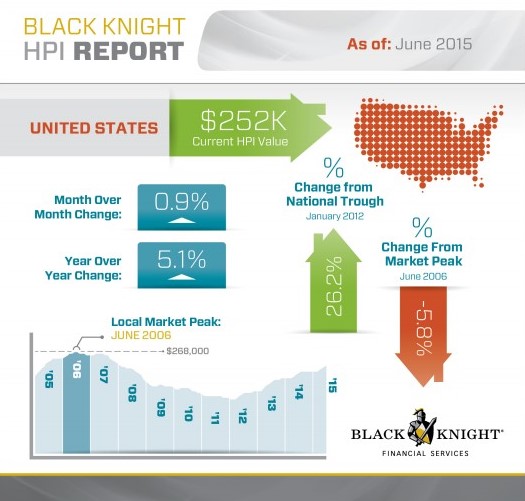

Black Knight Financial Services' Data and Analytics division released its June 2015 Home Price Index (HPI) report, finding that U.S. home prices were up 0.9 percent for the month, and have gained 5.1 percent year-over-year.

Black Knight Financial Services' Data and Analytics division released its June 2015 Home Price Index (HPI) report, finding that U.S. home prices were up 0.9 percent for the month, and have gained 5.1 percent year-over-year.

The report also found that the national HPI of $252,000 is now just 5.8 percent off its June 2006 peak of $268,000. In addition, the HPI is up over 26 percent from the market's bottom in January 2012.

Leading the gains among the states is Michigan with 1.9 percent month-over-month appreciation. Wrapping up the top five states with the largest monthly HPI changes are Colorado (1.4 percent); Nevada (1.3 percent); Alaska (1.3 percent); and Vermont (1.3 percent).

As far as the lowest appreciating states are concerned, Black Knight noted that even West Virginia, the lowest performing state, registered flat, rather than negative, movement in June. The company says that this is a sign of the month’s overall positivity.

Wrapping up the bottom five states with the lowest HPI changes are Virginia (0.1 percent); Missouri (0.2 percent); Arkansas (0.2 percent); and Maine (0.2 percent).

Wrapping up the bottom five states with the lowest HPI changes are Virginia (0.1 percent); Missouri (0.2 percent); Arkansas (0.2 percent); and Maine (0.2 percent).

Among all the nation’s metros tracked by the Black Knight HPI, Reno, NV saw the greatest monthly appreciation at 2.6 percent. Jamesville, Wisconsin and Detroit, Michigan followed with monthly appreciation changes of 2.4 percent and 2.2 percent, respectively.

Only one metro, Sierra Vista, Arizona experienced negative appreciation of 0.1 percent, the report says. Wheeling, Beckley, Morgantown, and Parkersburg, all metros of West Virginia, experienced flat movement in June.

According to Black Knight, Indiana ($146,000), New York ($347,000), Tennessee ($176,000), and Texas ($212,000) all hit new peaks in June.

Home prices are edging up once again thanks to pent-up buyer demand, affordability, consumer confidence, and an improving labor market.

According to CoreLogic’s June 2015 Home Price Index (HPI) report, home prices, including distressed sales, increased by 6.5 percent year-over-year in June released earlier this month.

“The current cycle of home price appreciation is closing in on its fourth year with no apparent end in sight,” said Anand Nallathanbi, president and CEO of CoreLogic. “Pent up buying demand and affordability together with higher consumer confidence buoyed by a more robust labor market, are a potent mix fueling a 6.5 percent jump in home prices through June with more increases likely to come."

Click here to view Black Knight's HPI report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news