New home sales jumped 5.7 percent in September to a seasonally adjusted average annualized rate of 389,000, the highest rate since April 2010, the Census Bureau and Department of Housing and Urban Development reported Wednesday. Economists surveyed by Bloomberg expected the report to show a sales pace of 385,000. The month-to-month sales improvement was the strongest since February, when sales improved 27,000, or 8.0 percent. While sales numbers improved, both the median and average sales price of a new home dropped.

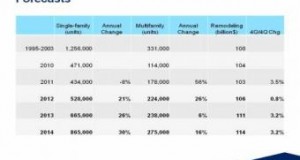

Read More »NAHB: Housing Construction on Track for Growth in Coming Years

In a webinar hosted by the NAHB, economists discussed the housing recovery, what's keeping it going, and what may throw it off course.

Read More »September Housing Permits, Starts at Four-Year Highs

Housing starts and permits jumped in September to their highest levels since July 2008, Census Bureau and Department of Housing and Urban Development reported jointly Wednesday. Housing starts jumped 15.0 percent to a seasonally adjusted annual rate of 872,000 while permits improved 11.6 percent to 894,000. Single family starts represented 69.2 percent of the total in September, matching their year-to-date share. Single family starts made up 71.5 percent of all starts for the same period in 2011.

Read More »Stronger Traffic Boosts Builder Confidence

After jumping 11 points in three months, builder confidence inched up one point in October to 41, remaining at its highest level since June 2006, the National Association of Home Builders reported Tuesday, matching economist expectations. The October boost was due entirely to a surge in homebuyer traffic in October, as other elements of the index were flat from September. The traffic index├â┬ó├óÔÇÜ┬¼├óÔé¼┬Øwhich had been revised downward in September to 30, from an originally reported 31├â┬ó├óÔÇÜ┬¼├óÔé¼┬Øleapt to 35, its highest level since April 2006.

Read More »Improving Markets Index Touches New High in October

The number of markets listed on the National Association of Home Builders (NAHB)/First American Improving Markets Index (IMI) broke the triple-digit mark in October, NAHB reported. A total of 103 housing markets across the country qualified for the list in October, up from 99 in September and the highest level since the list started a year ago, NAHB said. At its October level, the number of qualifying markets approaches nearly 10 times the number from when the index was first created.

Read More »Homeownership Rally in Missouri Draws Concerned Citizens

More than 800 homeowners from across Missouri, Kansas, and Nebraska, came together with local business leaders, real estate professionals, politicians, and civil rights leaders this week in support of homeownership. The rally took place in Independence, Missouri, and is one of nine events organized by the National Association of Home Builders (NAHB) to urge elected officials to back homeownership initiatives.

Read More »Single-Family Starts Reach Two-Year High in August

Single family starts increased 28,000 in August to 535,000, the highest level since April 2010, the Census Bureau and HUD reported jointly Wednesday. Despite the increase total, housing starts improved just 17,000 as multi-family starts fell. Despite the increase total, housing starts improved just 17,000 as multi-family starts fell. Housing permits meanwhile dropped 9,000 to 802,000. Economists had expected total starts to increase to 768,000 and permits to slip to 803,000.

Read More »NAHB: Is Multifamily Housing (Finally) on the Mend?

Multifamily housing continues to improve ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô at least by some appearances. The National Association of Home Builders recently registered 54 on an index that measures multifamily production. On a scale of zero to 100, the trade group found the index doing well for the eighth straight quarter, marking a high not seen in seven years. The Multifamily Production Index noted the rise from 51 for an index that tallies up homebuilder and developer sentiment about the state of the apartment and condo market.

Read More »July New Home Sales Increase as Prices Fall

New home sales regained all the ground they lost in June, jumping by 13,000 to an annualized rate of 372,000 in July, the Census Bureau and HUD reported Thursday. Economists surveyed by Bloomberg expected the report to show a sales pace of 362,000. Sales for June were revised up to 359,000 from the originally reported 350,000. Both the median and average sales price of a new home though dropped month-over-month and year-over-year according to the report, each falling to the lowest level since January.

Read More »Are Mortgage Rates on Their Way Back to Normalcy?

Could mortgage rates be on their way back? That's what today's mortgage rates just may suggest. Freddie Mac reported that the 30-year fixed-rate mortgage ticked up by a few basis points to arrive at 3.62 percent, up from 3.59 percent last week. The GSE also found interest rates for the 15-year home loan averaging 2.88 percent, with 5-year and 1-year adjustable-rate mortgages crawling to 2.76 percent and 2.69 percent, respectively. Bankrate.com likewise saw upward-bound changes in mortgage rates this week.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news