Mortgage applications for new home purchases increased 18.9% in January 2021 from the same period one year ago, according to the Mortgage Bankers Association (MBA)'s Builder Application Survey (BAS).

Mortgage applications for new home purchases increased 18.9% in January 2021 from the same period one year ago, according to the Mortgage Bankers Association (MBA)'s Builder Application Survey (BAS).

Compared to the previous month, December 2020, applications increased by 17% (not seasonally adjusted).

The stats represent a strong start to 2021, says Joel Kan, MBA's Associate VP of Economic and Industry Forecasting.

"These results are consistent with the still-increasing pace of single-family housing starts and permitting activity reported over the last several months," Kan said. "The low supply of existing homes on the market, and changing household preferences toward newer, larger homes, continue to spur buyer demand."

MBA estimates that new home sales increased over 3% in January to a 905,000 seasonally adjusted annual pace, he added, "which is the second-highest since our tracking began in 2013, and slightly below October 2020's record pace of 927,000 units."

MBA estimates new single-family home sales were running at a seasonally adjusted annual rate of 905,000 units in January 2021, based on data from its BAS.

The seasonally adjusted estimate for January is an increase of 3.3% from the December pace of 876,000 units. On an unadjusted basis, MBA estimates that there were 69,000 new home sales in January 2021, an increase of 16.9% from 59,000 new home sales in December.

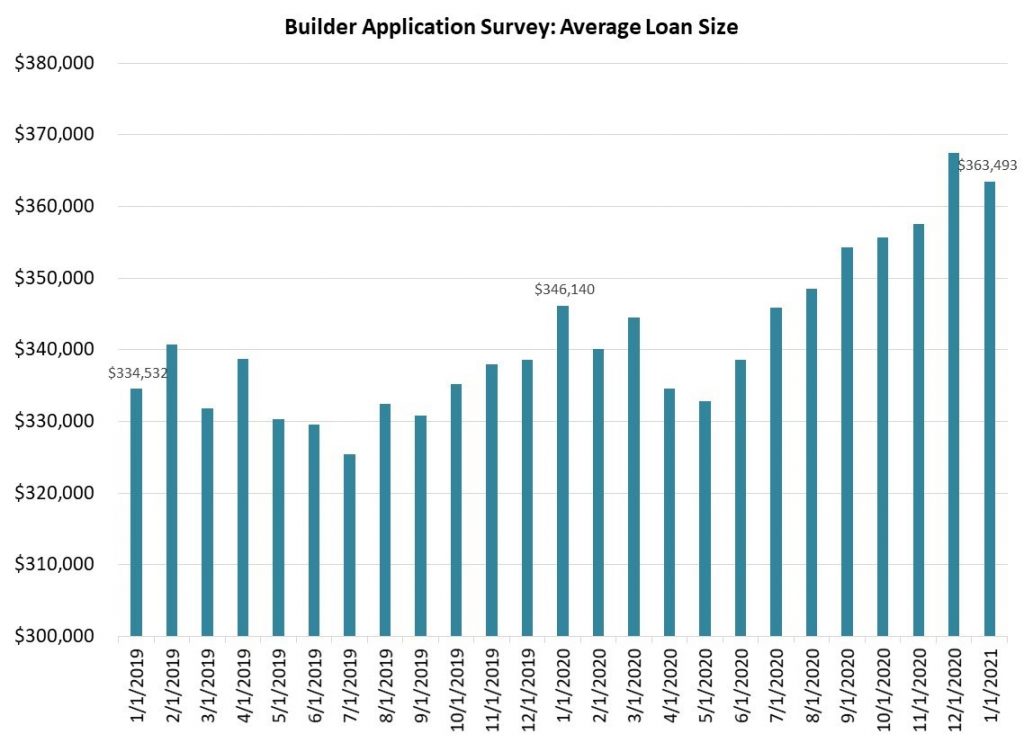

The average loan size of new homes decreased from $367,502 in December to $363,493 in January.

Broken down by type: Conventional loans composed 72.6% of loan applications, FHA loans at 16.2%, RHS/USDA loans made up 0.9%, and VA loans came in at 10.3%.

The survey tracks application volume from mortgage subsidiaries of homebuilders nationwide.

Using this and additional data, MBA provides an early estimate of new home sales volumes at the national, state, and metro level.

For further information on MBA's BAS, visit mba.org/researchandforecasting.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news