A high share of home sellers dropped their asking price in July, particularly in pandemic boomtowns, as they struggled to match their expectations with the reality of the cooling housing market, according to a new market report from Redfin.

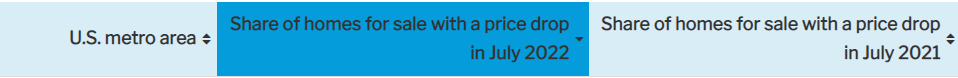

Nearly 70% of homes for sale in Boise, Idaho, had a price drop in July, the highest share of the 97 metros in Redfin's latest analysis. Next comes Denver, where 58% of homes for sale had a price drop, Salt Lake City at 56.4%, and Tacoma, Washington at almost 55%. Those four metros also topped the list in June, with Boise, Salt Lake City, and Tacoma among the 10 metros with the biggest upticks in their price-drop rates from a year earlier.

Rounding out the top 10 metros were:

- Tampa, Florida (52.1%)

- Sacramento, California (52%)

- Indianapolis, Indiana (51.4%)

- Phoenix, Arizona (50.1%)

- San Diego, California (49.7%)

- Portland, Oregon (48.3%)

More than half of those metros –Boise, Denver, Tacoma, Sacramento, Phoenix, San Diego, and Portland– are among the 20 housing markets that cooled fastest in the first half of 2022 after attracting scores of eager homebuyers during the pandemic.

“Individual home sellers and builders were both quick to drop their prices early this summer, mostly because they had unrealistic expectations of both price and timelines. They priced too high because their neighbor’s home sold for an exorbitant price a few months ago, and expected to receive multiple offers the first weekend because they heard stories about that happening,” said Boise Redfin agent Shauna Pendleton. “My advice to sellers is to price their home correctly from the start, accept that the market has slowed and understand that it may take longer than 30 days to sell. If someone is selling a nice home in a desirable neighborhood, they shouldn’t need to drop their price.”

Nationwide, the share of homes for sale with price drops reached a record high in July. Sellers had to cut their prices because they were catching up with buyers, who had come to expect lower prices amid a cooling market. Rising mortgage rates and the prospect of falling home values also made buyers hesitant to pay sky-high prices, and an uptick in supply gave them more to choose from. Price drops are likely to flatten out as sellers come to terms with the shifting market.

More than 15% of home sellers dropped their asking price in every major U.S. metro

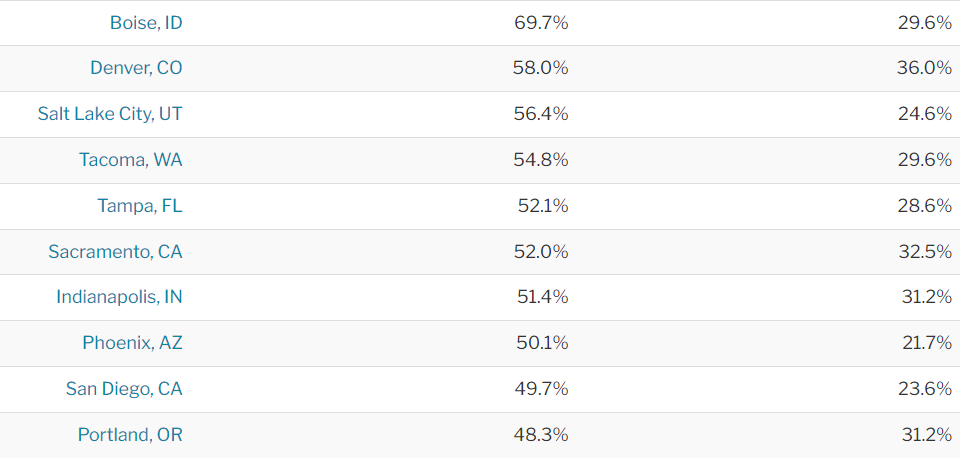

Nashville, where 32.3% of homes for sale had price drops, represents the typical metro area in July: Half the metros in this analysis had a higher share of price drops, and half had a lower share of price drops.

More than 15% of home sellers dropped their price in July in each of the 97 metros in this analysis. In McAllen, Texas, nearly 16% of sellers dropped their asking price, a smaller share than any other metro. It’s followed by Newark, New Jersey at 15.8%, Miami and Honolulu at 18.5%, and Bridgeport, Connecticut nearing 19%.

The share of homes with a price drop increased from a year earlier in all but three metros, all of which are in Illinois. The share dipped from 28.2% to 22.3% in Lake County, 27.3% to 22% in Elgin, and 26.4% to 21.3% in Chicago.

To read the full report, including more charts and methodology, click here.

theMReport.com Your trusted source for mortgage banking news

theMReport.com Your trusted source for mortgage banking news