During the last reported month, December 2022, mortgage payments nationwide dropped 2.9% to $1,920 from $1,977 the previous month.

During the last reported month, December 2022, mortgage payments nationwide dropped 2.9% to $1,920 from $1,977 the previous month.

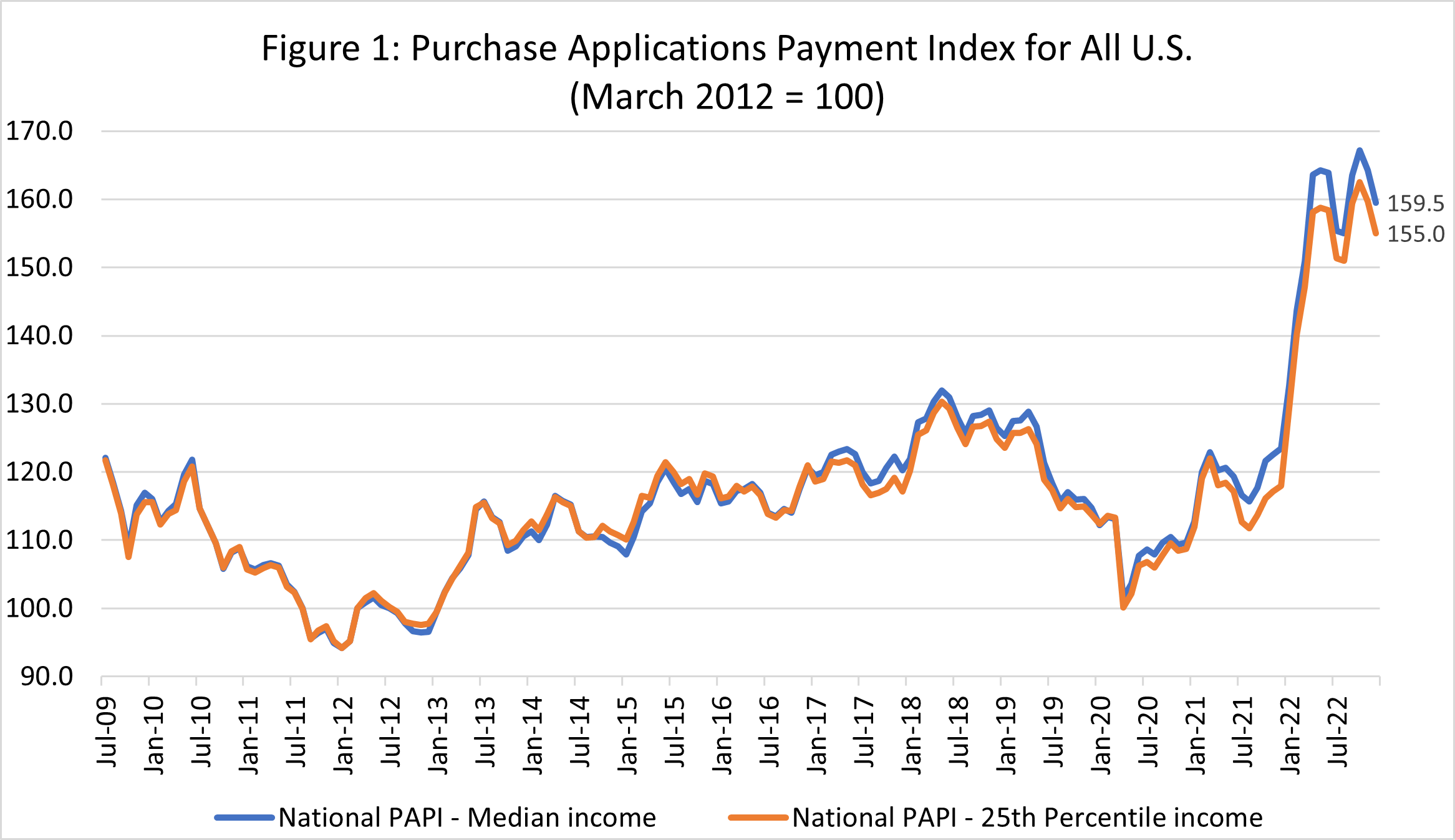

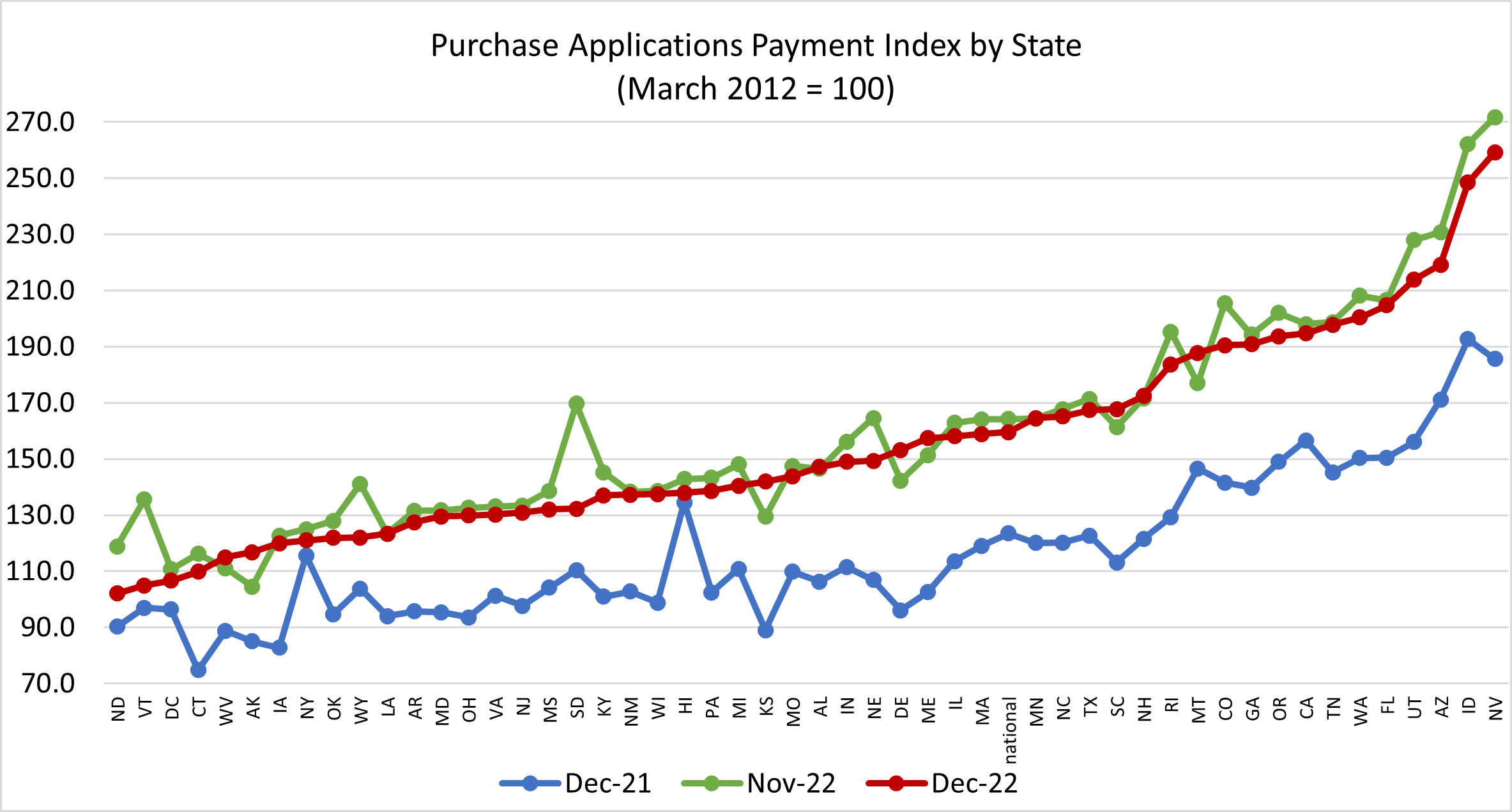

This improvement in homebuyer affordability is shown in the Mortgage Bankers Association’s (MBA) Purchase Applications Payment Index (PAPI) [1], a tool that measures how new mortgage payments vary across time, relative to income, using data that the MBA collects weekly from Americans’ mortgage applications.

The MBA’s Associate VP Edward Seiler [2] said that while overall homebuyer affordability did increase, the median purchase application amount last month increased nearly $3,000 to $300,000.

“With inflation cooling slightly, MBA expects both mortgage rates and home-price growth to soften, which along with cooling inflation, should help bring more prospective buyers into the market during the spring homebuying season,” said Seiler, who also serves as Executive Director at the MBA’s Research Institute for Housing America [3].

The MBA’s most-recent report includes a new dataset, according to a press release [1], based on applications for newly built single-family homes from MBA’s Builder Application Survey (BAS) [4] data.

The report shows homebuyer affordability increased month-over-month for households in every racial demographic. (A decrease in PAPI score indicates improved affordability.)

- For Black households, the national PAPI decreased from 164.2 in November to 159.5 in December.

- For Hispanic households, the national PAPI decreased from 157.0 in November to 152.5 in December.

- And among white households, the national PAPI decreased from 165.4 in November to 160.6 in December.

Other top takeaways from the report, which can be read in full at MBA.org [1], include the following:

- Mortgage payments increased $534 in 2022, an increase of 38.8%.

- The national median mortgage payment for FHA loan applicants was $1,602 in December, down from $1,631 in November, and up from $1,070 in December 2021.

- The national median mortgage payment for conventional loan applicants was $1,954, down from $1,994 in November and up from $1,447 in December 2021.