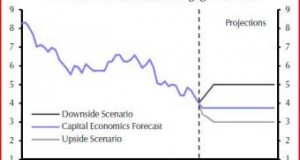

A steady pace for home prices and sales signals housing recovery, but a disorderly default by any of the euro zone states overseas could choke affordability according to Capital Economics analysts.

Read More »Mortgage Rates Ride Rollercoaster Ahead of Greek Deadline

All-time highs for housing affordability persisted this week as interest rates for fixed-rate mortgages hovered near their record-breaking lows, a sign that Europe continues to ward off investors. Real estate Web site Zillow found only a minor shift for the 30-year fixed-rate mortgage, which lingered between 3.70 percent and 3.75 percent before nestling at 3.69 percent Tuesday. The 15-year loan stayed near 2.95 percent, along with rates for 5-year and 1-year adjustable-rate mortgages that averaged 2.65 percent, according to the Web site.

Read More »Still Falling, Mortgage Rates Read From the Same Script

This week mortgage rates played by the same script seen for the last few months, furthering a season for all-time high affordability while fears for Europe drove investors across the Atlantic. Finance Web site Bankrate.com, mortgage giant Freddie Mac, and real estate Web site Zillow.com delivered a dearth for rates across the board. Bankrate.com likewise offered declines for loans across the board. For its part, Greece remains in the clutch of a debt crisis that drew $172 billion in bailout funds from eurozone finance ministers last week.

Read More »Mortgage Rates Lift on Greek Bailout, Housing

Interest rates for mortgage loans climbed close to 4 percent this week as a second Greek bailout sowed more confidence in the investor crowd and signs emerged that housing may see an upswing. Finance Web site Bankrate.com and mortgage company Freddie Mac each released separate surveys, with analysts attributing the rise to different causes. The GSE found the 30-year fixed-rate mortgage lifting to 3.95 percent, up from 3.87 percent. Bankrate.com saw rates for the loan hit 4.16 percent, up from 4.10 percent last week.

Read More »Mortgage Rates See First Increase in 2012

Interest rates for mortgage loans went up for the first time in several months this week but remain near historic lows. Finance Web site Bankrate.com and mortgage giant Freddie Mac reported modest increases for mortgage rates across the board. Freddie Mac found the 30-year fixed-rate mortgage rising from an all-time low of 3.88 percent last week to 3.98 percent this week, far below 4.80 percent seen for the loan at the same time last year. Bankrate.com posted a similar increase from 4.18 percent last week to 4.25 percent this week. Europe's debt crises have helped keep rates low.

Read More »Mortgage Application Volume Jumps 23.1%: MBA

Mortgage application volume shot up 23.1 percent on a seasonally adjusted basis, largely on a refinancing surge that eclipsed averages year-over-year as investors frittered about Europe. The Mortgage Bankers Association reported the figures in its latest Weekly Mortgage Applications Survey. The trade group├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós Market Composite Index, a measure of application volume, climbed 38.1 percent on a seasonally unadjusted basis from the week before. The Refinance Index accordingly reflected a 26.4-percent increase from the week before to the highest level seen since August last year.

Read More »Bank Shares Slide on S&P’s Eurozone Downgrades

Stocks and shares for the nation├â┬ó├óÔÇÜ┬¼├óÔÇ×┬ós four largest banks slid back Friday on news that ratings agency Standard & Poor's slashed credit ratings for several debt-saddled euro zone countries, including France, Italy, and Spain. A 0.4-percent dip led the Dow Jones Industrial Average to end the day at 12,422 points, a 48.96 loss from the day before. The S&P 500 went south in a 0.5-percent tizzy, losing 6.41 points to close at 1,298. S&P ignited an investor selloff in the markets earlier Friday by announcing credit changes for 16 European countries. S&P slashed U.S. sovereign credit last fall.

Read More »Record-Low Mortgage Rates Ring In New Year

Uncertainty in the markets helped ring in the New Year with record lows for mortgage rates, as concerns over debt crises and job growth lingered for wary investors. Finance Web site Bankrate.com and mortgage company Freddie Mac released their findings for mortgage rates Thursday in two separate weekly surveys. Bankrate.com reported interest rates for the 30-year loan hitting a record 4.18 percent this week, down from 4.21 percent last week. Freddie likewise found rates for the 30-year fixed-rate mortgage sliding from 3.95 percent last week to 3.91 percent this week.

Read More »Europe’s Crises Keep Mortgage Rates at a Standstill

Mortgage rates largely stayed the same this week as trouble in the euro zone threatened to upend global financial markets, encouraging investors to stay near the safe haven of U.S. Treasury debt. Mortgage giant Freddie Mac and finance Web site Bankrate.com released separate weekly surveys that found rates hovering at or above figures seen for several weeks in a row. The GSE noted averages for the 30-year fixed-rate mortgage reaching 4 percent ├â┬ó├óÔÇÜ┬¼├óÔé¼┼ô the fifth consecutive week for lows for the benchmark loan.

Read More »Reports: Fitch May Downgrade Fannie, Freddie

A failure by lawmakers to slash $1.2 trillion from the national debt spurred Fitch Ratings to place U.S. debt on negative outlook Monday, a move that immediately hit GSEs Fannie Mae and Freddie Mac by association. The ratings agency revised a stable outlook for debt held by Fannie and Freddie to negative, even while it reaffirmed AAA-ratings in place for the GSEs. Multiple news reports suggest that Fitch will likely downgrade credit ratings for the U.S. federal government, along with Fannie and Freddie.

Read More »

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news