The 55 and older population is often overlooked—especially when the spotlight has been on millennials for so long—but they are a large part of the housing market.

The 55 and older population is often overlooked—especially when the spotlight has been on millennials for so long—but they are a large part of the housing market.

The National Association of Home Builders (NAHB) and American Community Survey data found that over 48 million households in the U.S. are headed by someone that is 55 or older, accounting for about 42 percent of all households.

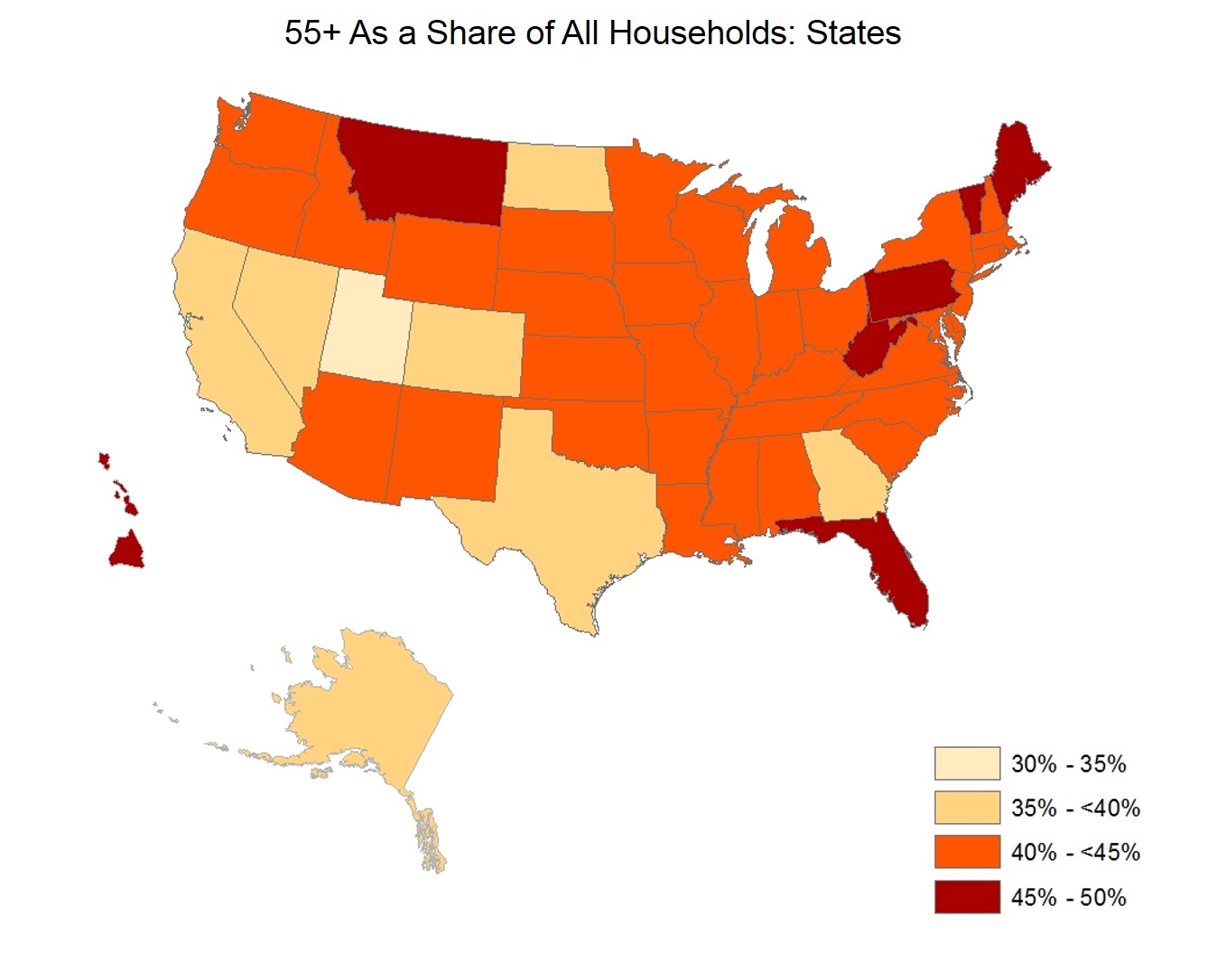

In Montana, Florida, Pennsylvania, West Virginia, Maine, and Vermont 45 to 50 percent of all households are headed by seniors, the NAHB data showed.

Of all the states, 35 fall within the 55 and older share of all households between 40 and 45 percent, but in no state do seniors account for less than 34 percent, or more than 49 percent, of all households.

Homebuilders in the single-family 55+ housing market showed strong confidence in the third quarter of 2015.

The NAHB 55+ Housing Market Index (HMI) showed a reading of 60 in the third quarter, an increase of three points from last quarter.

“Like the overall housing market, we continue to see steady, positive growth in the 55+ market,” said David Crowe, NAHB chief economist. “With the economy and job growth continuing to improve gradually, many consumers are now able to sell their current homes at a suitable price, enabling them to buy or rent in a 55+ community.”

Senior households have been rising slowly over the decades, but this is about to change in the coming years. Urban Institute’s analysis of housing trends determined that senior households are expected to grow dramatically by 2030.

The Institute found in 1990, there were 20 million households for seniors ages 65 and up. In 2010, this number had reached 25.8 million, and by 2030, the institute projects that aging baby boomer households will reach 46 million.

“This dramatic growth will occur among both senior homeowners and renters, Urban Institute said. “Our research suggests that from 2010 to 2030, senior homeowners will increase from 20 million to almost 34 million, and senior renters—who include both homeowners who will shift to renting and baby boomers who already rent—will increase from 5.8 million to 12.2 million.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news