Lending standards overall loosened during April, the Mortgage Credit Availability Index (MCAI) from Mortgage Bankers Association (MBA) and Ellie Mae indicates.

Lending standards overall loosened during April, the Mortgage Credit Availability Index (MCAI) from Mortgage Bankers Association (MBA) and Ellie Mae indicates.

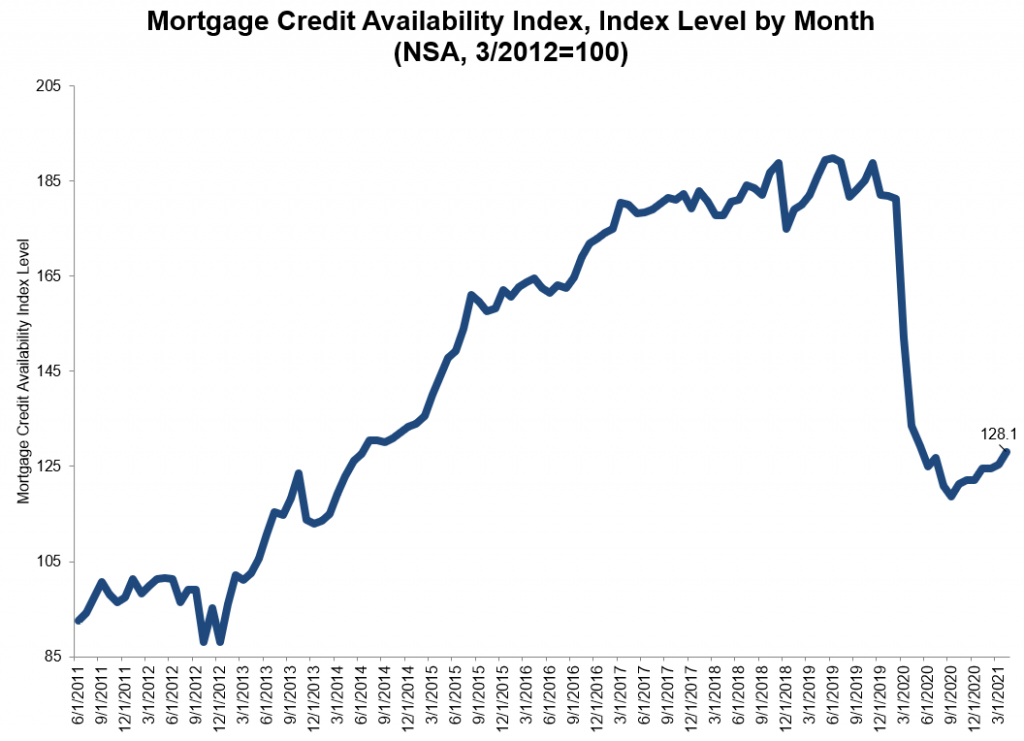

A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The MCAI is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etcetera). The latest MCAI rose 2.2% to 128.1 in April.

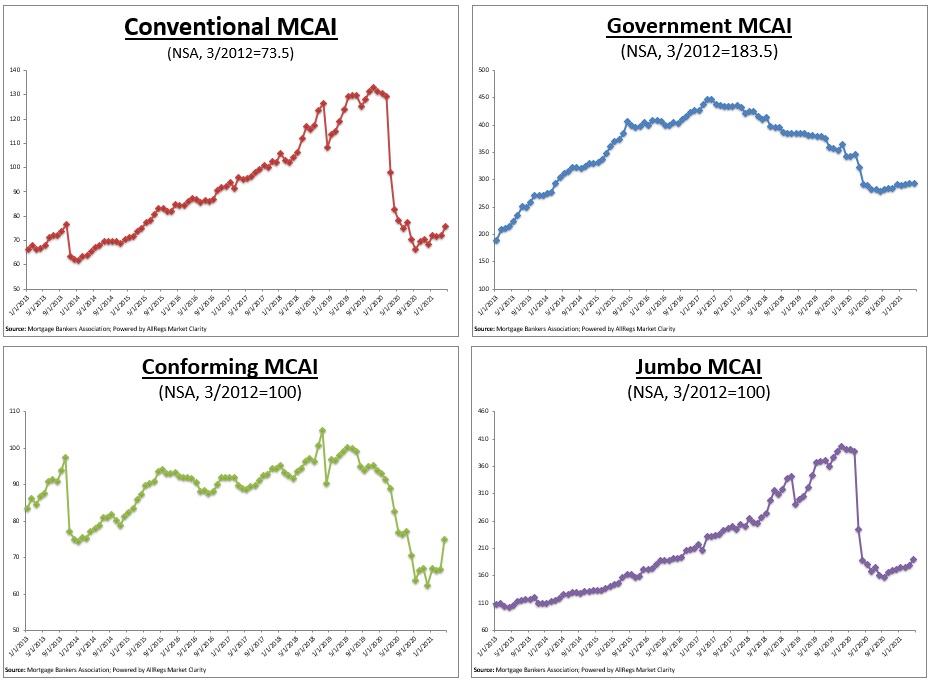

"Credit availability rose in April, fueled by a 5% increase in conventional mortgage credit, as well as an expansion in agency programs for ARMs and high-balance loans. The conforming and jumbo loan indices jumped 7% and 13%, respectively. The uptick in credit supply comes as the housing market and economy continue to strengthen," said Joel Kan, MBA's AVP of Economic and Industry Forecasting. "One trend that has developed in recent months is the rising demand for ARMs, driven by higher rates for fixed mortgages and faster home-price appreciation."

Added Kan, "Despite this month's increase, mortgage credit supply has not returned to pre-pandemic levels, given the over 2 million loans still in forbearance."

Note: Data before 2011 was generated using less frequent and less complete data measured at six-month intervals interpolated in the months between for charting purposes, according to the MBA.

The Total MCAI has an expanded historical series that gives perspective on credit availability from the last 10 years. It was created to provide historical context to the current series by showing how credit availability has changed, including during the housing crisis and ensuing recession.

As indicated in the above charts, the Conventional MCAI increased 4.8% in April, while the Government (which includes FHA, VA, and RHS mortgages) MCAI increased by 0.1%. Of the component indices of the Conventional MCAI, the Jumbo MCAI increased by 6.9%, and the Conforming MCAI rose by 12.6%.

Learn more about the MCAI at mba.org.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news