominent housing trade group joined a growing roster of policy makers by outlining ways to take the GSEs off federal conservatorship, reintroduce private mortgage-backed securities, and charge existing government entities with stewardship of the new system. The National Association of Home Builders released a white paper Monday that calls on lawmakers to slowly transition a system dominated by Fannie Mae and Freddie Mac to one that shares and balances responsibility. The proposal comes as others arrive from lawmakers and policy makers to replace the GSEs.

Read More »Last Year’s Housing Doldrums Dampen Obama Scorecard

A troubled year for housing surfaced in a February housing scorecard from the Obama administration Friday, underscoring a still-unsteady pace for home prices, mortgage origination volume, and housing supply. Jointly released by HUD and the Treasury Department, the scorecard reflects an industry still in transition from crisis to recovery. The scorecard cited a National Association of Realtors Home Affordability Index, showing that it moved from 179.1 February last year to 194.9 this year, not far from the level seen in January.

Read More »Moody’s Slashes Servicer Rating for Wells Fargo

Moody├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós Investor Service slashed credit ratings for Wells Fargo Home Mortgage Thursday over concerns about deterioration in the quality of prime and subprime loans. The ratings agency downgraded the servicer from SQ1 to SQ2+. When reviewing residential mortgage servicers, Moody├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós rates SQ1 as strong and SQ5 as weak, with modifiers like pluses and minuses signifying their relative strength and weakness in each category. Moody├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós cited the $25-billion settlement as one reason why, saying that added public pressure over negotiations lengthened foreclosure timelines.

Read More »Still Falling, Mortgage Rates Read From the Same Script

This week mortgage rates played by the same script seen for the last few months, furthering a season for all-time high affordability while fears for Europe drove investors across the Atlantic. Finance Web site Bankrate.com, mortgage giant Freddie Mac, and real estate Web site Zillow.com delivered a dearth for rates across the board. Bankrate.com likewise offered declines for loans across the board. For its part, Greece remains in the clutch of a debt crisis that drew $172 billion in bailout funds from eurozone finance ministers last week.

Read More »Housing Looms Large, As Ever, For Bernanke, Lawmakers

A hearing held by House lawmakers Wednesday with Federal Reserve Chairman Ben Bernanke recast housing and the Dodd-Frank Act as issues critical to the economic recovery. The central banker said that 30 percent of home sales recently consisted of foreclosures and properties in distress, reflecting ongoing trouble for a market underpinned by high home vacancy rates and downward pressure for home prices. The underwriting process, down payments, and pending regulations also took center-stage during the discussion, with House members spotlighting recent servicer consent orders.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news