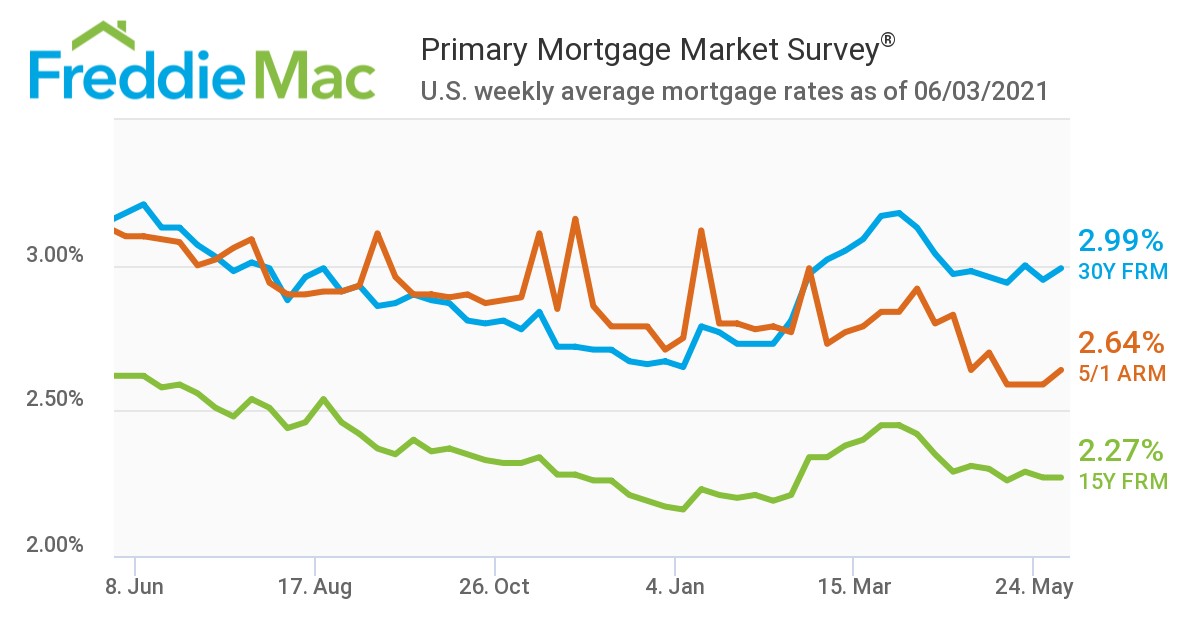

Mortgage rates rose slightly this week, but still remain below the 3% mark, as Freddie Mac’s Primary Mortgage Market Survey (PMMS) found the 30-year fixed-rate mortgage (FRM) at 2.99%, up from last week’s total of 2.95%. A year ago at this time, the 30-year FRM averaged 3.18%.

Mortgage rates rose slightly this week, but still remain below the 3% mark, as Freddie Mac’s Primary Mortgage Market Survey (PMMS) found the 30-year fixed-rate mortgage (FRM) at 2.99%, up from last week’s total of 2.95%. A year ago at this time, the 30-year FRM averaged 3.18%.

“Home prices continue to accelerate, while inventory remains low and new home construction cannot happen fast enough,” said Sam Khater, Freddie Mac’s Chief Economist. “There are many potential homebuyers who would like to take advantage of low mortgage rates, but competition is strong. For homeowners however, continued low rates make refinancing an option worth considering.”

Freddie Mac also reported the 15-year FRM averaging 2.27% with an average 0.6 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 2.62%. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.64% with an average 0.2 point, up from last week when it averaged 2.59%. A year ago at this time, the five-year ARM averaged 3.10%.

As noted by Khater, median home prices continued to appreciate in May, as Realtor.com reported that prices reached an all-time high of $380,000, up 15.2% year-over-year.

And with prices at all-time highs, more and more are pressing pause on the search for a new home, the Mortgage Bankers Association (MBA) reported that overall mortgage application volume was down 4% week-over-week for the week ending May 28, 2021.

“While interest rates remain affordable, and about 20 basis points below last year, the double-digit home price gains of the past 10 months have pushed the median listing price to a new record high, translating into a monthly mortgage payment $150 higher than the same time in 2020,” said Realtor.com Senior Economist George Ratiu. “In addition to the higher cost, today’s homebuyers are facing extremely low inventory and a competitive landscape, in which they are competing not only with other first-time buyers and homeowners looking for their next home, but also with deep-pocketed investment funds, bringing all-cash offers to the closing table. Not surprisingly, mortgage applications dropped for the second consecutive week, as many first-time buyers’ income growth is not keeping pace with rising real estate prices. As Americans return to a new normal in business and travel activity, housing markets are seeking relief from overheated demand.”

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news