Net equity among U.S. mortgage holders has increased by nearly $1 trillion in the last year, reaching the highest level since 2007, according to Black Knight Financial Services July 2015 Mortgage Monitor.

Net equity among U.S. mortgage holders has increased by nearly $1 trillion in the last year, reaching the highest level since 2007, according to Black Knight Financial Services July 2015 Mortgage Monitor.

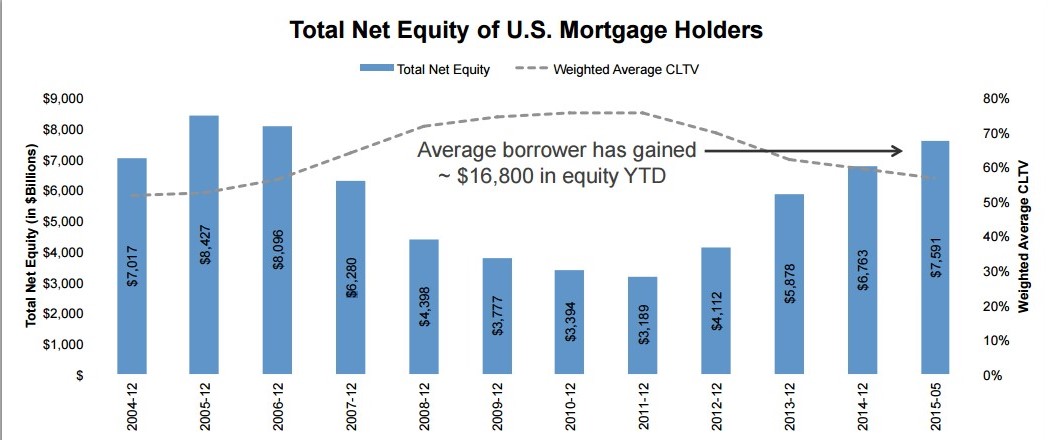

Black Knight Financial Services Home Price Index compared first and second lien debt among mortgage holders to May property values and found total net equity stands at $7.6 trillion as of May 2015, up $825 billion from the total of $6.7 trillion in December 2014. The total net equity amount is nearly 2.5 times more than it was at the end of 2011.

Black Knight used data from the their McDash mortgage performance database to determine the total amount of equity among those with mortgages and to find out how much of this equity is available to borrowers.

On average, American homeowners with a mortgage have approximately $19,000 more equity in their homes today compared to a year ago, the data showed. Homeowners also have nearly $16,800 more equity in their homes than at the beginning of 2015.

On average, American homeowners with a mortgage have approximately $19,000 more equity in their homes today compared to a year ago, the data showed. Homeowners also have nearly $16,800 more equity in their homes than at the beginning of 2015.

The report also found that the weighted average combined loan-to-value (CLTV) ratio for the U.S. is approximately 57 percent, including both first and second liens.

When Black Knight reviewed the amount of equity on every mortgaged home, using a limit of 80 percent CLTV, 59 percent of total net equity was accessible to borrowers prior to reaching that limit. Of borrowers with CLTVs lower than 80 percent, 37 million of them have tappable equity available in their homes.

The amount of tappable equity stood at $4.5 billion, up from last year when this total reached $3.9 billion, the report says.

According to the report, the nationwide average of available equity is $120,000, and can fall anywhere between $42,000 for those whose homes are in the bottom 20 percent of property values to $267,000 for those in the top 20 percent.

Tthe top 10 states ranked by available equity account for 74 percent of total tappable equity, while the top 10 metro areas account for 52 percent.

California holds 39 percent of the nation’s tappable equity alone at $1.7 trillion. This is more than six times as much as Florida, the next highest state with tappable equity of approximately $278 billion. Meanwhile, Los Angeles, California accounts for 14 percent of the nation’s total available equity at about $650 billion.

In June, CoreLogic reported that approximately 254,000 properties regained equity in the first quarter of 2015, bringing the total of residential mortgaged properties with equity nationwide up to 44.9 million – approximately 90 percent of all mortgages.

While more than a quarter of a million homes regained equity during Q1, the percentage of residential properties with negative equity – commonly referred to as being "underwater" or "upside down," meaning the borrower owes more on the mortgage than the home is worth – declined year-over-year by about 19.4 percent from 6.3 million homes in Q1 2014 down to 5.1 million homes in Q1 2015. The 5.1 million homes with negative equity in Q1 represent about 10.2 percent of all residential mortgages nationwide.

"Many homeowners are emerging from the negative equity trap, which bodes well for a continued recovery in the housing market," said Anand Nallathambi, president and CEO of CoreLogic. "With the economy improving and homeowners building equity, albeit slowly, the potential exists for an increase in housing stock available for sale, which would ease the current imbalance in supply and demand. There are still about 5 million homeowners who are underwater and we estimate that a further 5 percent appreciation in home values across the U.S. would reduce the number of owners with negative equity by about one million."

Click here to view Black Knight Financial Services July 2015 Mortgage Monitor report.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news