Although the majority of Americans consider themselves bargain hunters when shopping for various items or services, less than one-third of these consumers do not shop around for better prices when searching for a mortgage loan.

Although the majority of Americans consider themselves bargain hunters when shopping for various items or services, less than one-third of these consumers do not shop around for better prices when searching for a mortgage loan.

A recent study from LendingTree found that 79 percent of Americans consider themselves bargain hunters and 92 percent research prices online before buying an item.

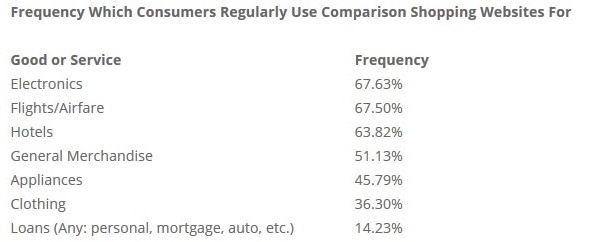

However, consumers do not appear to be as motivated to hunt for bargains when it comes to shopping for a mortgage loan. LendingTree determined that 30 percent of consumers seek the best prices when shopping for a major financial loan, such as a mortgage loan, while 18 percent indicated that they never look for better rates or prices on loans.

On the other end of the spectrum, consumers seem to be more willing to shop around for much smaller purchases.

"Once it comes to a major financial investment, we see a collapse of the normally rational pattern of behavior and mentality for saving."

The survey found that over 80 percent of consumers noted that they would go out of their way to save ten cents per gallon on gas, but only 17 percent of car owners negotiated their auto interest rate.

The survey found that over 80 percent of consumers noted that they would go out of their way to save ten cents per gallon on gas, but only 17 percent of car owners negotiated their auto interest rate.

“It’s an interesting phenomenon. Consumers are generally very savvy with their shopping behavior when it comes to day-to-day purchases and material goods," said Andrea Woroch, LendingTree’s consumer savings expert. "But, once it comes to a major financial investment, we see a collapse of the normally rational pattern of behavior and mentality for saving."

She added, “Consumers sometimes may be too focused on price and fail to consider the lifetime cost of interest which is really where banks and lenders make their money. Over a five-year auto loan, or thirty-year mortgage, a one percent difference between interest rates can easily translate to thousands of dollars.”

Woroch believes there could be a number of causes for this "irrational behavior" among consumers including:

- Many Americans don’t understand the long-term costs associated with compounding interest and the time-value of money

- Consumers are uneducated about loan shopping and the importance of comparing interest rates before financing a purchase.

"It’s easy to become emotionally involved with the purchase itself or to find the loan process so frustrating that you would rather finalize the purchase instead of shopping around," Woroch said. "Unfortunately, consumers are becoming accustomed to paying a premium for convenience on a variety products we purchase every day, such as bottled drinks for example. But is the convenience of not shopping for loans really worth thousands of dollars? Perceived convenience is a major trap consumers can fall into, but with technology improving our ability to find the best deal, saving money on your major finances is just as easy as online shopping.”

Click here to view the complete study.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news